13 weeks is a long time acktually

Over three months ago I setup a modest powerdown of 13k, 1k Hive per week. This is a thing I do pretty often just to make sure I have some liquidity available. It's always quite the race too, because my curation rewards and my blog post rewards can almost catch up to the 1000 Hive I'm powering down. So it feels like a race to earn as much Hive as I can so that my total powered up doesn't go down.

I still have around 12k Hive liquid in my wallet after shuffling it around to many different places and back again. The goal was to try to stay above water and not go below 225k powered up, but I took a lot of days off over the last 3 months and ended up at 223k after it finally ended. Now I slowly rebuild my position back to the target... which will only take 2-3 weeks so that's fine I guess.

So what do I do with my powered down stake?

Well used to be that I needed to pay bills with it, but I liquidated a decent sized whole-term life insurance policy six months ago and have been living off that the entire time. This was money I didn't even know existed for a long time even though the policy was setup in my name in 1999. Damn!

In any case that money is basically gone now (although there is still a significant loan that needs to be paid back to me) so I'm going to have to start selling crypto again to pay bills... which is super annoying... but also the plan was to make it to summer with that money and hope for a summer rally... which seems to be happening so once again my plan seems to be working out.

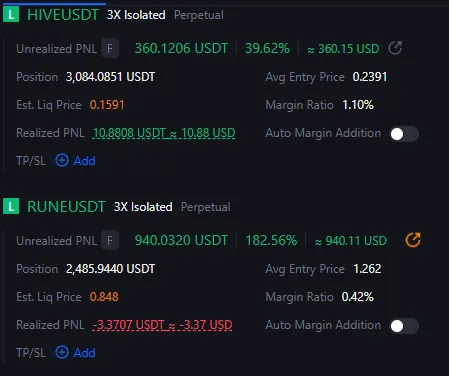

If you haven't noticed I also do a lot of gambling with my crypto, and I'm getting better at it. It's been a long time since I got a win like this and actually let it ride. Usually I'd of cashed out at +$300 or something and called it good. However, sticking to the plan is key and I'm trying to employ some discipline here. Need to hold these positions for at least 2 more weeks into the end of the month... rain or shine. We'll see how that goes.

Leveraging credit cards

I am in credit card mode right now as well. Unless we get a massive rally by the end of May (alt market) then I'd like to keep loading up on debt until we get to June and maybe even July. Every single metric has pointed to this summer being an epic rally for crypto. We are finally about to break free of the toxic ~$100k liquidity void we've been stuck in for the last 6 months straight. Alts have been sweating it while BTC just keeps going up in dominance. I know I keep saying this for a while but there will be a reversal... I mean let's be honest there's a good chance that reversal has already started with ETH up 40% on the week. ETH tends to lead the way when alt markets are concerned... and ETH is comically oversold.

That being said I own very little ETH and don't have any real faith in the network. It's proven itself to simply be not-secure. It doesn't matter how secure your chain is if people are constantly being forced to blindly sign unreadable smart contracts that can potentially drain your entire account. This exact issue is what prompted the biggest theft in crypto history a few months back.

How funny is it that the biggest hack ever in crypto happened three months ago and the market just shrugged it off like it was nothing? Maybe North Korea likes to HODL as well? Now they have an extra $1.5B in the coffers. I guess that explains why ETH crashed way harder than the TA on the chart thought it would.

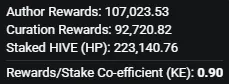

I've also noticed today that PEAKD added the KE ratio to the banner of accounts. I'm not sure I agree with this decision but hey I'm not going to complain because it makes me look good. Even after being here for 8 years and writing thousands of blog posts I've put more into this network than I've taken out.

Is this appropriate?

I've commented on this before and I still think that monitoring and micromanaging what people do with their money leads to extremely toxic outcomes. Imagine if you were working at a company with a KE ratio. Oh you don't invest literally all of your earnings back into the company you work for? Well then fuck you I'm gonna pay you less. lol. Pretty terrible.

Simply the existence of the KE ratio implies that everyone on Hive is being overpayed and the money they earned was not worth the value they produced on the network. And rather than try to fix overpaying everyone we'd rather just tell those overpaid employees to reinvest all their earnings back into the network so we don't bleed out. But I digress.

What does KE ratio even stand for anyway? I had a long-winded conversation with AI and one of the guesses was "kept earnings". That's must be it, eh?

There are lots of reasons to powerup Hive, and there are lots of reasons to sell it as well. Personally I find selling Hive to be very difficult because I enjoy the power I attain from having Hive power. Even if Hive was like $5 a coin it would still be difficult to sell (although much easier because we would expect number to go down) because it diminishes your governance votes and your economic votes as well. Losing RC regeneration isn't a problem yet but it will be of the blocks start filling up.

In summary I think it's cool that we can look at the KE ratio of an account in a very convenient manner but I know for a fact that some people are going to over-interpret that data in potentially toxic ways that will completely negate the value. It's inevitable. Diminishing returns everywhere I tell ya. Ah well we see how it goes. It's a good lesson in frontends being allowed to do whatever they want. Bitcoiners could learn something from it considering all their bickering about the op_return drama recently.

The chart keeps on charting.

Even after three pumps in a row we got zero action on Sunday, which would normally be a good time for bears to make a move and push the price down (at least temporarily). Then yesterday we got a full moon dip... and the bears tried very hard to swat down the price but we didn't even make it to $100k. They tried to swat it down again today and the result was even weaker than yesterday. Everything about the chart is screamingly bullish other than the fact that we're already up quite a bit in a short amount of time.

Next golden cross incoming.

Tomorrow's candle results in a golden cross with the MA(50) rising above the MA(100). This is a historically inconsequential one, but if we get a dip tomorrow I'm going x2 long with my entire gambling bankroll. It's just too bullish.

The MA(25) is now poking above the ascending yellow trendline and quickly heads to $100k to create that double-support I'm looking for.

CPI also came in today looking good and my feed is littered with people talking about it. Personally I don't give a damn about the CPI at this point, as it is a meaningless metric when compared to Bitcoin and the 4-year cycle. Nothing stops this train.

Wow this picture is timestamped Dec 18, 2017... just 3 days after I joined the network. Time flies.

The MA(100) has leveled off and the MA(200) continues on a significantly sloped ramp upwards. I honestly find it quite surprising that the MA(200) still looks like that even though we've been crabbing for 6 months now. It really demonstrates how impatient everyone is in this industry. Average long term price continuing onwards and upwards as if nothing ever happened. Love to see it.