With the S&P 500 index trading near all-time highs, there are reasons to be cautiously optimistic.

The first factor is the upcoming elections. It makes sense to book some profits. Any political uncertainty can trigger a market sell-off.

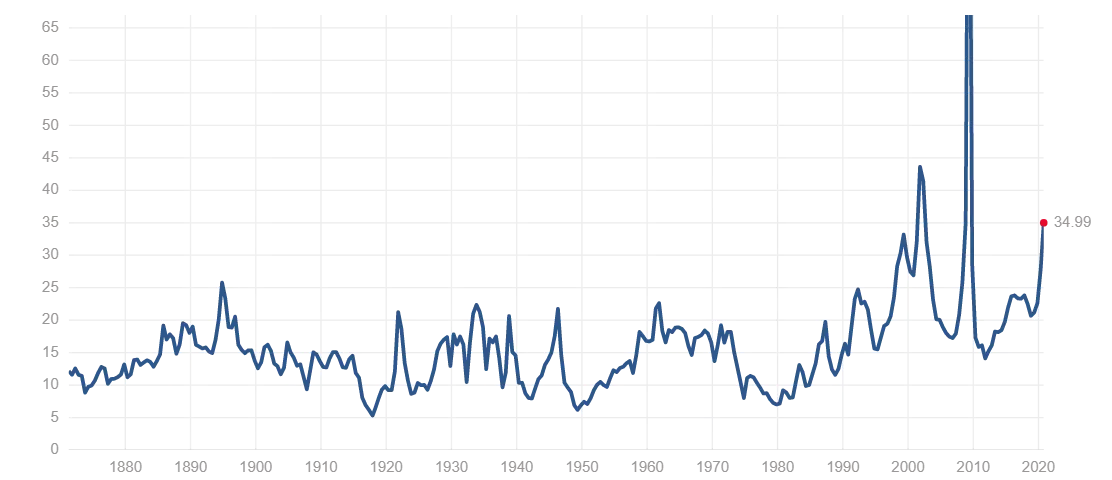

Another key point to note is that S&P 500 valuations. As the chart below shows, the index currently trades at a P/E of 35.

The mean and median price earnings ratio for the S&P 500 index is 15.85 and 14.83 respectively.

Clearly, valuations are stretched and some correction is likely relatively soon.

I believe that investors need to go overweight on low beta stocks and underweight on high beta stocks. Also, with the holiday season approaching, some low beta retail stocks might be attractive.

I personally like Walmart (NYSE:WMT) and Costco Wholesale (NASDAQ:COST).

Overall, it’s a time to be cautious and ensure that capital is protected. Investing in investment grade corporate bonds is also a good idea as a part of creating a defensive portfolio.