Wen though?

Finally back from my two-week long extended vacation from the Internet. I was thinking maybe when I get back we'll be on our way to moonville, but alas that was clearly wishful thinking. It's also a bit early for that as the plan has been to simply wait until mid April before reassessing the situation. Until then the downtrend is still fully intact.

Thanks for nothing: MEXC

Once again MEXC decided it was a great idea to "add new features" to their website, and in doing so deleted all the lines I had drawn previously. This is the second time it's happened and it's beyond annoying. So today I decided to just redraw the important ones:

- Horizontal milestones at $72k and $100k.

- Liquidity void range of $77k to $85k.

- MA(200) uptrend lines.

- Descending wedge downtrend.

Still stuck in the downtrend.

It's no secret that the price is still crabbing inside of the liquidity void I've been talking about for the last six weeks. Interestingly enough the half-point at $81k seems to be proving itself as a support line which I find to be reassuring that a bottom is being forged. I still very much believe that we have either already hit the bottom or just have one more panic dip to go. One more dip seems more likely than not but I won't be betting on it. Any price point underneath the liquidity void ($72k-$77k) is a screaming buy and completely oversold.

https://x.com/TraderMercury/status/1906720915095757018

Then I see tweet like this showing that stocks might be in for some trouble as well. The macro economy is not looking great, and it hasn't looked great for a while. Crypto traders take this as a bad sign, but I don't. Bitcoin is already close to a decoupling point with the stock market. I'd actually like to see the stock market crumple like 30% and get wrecked. Yes, crypto would probably bleed a lot in the short term but it would decouple very quickly and recover almost immediately... while the stock market could take a year or two before getting back to its former glory.

Parallel to this idea is a reminder that the 4-year cycle is MUCH stronger than anything the legacy economy can throw at us. BTC crashed 50% in a day when COVID started in March. What happened next? It went x10 over the next nine months (and made a full x2 recovery from the dip in 3 weeks). A COVID level nuke of the market should be welcomed as number can only go up after such a thing happens. I don't think it will happen but it's always on the table as these things are never predictable.

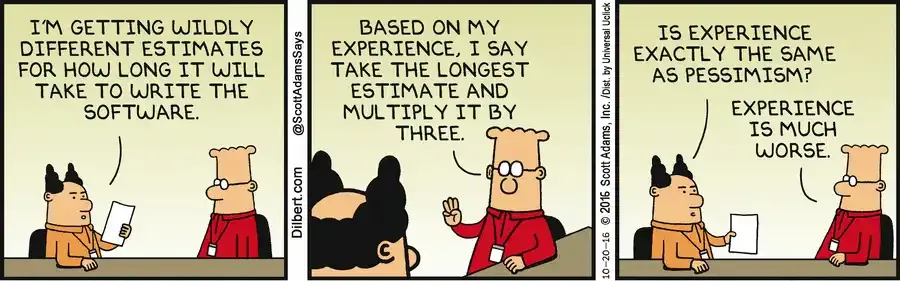

Luckily crypto is not akin to software development.

I think the worst that can happen at this point is that the summer rally I'm expecting is a bit of a bust and we just keep crabbing into October. That would be really annoying and downright demoralizing.

Death crosses boo!

We can see the latest death cross happened a couple days ago with the MA(25) crossing under the MA(200). That being said the affect of this event has been quite muted, further signaling that we may have already bottomed after filling the CME gap fully at $77k.

The only problem I'm seeing is that Bitcoin has a pattern of continuing to trade under the MA(200) for a while after it starts. So far it's only been a month... so we may be fated to spend another couple months getting batted down. Hopefully not because "four year cycle strong". We'll have a much better indication once we get into "sell in May and go away" territory. If we aren't trending higher than the 200 daily moving average come May there's definitely a problem that needs to be addressed.

What I can say with almost absolute certainty is that if and when all 4 of those moving average are close to one another and somewhat crabbing together this is a clear signal of strength and stability. This is an indicator I've made a lot of money on with x5 longs. Of course it would take another month or two of crab for such a thing to happen, leading me to believe that it won't.

Astrology Shenanigans

The planet retrogrades end in mid April (Mercury and Venus), and our last full moon was a blood moon eclipse (which often signals some kind of pivot in the market). The downtrend also hits the key support lines in mid April, and so everything has been pointing at mid April for a while.

Now that we've dipped back into the liquidity void, market sentiment has also dropped significantly. There's a huge percentage of the industry wondering if $110k was the top. This is exactly where we want to be, as anyone should be able to recall that in previous cycles a normal 30% retracement was never greeted with this kind of pessimistic outlook. It's not possible for the market to get caught off guard when we aren't overleveraged and everyone is asking if this is the top. The more fear we see the better.

Conclusion

Price action has been pretty boring lately but you'd never know that by looking at all the panic we see on social media. Nobody wants to wait for blue skies but that's exactly what needs doing. Within the next month we should have some indication as to whether we'll get that summer rally or not. Either way we still have the better part of a year to allow the 4-year cycle to play itself out.

Keep calm and carry on.