Hey, fella!

Can you pitch into this! By February 2021, Bitcoin just hit its All-Time-High and displaying no sign of dropping or coming down, and again some Altcoins are 20x or more and you happen to be holding a substantial amount of one of this whole coin/token mentioned.

The Crypto destination is clear and the moon is clearly inside, but the more we move closer the more you start to realize you have no answer to important cryptocurrency investing question of when should I sell? Check this out, do you really have an answer to this question?

This time last year, 12th November 2019 I published a post on decentralized lending with the mind of revealing the importance of staking, though many don't really understand DeFi then since the sector still a baby. Do you seek knowledge to understand the sector and the features that surround it or you are trying to buy your way into the sector? There is a saying, do not buy it, rather earn it. When you earn the process of researching, engaging, attending seminars, presentations, AMAs and build on them by asking questions, you will know how to sail through and land yourself a successful journey in crypto space.

Let's go back to the question!

When Should I Sell My Altcoin?

I need to say this, I am not a financial adviser, you are responsible for every action you take. Kindly Do Your Own Research before you take action.

The crypto market movement/structure is based on two important analysis which are:

Fundamental Analysis

Technical Analysis.

Mastering the above analysis, gibes you edge in crypto space and you will fully understand the market structure and movement. Yes, crypto market based on speculation, but you can't speculate if you lack understanding of the above. When you consider technical analysis, which is the base of what many crypto traders use to determine their movement and the market structure, you may be confused if you are new to crypto trading due to the fact that, there are many tools attached to crypto trading.

On this article, I will limit myself to only two tools/analysis, but if you want to learn more, you can hook up with me.

Before I talk about when to sell your Altcoin, you need to first carry out your assignment on the Altcoin you want to invest in. Check the equality, equity, and reality of its use case. Make sure inflation is not too high, it is important to note the circulating supply as against the maximum supply.

Now the Two Tools!

Bitcoin Dominant

Bitcoin dominant is an important tool when you are considering when to sell your Altcoin. You ask, what is bitcoin dominant?

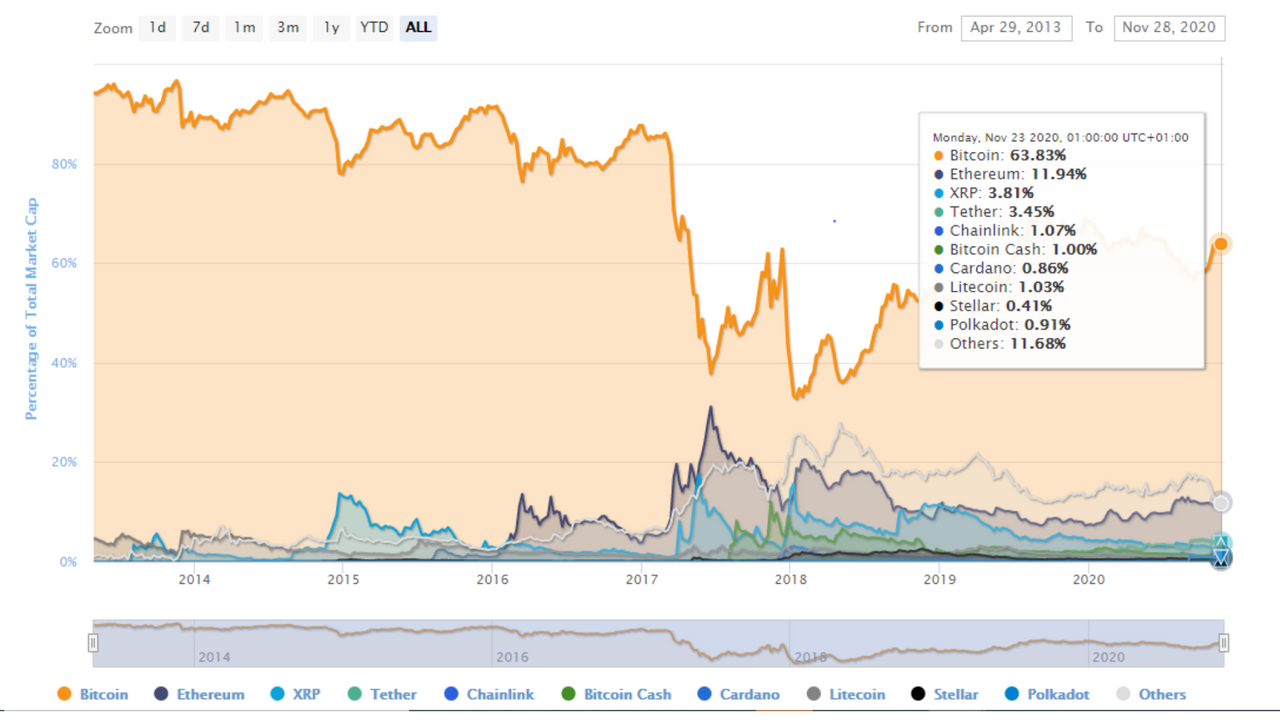

According to FXCM in South Africa (20 years trading experience), they define the Bitcoin Dominance Index as a metric that investors can use to get a quick sense of Bitcoin's value relative to the broader digital currency market.

NB: When you are using any technical analysis to determine market movement, the time frame is important and how you draw your tread lines.

In 2017/2018 during the bull run, bitcoin dominance felt just 37% which is very important due to the fact that a large amount of money moving into altcoin was part of why many hold sold-out ATH during that period and if we assume the continuation of this bitcoin predominance (presently at about 63.83% as against 70% of September) we may just see another sudden drop in bitcoin dominance. Should the drop happen, it may once again bring a lot of money into cryptocurrencies space and takes Altcoin to move ATH, so when you see bitcoin dominance lost it, then you may plan your Altcoin exit strategy.

Check The Satoshi Value Of Your Altcoin

Trading Altcoin for Ethereum because it is very easy to do this on Uniswap, but few usually check the price of their Altcoin as against Bitcoin before swap.

Crystal clear, many of us, when we look into Altcoin value, we focus on the dollar value, it is important to change your orientation, because, when you check the price of your Altcoin in Satoshi value, this is what gives you the best indication of whether your cryptocurrencies are rising in value in relative to other assets in crypto space.

See, it is the value of your token in Satoshi value that determines whether your token is rising in value when you compare it with other assets in crypto space. Are you trying to figure this out?

Suppose your favourite Altcoin has been rising in dollar value, and you start to feel the key of Bugatti La Voiture Noire materializing in your hands, then you click on other Altcoins to discover they are making even more impressive gains and your favourite Altcoin is barely keeping up maybe even lagging behind, so what's the game! If you take a closer check on the bitcoin pairing of your Altcoin, you will notice even as your Altcoin is rising in dollar value, by losing value in Satoshi and other tokens have been gaining value in Satoshi

Also, the time frame you use to analyze the trends might influence whether is going upside or downside and if you are lucky you will see a clear trend which can prompt you and reveal to you whether your coin is valuable in terms of real money or in term of dirty fish lol.

There are more into this, but a close look on bitcoin dominance and your Altcoin strength against bitcoin will help you figure out when is the best time to sell which then become your exit strategy.

What do you think about this analysis?