DeFi 1.0 has issues like security, scalability, decentralization, liquidity etc. DeFi 2.0 is a revolution that started in 2021 to combat these issues. Olympus DAO was one of the first ones to lead this race by providing ideas like Protocol Owned Liquidity using a bonding mechanism. It was forked several times and after that, many other projects came up with different ideas to get over DeFi 1.0 issues. In this blog, I am going to throw some light on one such project that could be the next big thing.

"Vader" means "Father" in german. 😂 When I found LUNA back in the day and got excited, the same level of excitement I felt when I got to know about Vader Protocol. Yes, it's the hottest decentralized liquidity protocol in the market right now. If there is one coin you want to buy in 2022, it has to be $VADER. At the time of writing this, it's only $0.02 which is so cheap because the project started a few weeks ago.

What Is Vader Protocol?

Vader ($VADER) is an all-in-one DeFi protocol built on Ethereum that uses three different DeFi 2.0 ideas which got popular in 2021:

- Terra (LUNA) - Stablecoin Burn Buy Mechanism

- ThorChain (RUNE) - Continuous Liquidity Pool, Impermanent Loss Protection & Synthetic Asset Creation

- Olympus (OHM) - Bonds Sales Mechanism & Protocol Owned Liquidity

In order to understand $Vader, you have to understand how the above three protocols work through the mechanisms mentioned against them.

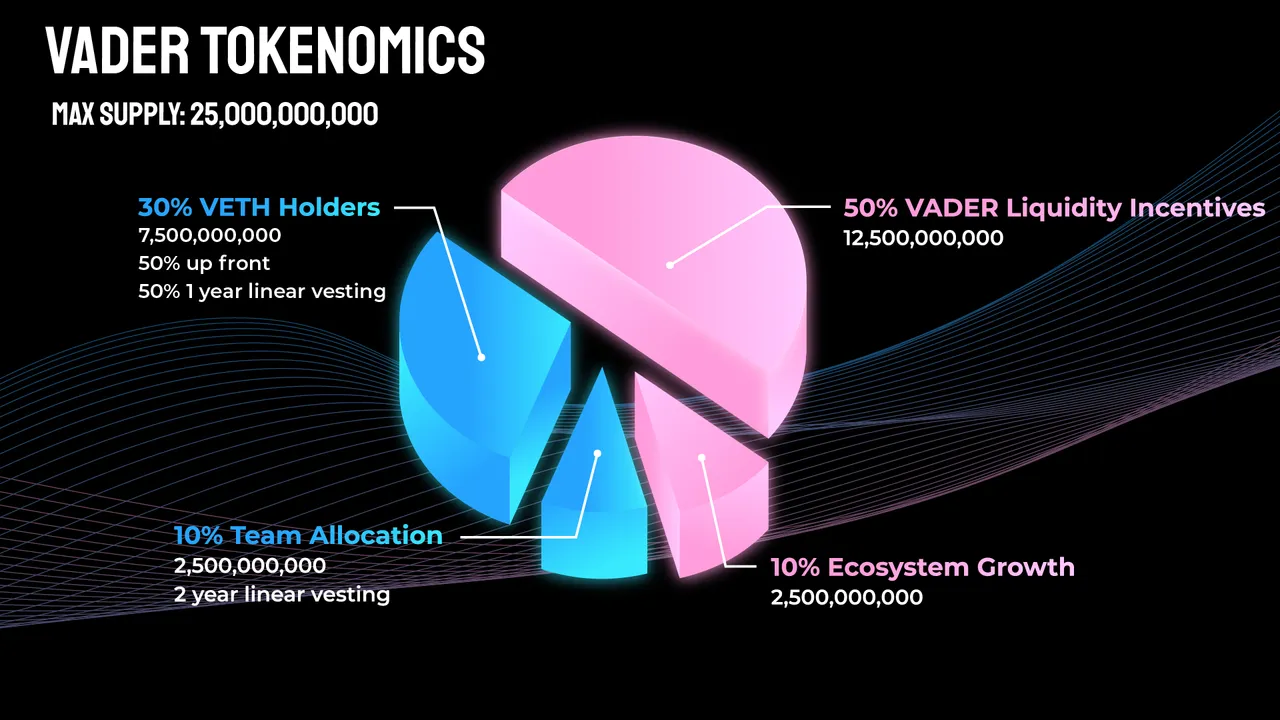

$VADER Tokenomics

It's pretty simple and straightforward. Max Supply of $VADER is 25 billion tokens. Just have a look at the below infographic to understand the Token Allocation:

Ethereum's Algorithmic Stablecoin - $USDV

Vader uses a stablecoin anchored AMM. $USDV (pegged to USD) is an algorithmic stablecoin minted from $VADER with zero slippage from the market price. Slippage has been an issue with beat Terra. It has gone up to 4% during market crashes when everyone sells. Nevertheless $Vader uses the burn buy mechanism that Terra (LUNA) uses. To mint $USDV you will have to burn $VADER and vice versa. Two uses of $USDV as of now:

- Token swaps with pricing in a currency we all are familiar with. SO you will know exactly how much you are buying or selling.

- Liquidity pool pairings are done with $USDV in association with other assets to avoid volatility issues.

Exciting AMM Features & Synthetic Assets

Vader has provided various features to benefit the liquidity providers who play a huge role in making all of it happen:

- Continuous Liquidity Pools (From ThorChain) & Slip-based fee mechanisms are used to incentivize LPs since you have to pay high fees for each transaction on Ethereum. As demand rises, LPs will have the chance to make more money because all fees collected from these mechanisms go to LPs.

- Impermanent Loss Protection is provided to LPs using a reserve pool. The fees will be generated from the protocol as more and more people use it. A part of it goes to the reserve pool which covers the deficit from their original stake while cashing out.

You can also mint Synethic Assets using Vader and earn interest by simply holding them. They are tokenized derivatives of other assets - 50% collateralized by the real assets & 50% collateralized by $USDV. Rising demand for Synths and an increase in their adoption rate would help the protocol scale automatically and there is no limit to it.

Governance

As per their whitepaper, they have chosen to go with minimal governance. This means only a few features can be edited using the DAO. In a perfect system where there's no need for any change to be implemented, governance can be removed completely. It sounds like a unique concept but I still feel that it is necessary to keep a check on the network.

Should You Buy $VADER?

Vader is an amalgamation of one of the best DeFi 2.0 protocols out there. In theory, it's THE BEST of everything. I think it has the potential to become 'The Father of Decentralized Liquidity' but it's too early to have such bold conclusions. Right now, they have a running app - https://www.vaderprotocol.app/ where you can purchase bonds to get $VADER at a discount price. Also, the burn buy mechanism is live to acquire $USDV or $VADER. AMM features are not live yet but they will be launched soon. Honestly, I haven't looked into their team and they seem to be busy with the launches related to Aphra Finance. The project looks promising to me but a long road ahead because developing such a platform is not child's play. So, should you buy $VADER? Yes, if you think this could become something big in the future and you want to be a part of it. No, if you think it's another 'too good to be true'. Do your own research! Please let me know your thoughts in the comments below!

Vader Protocol Linktree - https://t.co/YqNhZxy7ux