So you bought your first NFT (jpeg) and now it is rotting in your Opensea wallet. You love it so much that you don't wanna sell it anytime soon or maybe you plan on selling it never ever. So what's the other best thing in crypto right now after NFTs? It's DeFi. Finally, we have a platform where you can do something with your NFT, a major utility that can benefit many NFT holders and crypto lenders. NFT x DeFi !!

Meet NFTfi

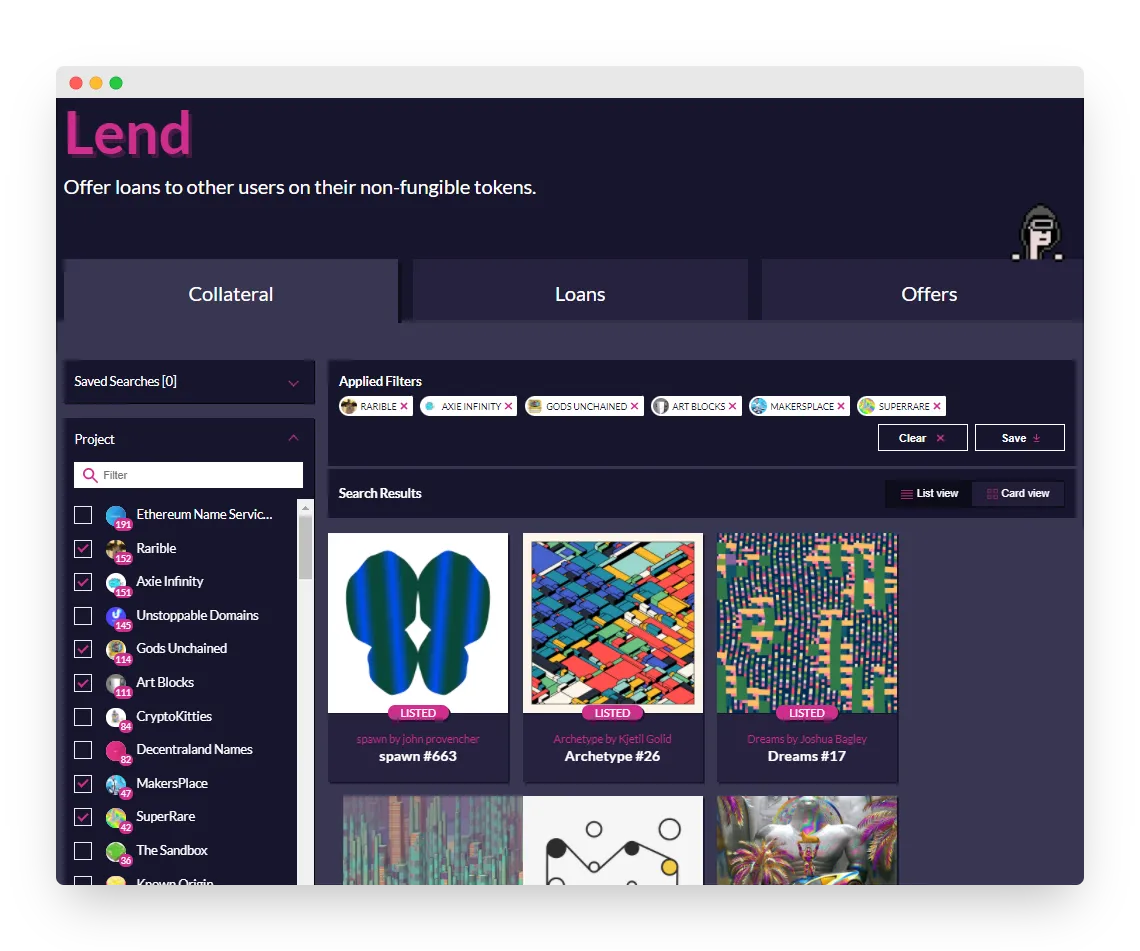

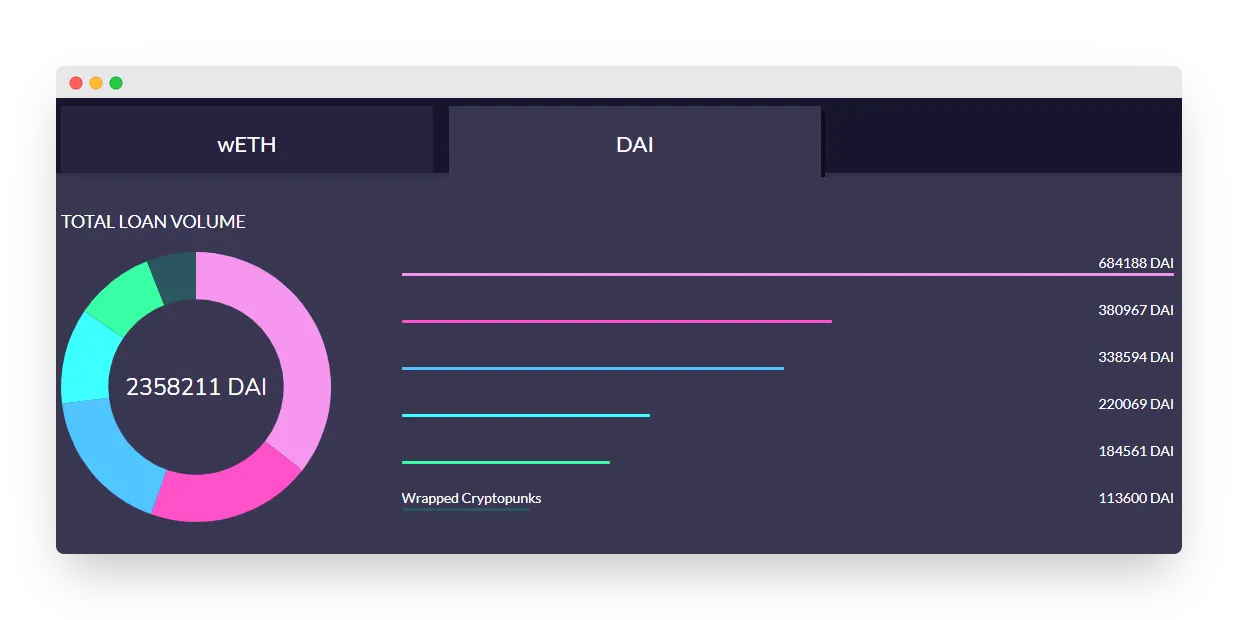

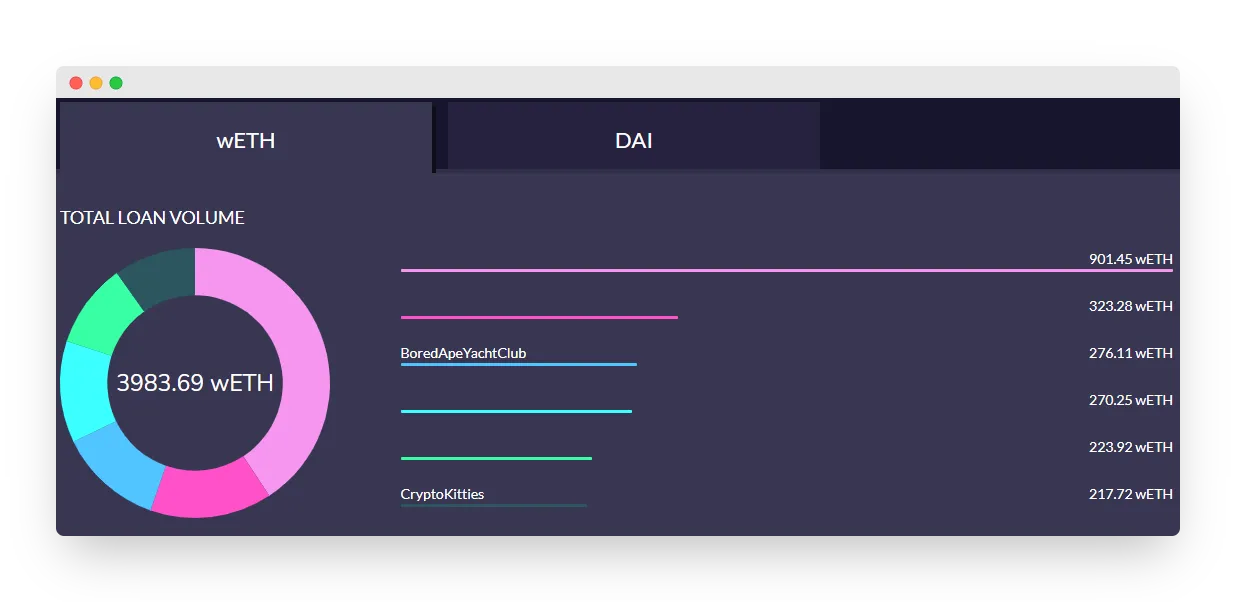

Where NFT meets DeFi. NFTfi is a peer-to-peer marketplace for NFT Collateralized Loans. It allows you to put your NFT (Non-Fungible Token) assets as collateral to get the loan or alternatively you can provide loans to other users on their NFT assets. You can also Lend or Borrow wrapped Ether (wETH) or DAI.

The platform is founded by Stephen Young who is also acting as the CEO. He believes that there will be a growing ecosystem of DeFi applications built specifically for NFTs like lending and insurance products.

How It Works

It's pretty simple for both Borrowers and Lenders. Just need the Metamask wallet to get started:

- Borrowers can list any ERC-721 token up for collateralization. Lenders will be able to offer them a loan with a certain percentage of interest.

- Once a loan is accepted by the borrower, Ethereum (ETH) from the lender's account will be paid to borrower and their NFT gets locked in the NFTfi smart contract. It will act as an escrow for the loan replayment.

- After the repayment of the loan with the amount of interest, the NFT asset will be transfered back to the borrower. If the borrower fails to repay, the asset will be transferred to the Lender.

- Lenders have the power to offer loans on various NFT assets of their choice, available on NFTfi's marketplace.

The Future of NFT x DeFi

We already have a couple NFT x DeFi applications in the market like NFTX, NIFTEX, Yearn Insurance NFTs and Raribale. NFTfi has facilitated more than US $15 million dollars in loans (wETH & DAI) since its public beta launch in June and continues to grow.

They have been funded by Animoca Brands and further collaborated to attract more investors. In the first round of funding they raised a total of US $890k from top VC firms like Coinfund, 1KX, Collab+Currency, Maven 11, and The LAO. People like Roham Gharegozlou (CEO, Dapper Labs - created NFT DApps like NBA Top Shot & CryptoKitties) are also associated among many other individual investors who have expertise in the space.

NFTfi is one of the earliest projects tapping into this market and combines DeFi and NFTs. I think their team has the capability to expand this platform with more features and options to choose from. Once they provide support for more platforms like BSC, Polygon, WAX etc. I see these volumes go up in no time. What do you guys think? Would you lend your NFT for a loan or provide a loan with NFTs as collateral? Comment below!