Let's be honest

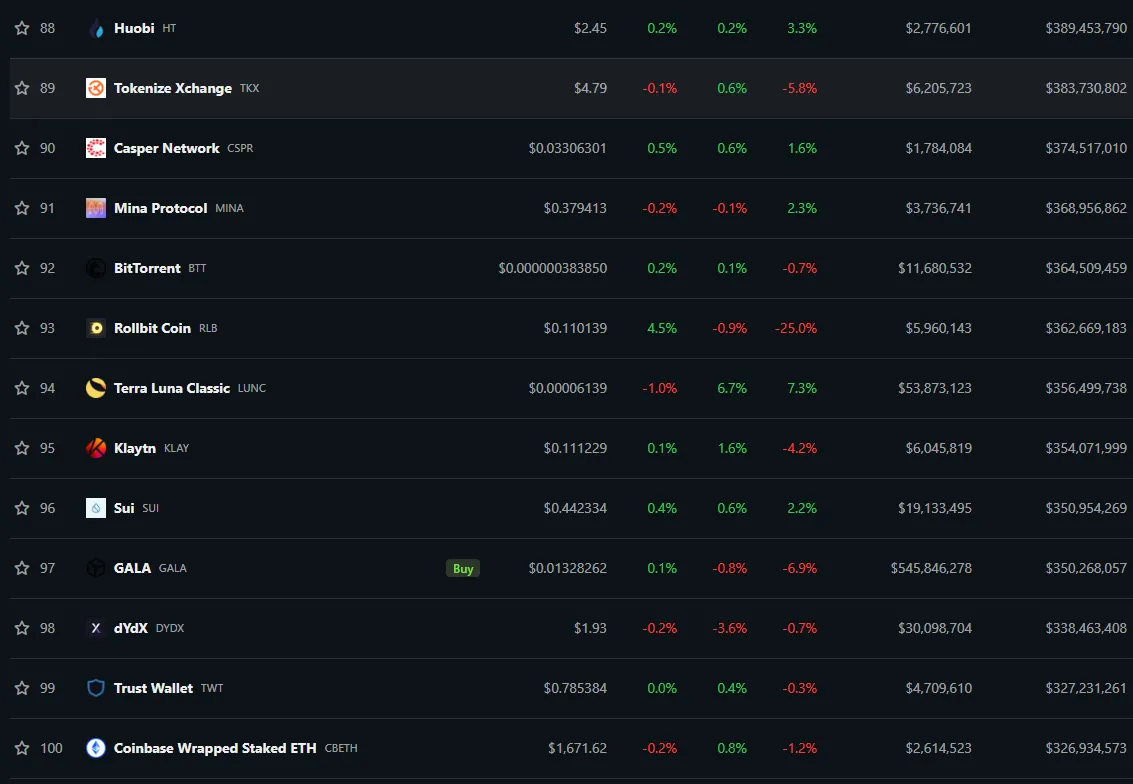

It is painfully obnoxious that Hive isn't in the top 100 market cap. Like, come on, we deserve to be there. I mean just look at all the garbage that sits as a placeholder until the real ones come around. It's just comical at this point.

I mean please, that's hilarious.

Remember how Terra Luna "crashed to zero"? Yes well apparently when something crashes to zero it can still have a market cap that's over three times as big as Hive. Pretty funny honestly. Ah, the power of dumb and greedy institutional money combined with overzealous communities.

And then at #100 we have Coinbase Wrapped Staked ETH. So simply a centralized derivative of ETH that only exists on Coinbase is once again three times our entire market cap. Pretty wild honestly.

We got trust wallet token in there and Huobi (and KuCoin and LEO), which again is just kind of funny to see random exchange tokens that are very obviously cash grabs with zero utility sitting in the top 100. At least with tokens like dYdX or Uniswap or Rune it makes a lot more sense to have a coin because the exchange is actually decentralized and exists on-chain rather than being funneled through some blatant centralized agent that scoops 100% of all trading fees.

We can see BitTorrent token there as well... a token that was created well before we even knew that Justin Sun was a rampaging dumpster fire. I've actually written multiple posts on-chain about how exciting it was to see the BitTorrent token. What have they done since then? Well obviously nothing because legit no one on Hive is using or talking about the protocol in any capacity (good or bad).

Even greater than hate: indifference is the ultimate indicator of complete systemic failure across the board.

See that even Taylor Swift agrees.

Then there are all the potentially legitimate projects in the top 100 that seem like a good idea but haven't actually done anything yet. For example VeChain & Filecoin. Yes, it seems like a good idea to put data on the blockchain or to use blockchain to track products in the real world, but the devil is in the details and the incentives of these networks actually don't align in a way that creates a working product that the world actually wants to adopt.

There's also no supply shortage of meme tokens in the top 100. Imagine being a Bitcoin Cash moonboy at #18 and seeing god forsaken Shiba Inu at rank #17. lol ouch! Farther down the list we see Apecoin with x4 the MC of Hive, and of course the ultimate and original memecoin Doge towers above them all with an $8.7 BILLION dollar market cap. heh. It's funny to think that Hive needs to x85 just to catch up to Doge of all things.

Then come the gaming tokens like Axie Infinity, Decentraland, and more generically Avalanche. Wanna know how I know all these products are hammered dogshit? Because I'm a hardcore gamer that just finished a 569 hour game of Factorio and I'm sitting here writing this post instead of creating content for a gaming platform that knows how to actually leverage decentralized creation and ownership. Doesn't really get more clear-cut than that. Legitimate crypto products don't need to advertise or market themselves. Their utility alone should easily be enough to make them go viral. But I digress.

Legitimate crypto products don't need to advertise or market themselves. Their utility alone should easily be enough to make them go viral.

Oops

So what happens when we retrospectively apply that same logic back on the Hive network? Ah well it basically just proves that while we may be on the cusp of greatness, we haven't actually done anything to truly merit a breakout by sheer force of will. In fact it could be argued that no cryptocurrency has achieved such a feat except maybe Bitcoin. Everything else is simply trading based on rampant speculation. And even in the case of Bitcoin the argument will not be fully validated until dozens of banks, governments, other institutions are utilizing it (seemingly against their will).

If you can't beat 'em, join 'em!

Stablecoins!

Hey hey let's not forget about the ultimate shitcoins: the ones pegged to assets inside a fractional reserve system. We got Tether and USDC in the top ten alone. Then comes Dai and TrueUSD. Used to be an argument could be made that Dai was decentralized. Now a huge portion of the underlying collateral is USDC. Oops. Let's wrap a derivative inside a derivative inside a derivative and see what happens. I'm sure it will be fine.

Hilariously enough it doesn't stop there. We got BinanceUSD under extreme fire from regulators and yet still has over two billion dollars. We've got the PAX dollar and even shit-ass USDD compliments of Justin Sun... which means Sun has at least 3 coins in the top 100 that I know of. lol.

Hm there's also a token here called FRAX which I've never heard of that is an algo stable coin. Don't know how it works, and don't care! Same story for the dozens of other tokens in the top 100 that I've never heard of or care to find out. I don't need to be wasting my time trying to keep up with the next new fad. This isn't 2018 anymore. I'm a Bitcoin and Hive maximalist now. These things happen.

And then there's the one last elephant in the room we call EOS. Current market cap x6 higher than Hive... but also worth x23 less than it was during the ICO phase: when it was nothing but a worthless placeholder on Ethereum and the main-net didn't even exist. Hilarious.

What an embarrassing project. Can you imagine? Runs off to fix all the problems of the previous network only to create something that was even more prone to failure. EOS had infinite funding. They did not get sucker-punched by a punk vulture capitalist billionaire. And yet I feel like we are still in much much better positioning than EOS at this point. Pretty crazy honestly.

Regardless of all that, considering the competition, it's pretty obvious that EOS deserves to be in the top 100 and I wish them all the best on their journey. I do not envy that community considering they probably aren't going to get anywhere until they fork Block.One into oblivion. Good luck with the hostile takeover, friends.

So Hive has to pull an x3 while the market stands still just to get back into the top 100. In all likelihood such a thing would happen during a bull market so the move would have to be exponentially more pronounced than that, at least when measuring against USD.

For a while there during the 2021 bull market things were looking pretty promising. We pushed our way to about rank #180 before falling back down to our seemingly standard level of #220. Don't even get me started on rank 100-200. It's basically just no-man's-land with a handful of scattered promising projects and everything else simply has-beens from previous bull runs.

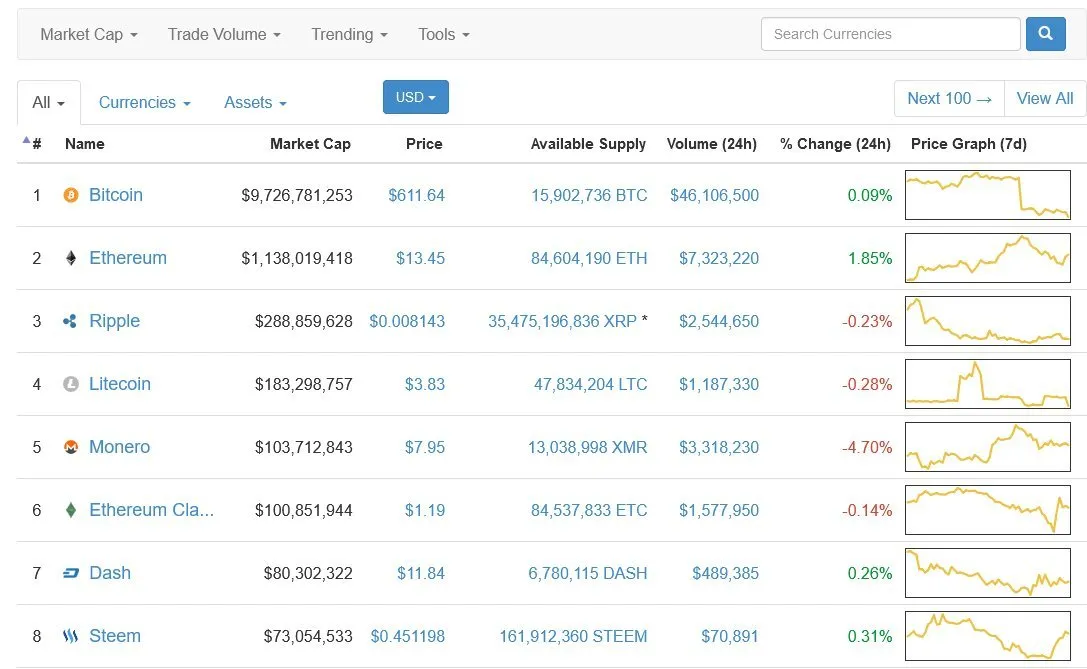

Yes, dash is indeed top 200 now.

Hilariously enough it's also worth pointing out that even though DASH has crashed from rank #7 to rank #106 over the last 7 years, the token price is still worth double what it was back then. From here it becomes a matter of perspective. Is that a failed investment? Because if we compare it to the stock market over the last 7 years it's actually a pretty good investment.

So it doesn't really matter than Dash lost a hundred ranks on the market cap. A rising tide lifts all ships. Doesn't matter of Hive sits at rank #220 forever if crypto as a whole decides to go x1000. An x1000 on Hive can change the world even at rank #220.

This brings us back to the theme of none of these networks being in competition with each other. This is not a zero-sum game. There is no rule that says we can't all be winners. Economies are largely collaborative, especially permissionless ones like crypto. Both sides are supposed to gain when a trade agreement is made.

While getting into the top 100 and beyond would be nice and get us some more attention within the attention economy, there are still plenty of other ways to go about getting noticed and making ourselves heard.

It's also quite noteworthy that even when Steem was rank #8 in 2016 the token price was only 45 cents and the market cap was only $73M. Hive's current market cap is higher than that, and while the current token price of the network is only 30 cents it's still quite obvious that anyone who was involved back then should still be in the green today. In fact when we add the price of Hive to Steem we can see that it equals around 47 cents, which accounts for the hostile takeover and resulting Hive airdrop.

Once the yield is calculated for curation and HP interest rate it's a pretty healthy profit. Certainly didn't outperform Bitcoin but that's beside the point. It's actually pretty unbelievable that a network that experienced so much hardship could still be in the green after everything that went down. Impressive.

Unfortunately the days of being able to say "this is a great time to accumulate" are long gone. Nobody wants to hear things like "buy the dip" or "soon™". On the flip side it's nice that it looks like we aren't going to bottom out at that dreadful 10-15 cent level, but also we aren't out of the woods yet. 2020 was a pretty boring year for alts (except for the degen DEFI stuff) and 2024 might be largely the same considering the current economic climate combined with the 4-year halving cycle.

Conclusion

The crypto market cap rankings can be quite deceiving. Not only is market cap a very flawed way to measure value, but also this number gives us zero indication as to the network having any fundamental value or staying power whatsoever.

I know for a fact that the Hive community has staying power, can't say the same for the vast majority of tokens I'm seeing in the top 100. It's only a matter of time before a lot of these networks drop like flies; same as their predecessors. Not that we should wish for such things to happen, only that they will and there's nothing we can do about it.

The more successful networks exist in crypto the better. These are cooperative networks, and the false competition that is constantly projected onto them is fueled by nothing but a greed and scarcity based mindset. We would do well to evolve past such toxic and outdated modes of analysis.