The cryptocurrency is the futuristic digital currency even though volatility is common a character of cryptocurrencies, the technology still brought in solution which is Stablecoins. Trust is important when considering currency because we did not only put value not on just a piece of paper or digital figures, but on what they can give us, so the use of currency is not without trust. However, trustfulness does not always need collateral. You ask, what am I talking about?

The majority of paper money (fiat currency) backed up with gold in time past but because the world can't manage the gold standard system, they resolved to currency system which is government control and issued by central banks. The moment the government lose their trust and people start to afraid, the price of currency starts to drop. The stable coin at the centre of this discussion also has the collateral side of its own which made it not stable. Are you confuse?

Follow me closely!

From the name, it's clear that stable coin was introduced to function as stability for the volatility in the crypto market (price fluctuation).

What Is Stable Coin?

We can say stable coins are coins that their unit of value is not from any specific currency, but only based on the set of stabilization tool which serves as controls (minimizing the fluctuation of their price in such currency). There are stable coins that based their value on fiat currency, which made them not stable in real sense. What do I mean?

Cryptocurrency is a decentralized asset and every operation that counter the decentralized feature of crypto is not solving the problem sighted in the traditional finance system. A collateral stablecoin based its value on fiat which made them vulnerable to an intervention of human and made it centralized at its operation and functionality. As an issuer of a fiat-collateral stable coin, it is of necessity to prepare the same amount of fiat currency as their stablecoin to ensure their stablecoin is pegged and changeable to the fiat currency, whenever.

Have you thought about a stable coin that is pegged on crypto assets? This can't solve volatility we are talking about, therefore looking closely on non-collateral stablecoin is the best saving asset when dealing with volatility in crypto space.

Non-collateral stable coin

This type of coin uses protocol and application for its operation. The algorithm in question here is a smart contract that generates a mechanical function that enables change in the supply volume of the coin if needs be to maintain the price of the token which is pegged to an asset. The moment the price falls below the peg the smart contract sell off the tokens and supply token to the market if the value increases. In this way, the token remains stable and holds its peg.

Are you thinking of converting your fiat currency in your local country to the crypto asset?

In less than five minutes you can get this done here

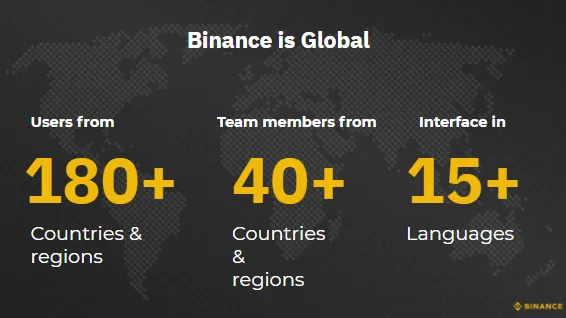

Binance support over 18 Fiat currency on their exchange and having users from over 180 countries with 15+ language interfaces. Get your local currency deposit within 5 minutes and you can also benefit from $5 first trade transaction.....

Register here and chat me for a guide if you need support.