Who remembers the Uniswap Airdrop? 🖐

The Uniswap airdrop of DEFI September 2020 was undeniably a huge milestone in crypto. Many of us, including yours truly, woke up that day and realized we had been gifted over $1000 worth of free tokens; conjured out of thin air as it were. It was an incredible feeling. Anyone who had multiple wallets interacting with Uniswap got this airdrop multiple times. Actually I'm still a bit salty that I went through a router on an alt-wallet and picked an option with fee of 10 less cents than Uniswap. That 10 cents cost me 400 UNI.

Yikes. 🤦♂

But since then there's been nothing but degeneracy in the space. People in crypto for a time made it a full time job to "farm" airdrops. Of course "farming" in this case is a Sybil attack designed solely for the purpose of extracting value from new communities. It is unacceptable dishonorable unethical behavior that, at the time, was seen as completely standard practice. Honestly we should be tracking the people who did this and putting a black star on their permanent record, but we won't. In fact many of the people reading this surely have done it, or at least attempted to do it.

So it becomes clear that we need a new way of going about this airdrop business because people are greedy goblins and must be treated as such. Standard practice in the memecoin era is to force anyone who wants to participate in the airdrop to provide locked liquidity to the market.

Taking Solana for example:

This is a potentially contentious example because The Swarm here on Hive doesn't have a lot of love for this VC funded hunk of centralized garbage. It's also the best example to give because Solana is at the heart of the shitcoin casino and where all the billion-dollar memes are being cranked out like hotcakes.

LP airdrop

The liquidity pool template is simple enough. Let's say I want to launch a token on Solana but I actually want it to be a decent deal. This means a premine for myself is out of the question. No problem. Fair launches exist where I can provide the airdrop in the LP 1000:1 or whatever other ratio I want.

Let's say I personally lock 10 SOL into my airdrop contract. At 1000:1 this would print 10k memecoins out of thin air and pair those tokens in a liquidity pool 10000:10. This creates a floor value of the token using SOL as the unit of account. So at the ground floor the memecoin is worth one-thousandth of a SOL. If the meme gets dumped it will be less and if it gets bought it will be worth more.

But it can't be dumped...

Coins in the LP have to be locked for a certain amount of time. Could be a week, month, year, or permanently. Personally I like the idea of permanent liquidity. This would mean my 10 SOL would get locked in the contract forever and 20k memecoins would be printed; 10k also locked permanently and 10k liquid in my wallet (or timelocked depending on preference).

This is what makes the airdrop and distribution much more fair than others because the only way to mint coins is by putting the parent token (SOL) at risk in the LP. Forcing users to have skin in the game completely negates the Sybil attack. The bonus is exponential liquidity in the AMM. Money talks and bullshit walks.

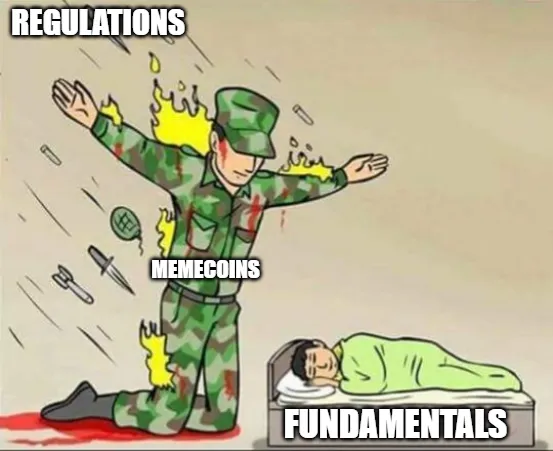

So while memecoins may seem stupid and idiotic at face value, there is a very good reason why billions of dollars are pouring into them. This is a convergence of multiple technologies over multiple crypto cycles. We have ICO tech that allows the token itself to exist. We have AMM liquidity pools which create exponential liquidity. And now we have fairdrop mechanics that allow all three to come together in a perfect storm.

We might try to make the argument that memecoins have zero usecase... they actually have a ton of usecase. This should make sense because the technology they inherit from the work we've done over the last decade is already good enough to make these memecoins a standalone asset.

Because there is no dev team to pay tribute to all that money can be recycled back into the community. Is this how it works out all the time? No, but some of them do. Maybe I should make my own to prove it... or maybe not lol. The main issue of contention is: what's the point of spinning up a new asset when we could just as easily use an old asset with an existing community?

Usually the answer is: degens gambling on shiny new volatile things that can pump harder. That's not the fault of the supplier: it's the fault of the greedy goblins who demand x1000 opportunities. We are doing what we always do and blaming the sellers instead of the buyers. Ironically this is an inherently centralized tactic of enforcement, very similar to "the war on drugs" or demonizing sex-workers. We love to blame the centralized supply while giving the decentralized demand a free pass.

Especially now with the Trump admin and recent memecoin launch nonsense it seems that now more than ever memecoins are becoming the ultimate smokescreen for crypto. How can the judicial branch possibly go after any of these legitimate tokens with 10000 memes running around in a lawless jungle? It actually kind of reminds me of the Streisand Effect. When you try to hide information it makes people look to uncover it even harder, but if you flood the space with information it is exponentially better at hiding the stuff you don't want found.

In a way memecoins are the flood or moat that currently protect the crypto castle. Of course many of us are upset that all these noobs and no-coiners are going to fall into the moat and drown, but that is just the cost of doing business. These memecoins are not securities, and we don't get a vote as to whether the moat full of toxic sludge exists or not. Such is the cost of a permissionless ecosystem.

They aren't even scams.

A beanie baby does not become an investment contract because the public decides that they might be collectibles. Memecoins are not investment contracts just because sometimes they go 1000x and attract a ton of attention. If I tell you to give me your money and you do, that's not a scam. I haven't promised you anything.

Conclusion

Oddly enough this post was supposed to be about a completely different topic, but apparently that topic has prerequisite reading (this post). Tomorrow I'll be discussing a new type of airdrop template that is potentially only something that can be done on Hive (or anywhere else that user accounts have actual community reputation attached to them, IE nowhere else).

During the next four years we are going to experience an extreme snapback effect in terms of regulations. We're going from Operation Chokepoint 2.0 to complete lawless anarchy. It seems like many crypto users would rather have a happy medium, but I think I'm going to enjoy the next four years of anarchy, and I also doubt that a happy medium will ever be achieved. Embrace the chaos while it lasts.