Following the launch of the decentralized USD, or simply USDD, Tron's DeFi activity has experienced a strong momentum, now positioning itself in the DeFi world as the third largest blockchain in terms of Total Value Locked (TVL).

Image edited in Powerpoint, original taken from Wikimedia.org.

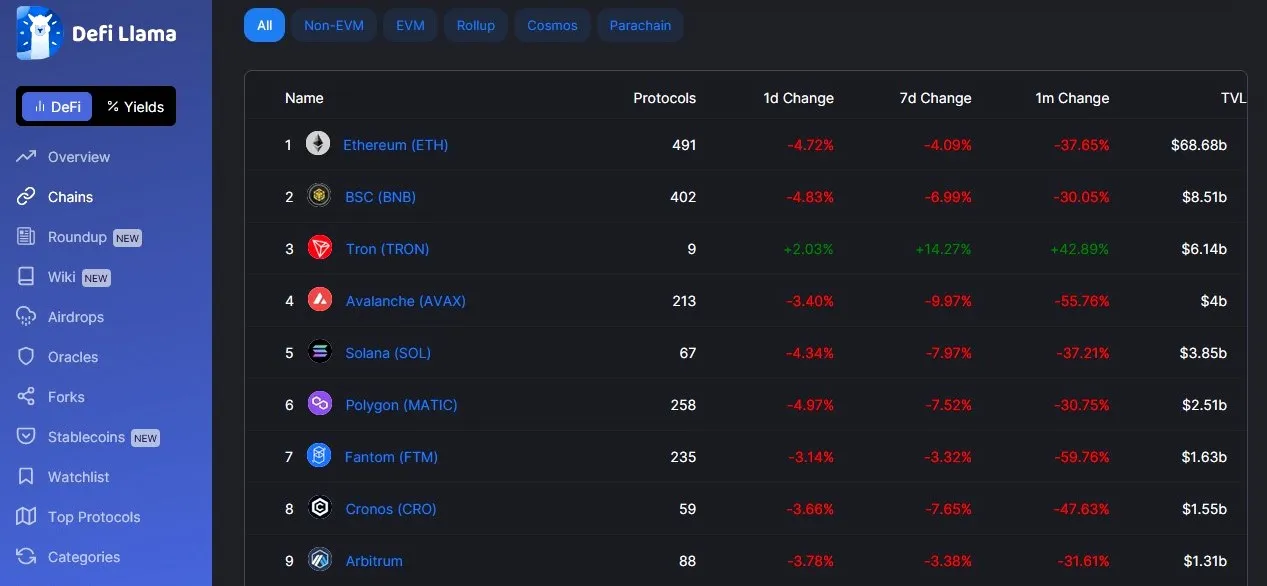

And the fact is that Tron's TVL, through its 9 protocols, currently amounts to 6.14 billion dollars, experiencing an incredible increase of 42.89% with respect to last month. At the time of this publication, the blockchains leading this ranking are Ethereum with $68.68 billion and BSC (BNB) with $8.51 billion; and it is striking how most of the chains are in the red while Tron has experienced good growth.

Screenshot taken from DefiLlama.com.

USDD driving Tron

This bullish activity on Tron's blockchain is being driven by the launch of their USDD algorithmic stable coin, with which they offer yields of up to double digits.

This stable coin is governed by smart contract algorithms and its issuance is regulated by TRX, Tron's native cryptocurrency, and unlike stable coins such as USDT or USDC, USDD is not backed by fiat money or any physical asset for that matter; an algorithm controls parity with the US dollar through an arbitrage trade between USDD and TRX, where basically, to create USDD you burn TRX, working in reverse as well.

Sound familiar?

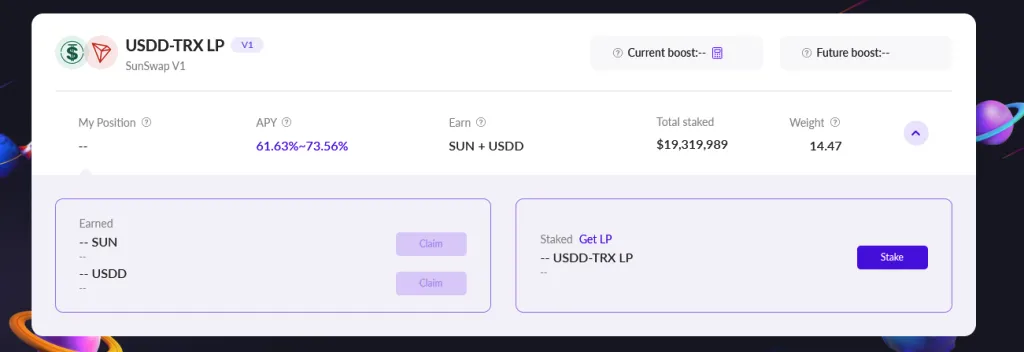

Yes, it is a very similar system to the one implemented by Terra to issue its stable coin Terra USD (UST), in which the UST collateral was LUNA. But another coincidence with this failed project is the fact that USDD also offers an annual return of more than 20% on several projects. For example, on the Tron network's own SUN.io platform, interest rates stand at 24-28% for those depositing USDD-USDT to add liquidity to the pool, and even more than 61% can be earned by adding funds to the liquidity pool in USDD-TRX. These rates have captured the attention of investors, and platforms such as SunSwap and JustStables have also experienced growth in their TVL this month.

Screenshot taken from Sun.io.

While USDD is still far from the size that UST was in terms of market capitalization, we can see that it is growing rapidly, on Coinmarketcap we can see that USDD currently has a circulating supply of over 667 million tokens, giving it a market capitalization of over $667 million, a figure much higher than the $90 million recorded during the day of its launch.

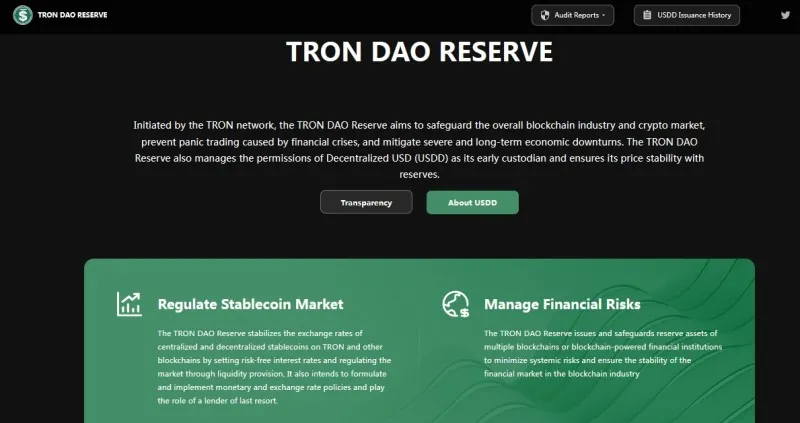

And to support investors against a possible failure of the algorithm, Tron has contemplated the creation of the TRON DAO Reserve, through which a reserve fund will be created with the aim of preventing panic trading and safeguarding the blockchain, a function similar to that fulfilled by the LUNA Foundation.

Screenshot taken from tdr.org.

Well, based on the very recent experience of Terra and its UST it is inevitable for anyone to make these comparisons, let's just hope that this project based on the Tron network does not follow the same path, and can actually deliver on the returns offered and keep its currency parity stable with the US dollar.

Thanks for coming by to read friends, I hope you liked the information. See you next time.