Introduction

In the crypto space, tokens are the pivot of almost all transactions and activities. Many have come to view crypto tokens as just money which could be traded, used for investment or even for digital payments. For the newbie just joining the blockchain space, tokens are mostly digital currency for them. But seasoned participants in the space realize that crypto tokens play a far larger role than just a medium of exchange.

In this presentation, we will look at other important roles that tokens play in the crypto ecosystem. The knowledge would serve readers for good. When they realize the different ways tokens could be used in the space, it could inform their decisions to store, or invest more in different crypto tokens. Of course the article is not financial advice, always do your own research before getting involved in any project.

Now consider other different uses of tokens in the crypto space beyond being just digital currency.

Providing utility in a blockchain protocol

One of the most important roles tokens play in any blockchain project is to provide utility for users. Basically, it means that such a token was designed to be used for a particular purpose other than being a medium of exchange. Depending on the type of project involved, utility could take on a number of different purposes. Lets see how this works out in various ecosystems

Utility tokens could be used to open up premium opportunities to its holders. A blockchain platform might have limited features which is accessible to all users at no cost. Everyone that signs up to the platform gets to use those features. However, there could be advanced features or tools which are unavailable for free. To unlock or access these features, users could be expected to hold or deposit a token. In this regard, this token has served as a utility token.

Without looking too far, the Inleo platform is a very good example. When users sign up, they are free to use threads to publish microblogs, and interact with other users. They are actually free to thread and use all features available for free. However, those that wish to use advanced features on the platform need to deposit 10HBD to the designated account. Once they do this, they become premium users. Some advanced features becomes available to them such as making longer threads. In this example, the 10HBD deposited becomes a utility token which unlocks premium features of the blockchain.

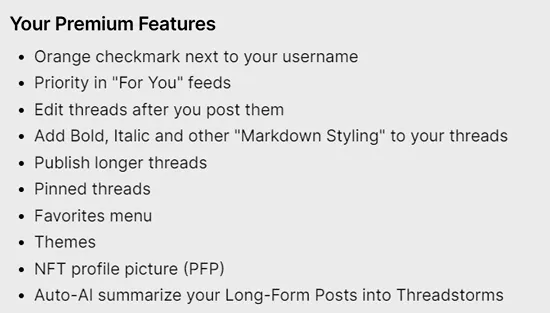

Note in the image above the number of features that are available to premium Inleo subscribers? The most obvious one is the Orange Checkmark that is attached to their username. The other features listed here can only be access by premium users. Depositing the 10 HBD utility unlocks these benefits.

Another example of using a token to provide utility is found in decentralized exchange platforms. When users open up trades in a DEX platform, they are expected to pay for the trading fees. Most DEX platforms prefer to have these fees paid using their own native token. And to incentivize this preference, they usually charge a lower fee when paid with the platform token than with other currencies. Sometimes, some new DEX provide free swaps for holders of their token. In this example, the token has unlocked access to conducting swaps at lower fees or for free.

There are many other numerous examples of utility tokens in defi and blockchain ecosystem. Each protocol and needs differ. Founder teams develop utilities based on activities and events scheduled on the protocol. But then, utility tokens help to unlock specific features, tools or services. This is one good example of how crypto tokens are used beyond being a medium of exchange.

Tokenization of Real World Assets

This is another huge usecase for crypto tokens which is apart from being a medium of exchange. Tokenization of Real World Assets involve creating a crypto token and tying a physical asset value to it. There are many examples, but the biggest example here is real estate.

So a huge real estate property could be valued. Then the value of converted to a crypto token and investors and of course everyone could be free to invest in those in them. The value of the token is thus derived from the value of the physical asset it represents. Not just real estate, tokenization could be done with any physical, valuable assets such as stocks.

Tokenization of real world assets have made it possible for people with little budget to invest in big projects and opportunities. It has also opened up a frontier known as fractional ownership. With fractional ownership, users are able to own a portion of a real physical asset which was tokenized. Investors are able to own a portion of the asset based on how many tokens of the asset they were able to accumulate of buy.

Tokenization thus represents another use of tokens apart from being a currency. When users buy tokenized assets, it gives them the right of ownership of a portion or all of the physical asset it represents. For example for those that purchased a tokens of a real estate property, the tokens gives them ownership rights to the property. It makes them part owners and if the property appreciates in value in the future, the token holders have the right to share in profits because they invested. So tokenization is another example of the use of tokens which is apart from being a medium for exchange.

Community governance

The third use of tokens that I really want to talk about is in the ability to participate in decentralized governance. Web3 introduced a new concept or style of governance which more of digital democracy. Instead having a few people become leaders and represent the rest in government, web3 allows everyone the opportunity to participate in that governance. However, in order to participate in this type of governance, users must hold a token.

So there are community governance tokens that users must purchase and hold. This tokens give them the right to vote decisions proposed by the community. Usually, the power of each users votes depends on how many tokens they hold. The larger their tokens, the bigger the votes. Only users that have the tokens are allowed to vote. Otherwise, they are not.

Governance tokens allow the users to vote on a number of different things with regards to the protocol. For example, there could be a proposal to increase or decrease the network fees of the platform. other changes could involve adding a feature to the platform or removing a feature. It could involve to run a hardfork and upgrade the underlying technology. Whatever these changes and proposals are, not everyone is allowed to participate in reaching a decision. Only token holders are allowed to do this.

Depending on the protocol, governance tokens are utilized in different ways. Some protocols expects users or participants to stake their governance tokens. This means the tokens are to be locked and they are not liquid. Thus they are strictly for the purpose of governance. There are other protocols that require users to just hold the token in liquidity. They way governance tokens are to be held differ from platform to platform. But the most important thing here is that tokens could be used or held or staked to participate in governance. This is another use of crypto tokens which is not as a medium or exchange.

Conclusion

Crypto tokens are popularly looked as money, to be used only in making financial transactions. But from the discussion, it is apparent that tokens go beyond this. Crypto tokens serve a number of many other uses that includes various utility services. There are security tokens that represent ownership. We also have governance tokens which allow holders the right to vote in a decentralized protocol.

Which other uses of crypto tokens do you know apart from the ones discussed above? Lets talk.