One of my preferred long-term holds has been Travala (AVA).

With such a low supply (~61M) and a working product with hundreds of thousands of USD in revenue + the backing from Binance makes the $AVA token a strong long term hold in my eyes.

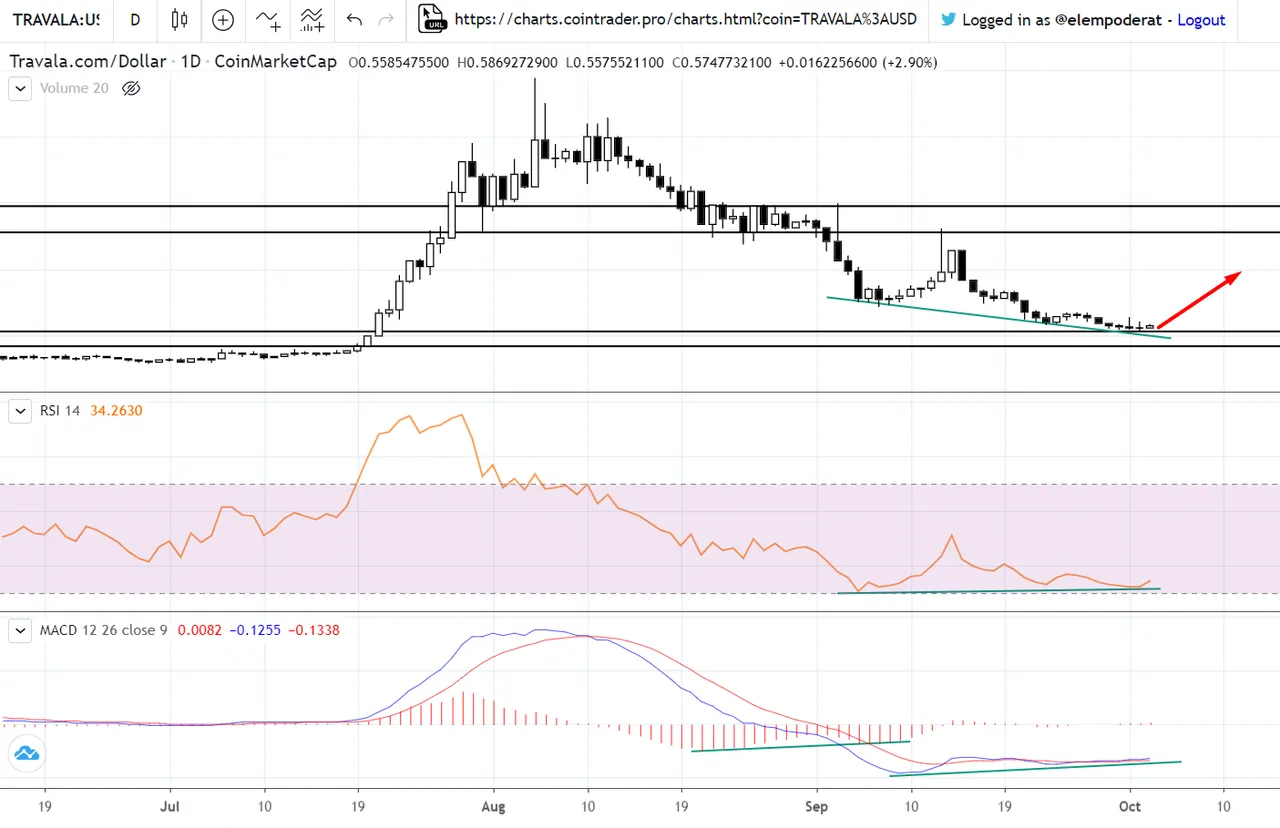

From a TA perspective, we can see this:

After a massive bull run in July (+430%~) and a Binance listing in early August, AVA corrected a massively (-70%~) from the top and seems that is finding slowly but surely their bottom.

I sold some in the run up, and I have been rebuying like a degen since the ~1,5$ levels.

It's true that I'm facing some pain atm in terms of ROI, but I'm confident that we'll see a reversal soon. (I'll keep accumulating if it keeps falling).

Check the indicators (MACD & RSI):

Maybe it's my permanent bullish bias, but if you like easy money you also be buying as much AVA as possible.

I also like the fact of how the lower timeframes are slowly escalating into the higher ones. The weekly chart could still face some downside, but the 3D one is also ready.

Pro tip: always remember to search for 'confluence' to confirm your trades.

Disclosure: yes, I own some AVA, if you're wondering.

And just in case I don't say this enough times.

Take care, because this space can be wild.

Trade safely and don't gamble your rent!

You can follow me on Twitter