Crypto is a difficult concept to understand for many people out there. It's not just a digital currency, it's not just an investment vehicle, and it's not just the technology behind it all. Crypto can be all these things at once and more! It can also be confusing as hell! The "market cap" of cryptocurrencies is one metric that gets thrown around a lot everywhere on social media, but what does it mean? Let's understand in a simple way!

What Is Crypto Market Cap?

The crypto market cap is a number that represents the total value of all coins in circulation. It's calculated by multiplying each coin's price by its circulating supply and then adding those numbers together.

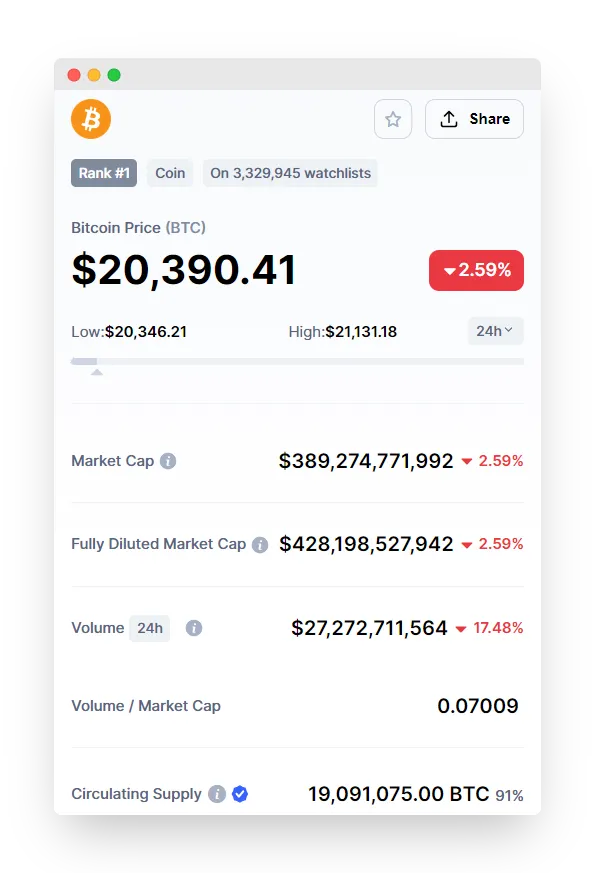

Since the total value of cryptocurrencies can fluctuate daily (for example, Bitcoin went from $47K to almost $20K within a few months), this number can change significantly over time as well—sometimes drastically—so it's important for investors and traders to know how much their investments are worth in dollars at any given moment. At the time of writing this post, the price of 1 Bitcoin is $20,390.41. The circulating supply is approx. 19 million. If you multiply these two figures then you will get the market cap i.e. $389,418,574,537.

Now you can use the same formula to know the market cap of your coin and judge where it stands as compared to other coins.

Does Crypto Market Cap Matter?

The crypto market cap is a measure of the total value of all the cryptocurrencies in circulation. It's important because on a very basic level it tells you how much progress has been made toward cryptocurrency adoption.

If you're new to cryptocurrency, you may be wondering what this means or why it matters at all? Well, there are several reasons why having a large crypto market cap is good for your investment strategy:

The bigger the market cap, the more money is flowing into cryptocurrencies and exchanges which means that more people will be buying and selling crypto coins. This also means that there will be more investors trying to get involved in them.

A higher market capitalization also shows investors that there is demand for this particular coin or token – i.e., someone actually wants these things, otherwise known as "demand". This can help increase confidence among other investors who may have been hesitant before due to fear over future returns from an investment made today (i.e., volatility). If enough people start buying up tokens from around the world then we might even see some exciting growth rates.

Conclusion

As crypto markets continue to grow, it is important to keep an eye on the total crypto market capitalization. While many cryptocurrencies have seen explosive growth, even more have died off due to various circumstances. Thanks to CoinMarketCap's tracking of these numbers, it is easier than ever for us to monitor these trends, as well as make predictions about where the crypto markets will go in the near future.