because guess what we were in the bear market when HBD APR was changed in the first place.

Incorrect... I think... now I need to look it up.

It had to have been implemented in 2021 pretty sure.

The entire point of 20% was competing with stables like UST.

@edicted/20-interest-rate-on-hbd

Wrote that post in April 2022 right before shit hit the fan.

Hive was still trading at around $1.

So the timing is... interesting.

In any case @dalz has all this information organized into nice charts and things.

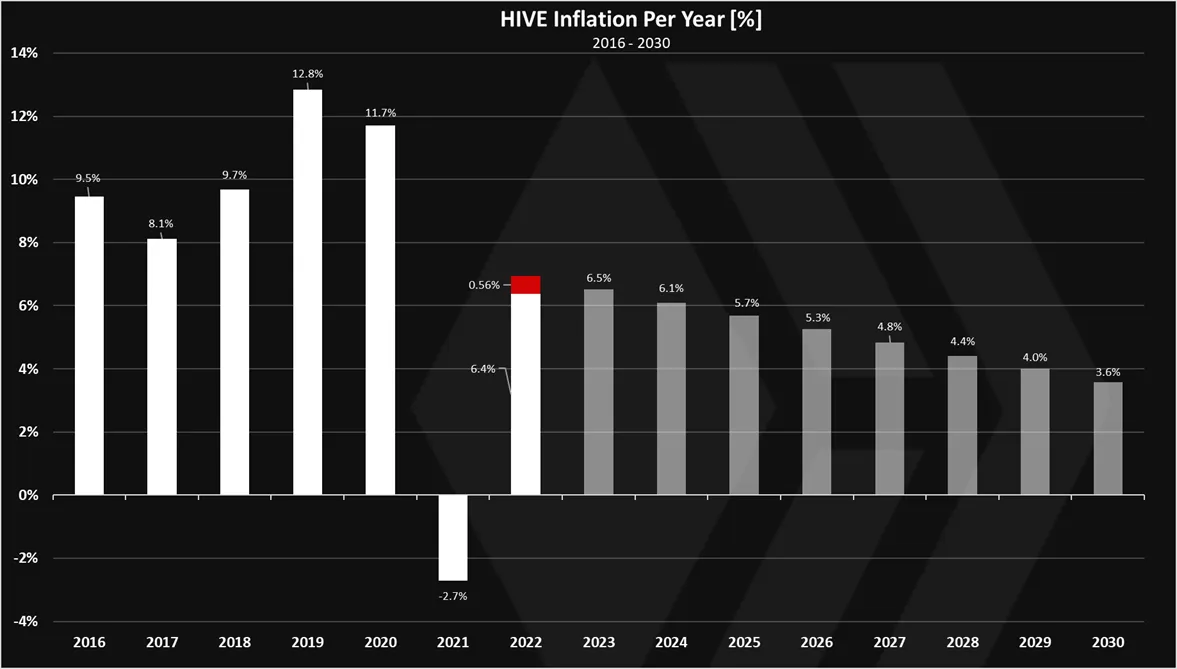

It very clearly shows that a high demand for HBD can easily make Hive go completely deflationary and results in net-negative inflation as Hive is destroyed to mint more HBD. The question then becomes okay if we keep printing 20% yields how much demand does that give HBD vs how much do those yields get dumped out to Hive. It's all guesswork, but a lot of the people saying we should reduce yields don't even consider this math or even attempt to calculate or guess at it because "printing money is bad".

So yes, easily easily easily HBD can sustain 20% yields if the demand outstrips the supply. 20% yield gives HBD more demand. There are many other reasons to hold HBD as well, with even more projects being built that will certainly use it. The cost of 20% with the current 7.5% debt ratio results in the Hive network only having to pay 1.5% of the Hive market cap to sustain 20% yields on HBD. Is HBD worth 1.5% a year to the Hive network. I would say this is obviously the case. Things could change if the debt ratio goes higher, but for now it's fine, and there is a hardcap at 30% haircut.

RE: Hive has officially reached the desperation phase.