WTF is WEEX?

Yesterday I saw that an exchange I've never heard of made the decision to list Hive, so I decided to look into it a bit more. Thus far it seems to be a bit of a mixed bag. However, it doesn't have a KYC requirement so I decided to create an account.

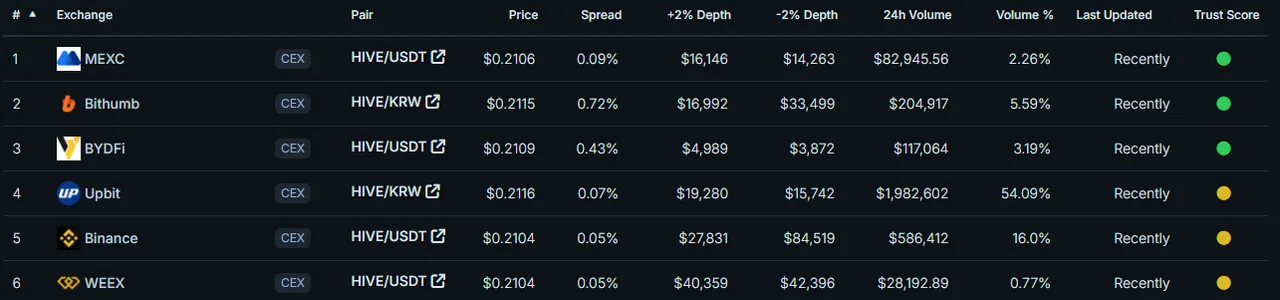

How's the liquidity look?

I was shocked to see that the liquidity they are providing to our market is actually much better than expected and even comparable to Binance. Without liquidity a listing is completely worthless... as some of you may remember when we got listed by a little-known exchange called Ionomy who's liquidity for the market was just awful. If it costs a 5% fee in slippage to buy a couple hundred bucks worth of crypto it's quite simply not worth it.

I also noticed right away that WEEX seems to cluster buy and sell orders into consolidated groups so that the orderbook is easier to read. This is something I think about often and I which that HiveEngine had done this years ago (along with fixing their broken graphs that are constantly bugged out by extreme outliers such as buying a million tokens for $1).

The WEEX website is clean.

Like so many other exchanges out there they just copy/pasted the Binance UX, which isn't a bad thing as many crypto users are quite familiar with that layout. Even the double-diamond logo sort of resembles the Binance logo so they are clearly copycats.

Revealing the inside story of WEEX Exchange: There are many shady dealings, and users avoid it

First of all, WEEX Exchange was exposed to have serious behavior of eating customers’ losses. The so-called eating customers’ losses refers to the exchange manipulating market prices to make users lose money in transactions, while the exchange makes profits from it. This behavior not only violates the principle of market fairness, but also is a naked infringement on user funds. In addition, WEEX Exchange is also suspected of gambling, that is, the exchange and users bet against each other instead of conducting real transactions in the market. This means that every loss of users is a profit for the exchange.

OUCH!

Tell me how you really feel, Binance...

So obviously Binance Japan is not a fan of this website clone. Not sure if I can take this review at face value but those financial incentives are certainly in alignment. When an exchange offers "free" trading fees they have to make up the loss elsewhere... and that can indeed come in the form of using their godmode knowledge of their own userbase to trade against the degenerates.

On top of this the Hive perpetuals listing is extremely low liquidity so they could margin call any of your positions immediately... definitely don't recommend using their futures market but this might still turn out to be a good place to just buy Hive on the spot market and immediately transfer it into self-custody on-chain.

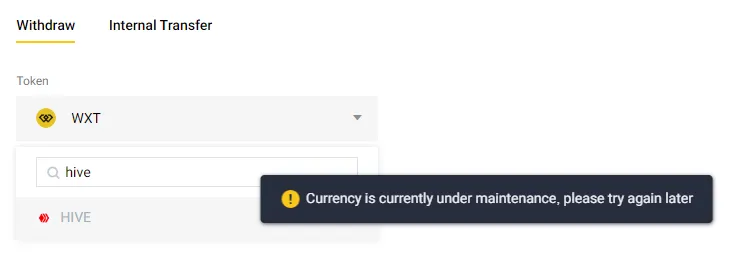

OOPS! Not so fast...

Because their wallet is still "undergoing maintenance" withdrawals of Hive are not allowed. However this is totally normal for a coin that just got listed. Deposits are also not allowed so they are making sure everything is good to go before they turn those features on. So you could buy Hive here to get price exposure to Hive but I absolutely would not recommend leaving crypto on an exchange like this even if it might be a good tool for buying and withdrawing small amounts once they turn on withdrawals.

Is this what created the Hive pump recently?

This is a new listing whose chart begins on August 20th. If it's not possible to deposit coins yet and they have good liquidity it means they had to seed that liquidity themselves which could have created one or two of the pumps we've seen recently.... so that's interesting.

I must admit that I got a tiny bit of Hive FOMO here and shoved all my HBD into Hive yesterday. I made a couple bucks selling a couple thousand Hive at 23 cents... but day-trading here is pretty dangerous as we head into 2025. It's very easy to get sidelined by god-candles that never come back down. If you know you know.

We can see from data aggregators like COINGECKO that WEEX has a "yellow" "trust rating"... whatever that means. Better than red but worse than green. Again, the futures market would be fun to gamble on but they can basically just flash-crash liquidate you and steal your money on a whim using their market-maker bot so that's not a great dynamic.

How long have these guys been around?

The Internets says they're based in Singapore and founded in 2018 so that's a fairly decent track record having survived two distinct bear markets. Also Singapore is known for having very strict laws, but I'm not sure if this applies to financial markets. Probably not I suppose considering a non-KYC exchange. Who knows?

Conclusion

Is this WEEX listing a sign of the times that signals Hive has bottomed?

Or is it just a honeypot for degens to get rugpulled?

You decide.