J P morgan is serious about blockchain and so they developed a chain named Onyx. This is one of the reason they are holding the bitcoin too. Though the amount of coins they hold is purely meant for the funds and collateral. And soon they are planning to be chain that connects other investment banks and services.

J P morgan is not the first mover in this space. Chase, Mirae assets, and many banks out of Hong Kong have deployed similar use case and they seem to be doing pretty good and faster than SWIFT can ever be for their asset movements.

So now the JP Morgan has managed to move the assets between the two giant companies who want to do this through Tokenized Collateral Network. Which is again one of the investments of the JP Morgan.

Let's talk about how Onyx is playing the role here.

Image Credit: Onyx Chain

What is Onyx Chain?

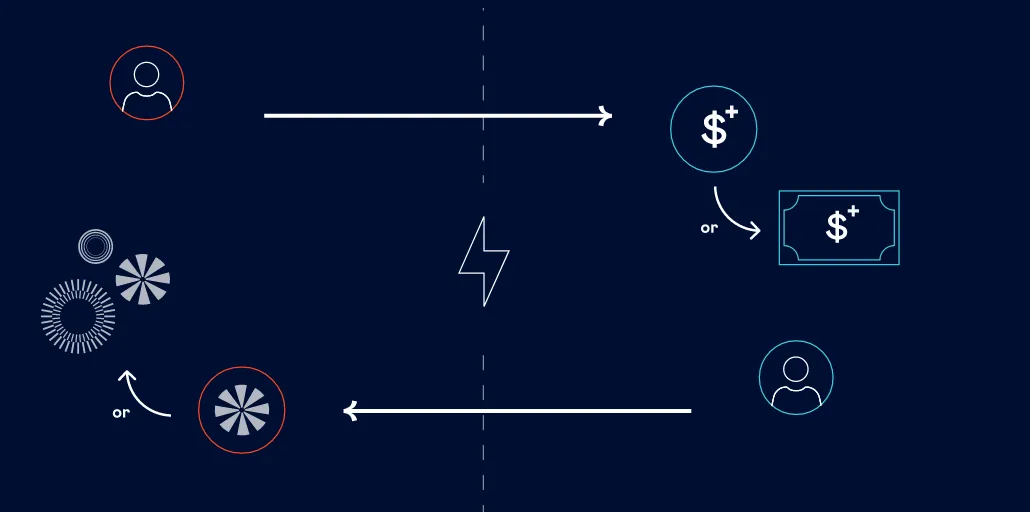

When it comes to the blockchain designed for bank. It has certain process. Like you are going to follow the requirements and also setting the rules in the trade. Once the trade is accepted there will be transaction and the chain is going to convert the liqudity and give both the sides what is inteded in the contract.

So this type of approach was common in all opensource chain. However the thing is this is the chain under JP Morgan. So not a lot of people would get the chain access and also this being the chain which would be under their control the parties who choose to use it would be using it for their finance and asset movement only.

BlackRock & Barclays Asset Movement

JP Morgan has designed the system which has been called as the Tokenized Collateral Network (TCN). This system takes two parties and one party has its own collateral which they wish to transfer to another with the smart contract. They do this using the system.

Now here Blackrock has managed to digital tokens and those are now transfered over the counter to the barclays. And this has been done through the Onyx chain. It also moves the asset lot quicker than anything so you can see how it would help banks and the multiple parties in consumer side.

Consumer side JPM Coin

JP Morgan is not just doing the blockchain but also making it's own token. Like that would be pretty much common consumer case where chains make their own token and let the consumers do what they want with the same. Here JP Morgan bank is making its own coin that would be used for remittance and the transfer internally.

Think of it like a stablecoin. Where you can have them pegged to the USD or any other national coin. You can find them working like an XRP. In that case you can see that JPMorgan chain has decided to act faster to get into the market.

World of the blockchain and the crypto has been going on pretty strong over the years. And JP Morgan, Chase and many other banks are not letting the trend pass them by. This is a proof that Ethereum and Bitcoin are going to be market leaders on which these bank chains would look for value.