https://x.com/BitcoinMemesIRL/status/1927180295138103434

A few days ago Saylor was once again asked to provide "proof of reserves" for the Bitcoin that Microstrategy allegedly owns, and once again the answer is a resounding "no". Funny thing is that I agree with Saylor on this; publishing addresses of massive bags owned by your company is not a good idea, and also falls well beyond the requirements of the regulators. The right to privacy is important, even for a public company on the stock market.

Notice how every single comment on this issue doesn't do the ONE THING Saylor tells everyone to do: ask AI what the risks are for publishing these addresses. Everyone just wants to chime in with why MSTR should do it without even the most cursory research to back up the opinion. The man children that want Saylor to publish quite frankly do not care if it's a risk because they feel as though their MSTR bags will be more secure with the addresses known (which is obviously not correct).

It's funny because the link between MSTR and BTC is fueled by delusion. It's already a stated fact that Saylor is "never selling". That means that when number goes down they aren't going to do buybacks to boost it back up and maintain this delusional peg that investors seem to think is real. Saylor is doing what ever shitcoin does: printing a shitcoin and tricking people into trading their Bitcoin for it. Next bear market is going to be a thing of legend on all fronts considering how many other companies are currently at the ground floor of adpoting this Strategy.

The biggest revelation in all this is a simple fact I've been preaching for years now: Bitcoin is 100% private. Imagine thinking Bitcoin is 100% tracked when you can't even confirm or deny that MSTR owns 2.5% of the entire supply. Bitcoin is very hard to trace. It's the KYC/AML banking system that makes it even possible to track what people are doing. Those with a keen understanding of UTXOs understand this full well. Moving BTC from one wallet to another could be transference to a new person or to the original party, and the only way to know for sure is to watch where the money goes and wait for that wallet to get KYCed within the legacy economy... and even then there's no way to know because it's possible to share wallets. None of this even considers the extensive privacy tools available to the market.

https://x.com/UnderCoercion/status/1927885141059260768

Malkovich Malkovich Malkovich ???

Market is dipping a little after the big Bitcoin conference everyone was pumped about. No surprises there; sell the news as they say. What was a bit more surprising than that is how much stablecoins got brought up in a sea of maximalism. I bet that was pretty damn annoying for a lot of people.

What exactly do people think stablecoins are going to accomplish anyway? Like yeah, there's a little value in the ability to peg your digital value to USD, especially if you're a business... and it's also fun to watch banks/governments squirm when users are getting 10%-15% yields on their savings accounts and the legacy system can't even come close to competing with that. But all the real value is in the volatile asset. Without that stablecoins are less than worthless.

The big takeaway here for me is that THERE WILL BE BLOOD when someone invents an algo stable coin that is stable on its own merit (aka not pegged to USD but rather its own elastic policy). I've thought about this quite often over the years, but it's clear to me that anyone who invents that technology is in extreme danger. That's the kind of thing the CIA will blackbag you for. A real algo stablecoin not pegged to USD is the biggest existential threat to the legacy economy by exponential margins. If someone figures out a superior solution: the entire fiat system goes up in smoke after 10 years. Pseudo stability is the only advantage fiat has left.

Bull market back on?

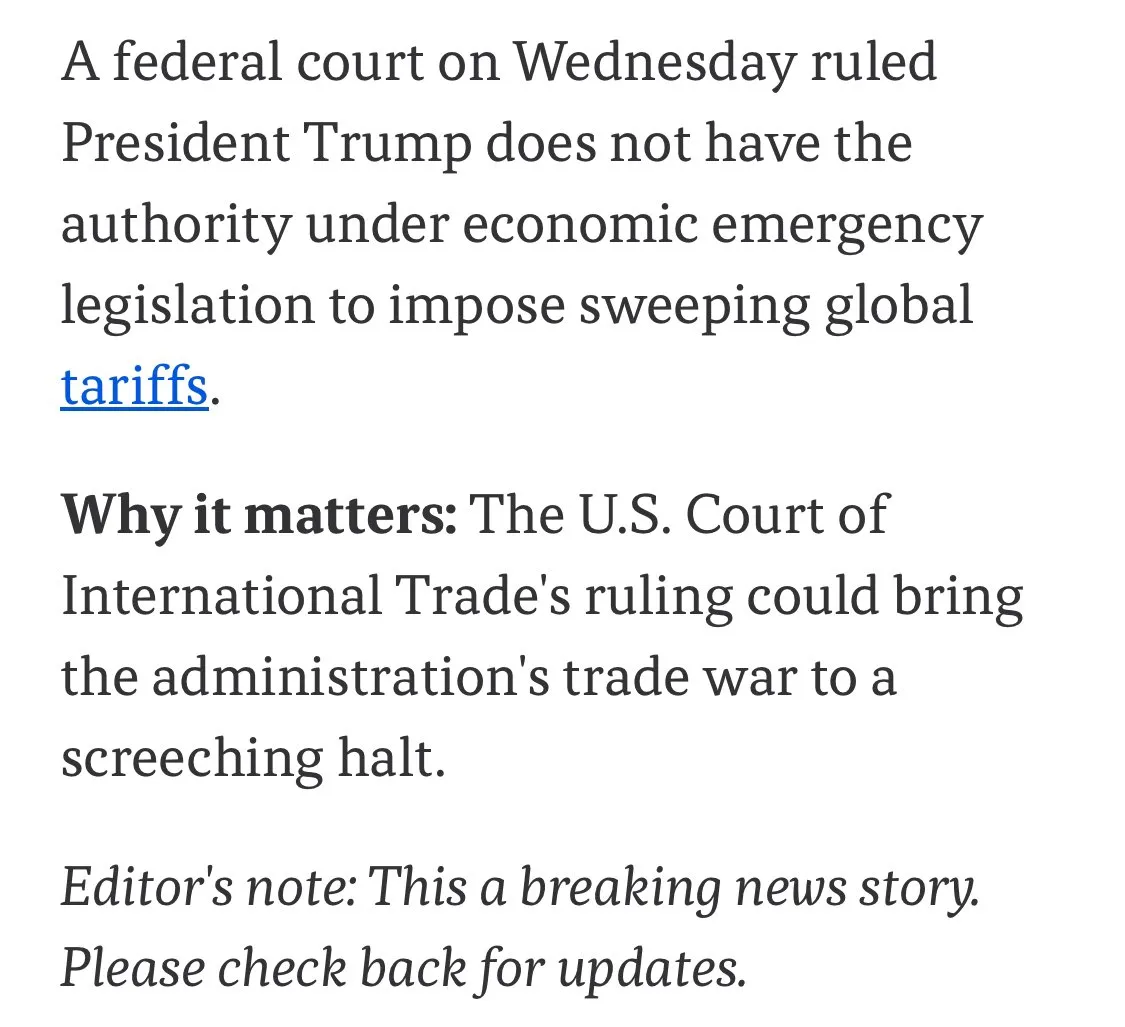

Courts are saying Trump's trade war is illegal, which is kind of funny to me for a couple of different reasons. First of all... what "economic emergency" are we talking about? The tariffs are the thing that created the emergency if anything. Second... Trump literally doesn't care. It was obvious the entire time that this nonsense was temporary and his cronies have been insider trading the flip-flopping policy.

My knee-jerk reaction to this is that legally blocking the tariffs was all part of the plan... and if it wasn't part of the plan it can be easily pivoted around. Tariffs were a dumb idea. DOGE was a dumb idea that didn't even make a dent in government spending. It's all smoke and mirrors. These actions are just being used to justify other actions. It was never ever about making America better. OBVIOUSLY. And now people are finally starting to wake up to that fact.

https://x.com/jeffreyatucker/status/1927797464913911925

No, I don't remember that because I'm not a gullible child.

Imagine being a fully functioning adult and believing a politician is actually going to fix something. Do we not live in the same reality? When has a politician literally ever done something for you without first enriching himself and the people around him? People need to wake up and stop putting their faith in this magical solution where all they have to do is vote once and a while and things will get better. Stop voting. Stop participating in this nonsense. Figure something else out. That's why my focus has been on crypto for the last 8 years.

https://x.com/TraderMercury/status/1928085765168259334

Bull market is still on, clearly.

We're in for some chop but that's fine.

Moon cycle is still doing its thing which is funny.

New moon was Monday and full moon on the 11th of June.

Wait it out and lets see what happens.

https://x.com/micsolana/status/1927443819584176632

LoL!

Everyone now fully understands and admits that Biden was not making any decisions during the end of his term. So who issued all those pardons? It sure as shit wasn't Biden. These people pardoned themselves and everyone close to them. Blatant corruption is legal now. Crime season started early and people didn't even realize it.

Conclusion

It's been a fun ride this month. The peak of this bull market is going to be a thing of legend considering how many corporations are putting BTC on their balance sheet and issuing convertible bonds to buy corn off the open market. Of course that means the bear market will be just as legendary. Volatility breeds volatility.