Direct from the desk of Dane Williams.

As with any trading approach, it's crucial to continuously refine and adapt your strategy to evolving market conditions.

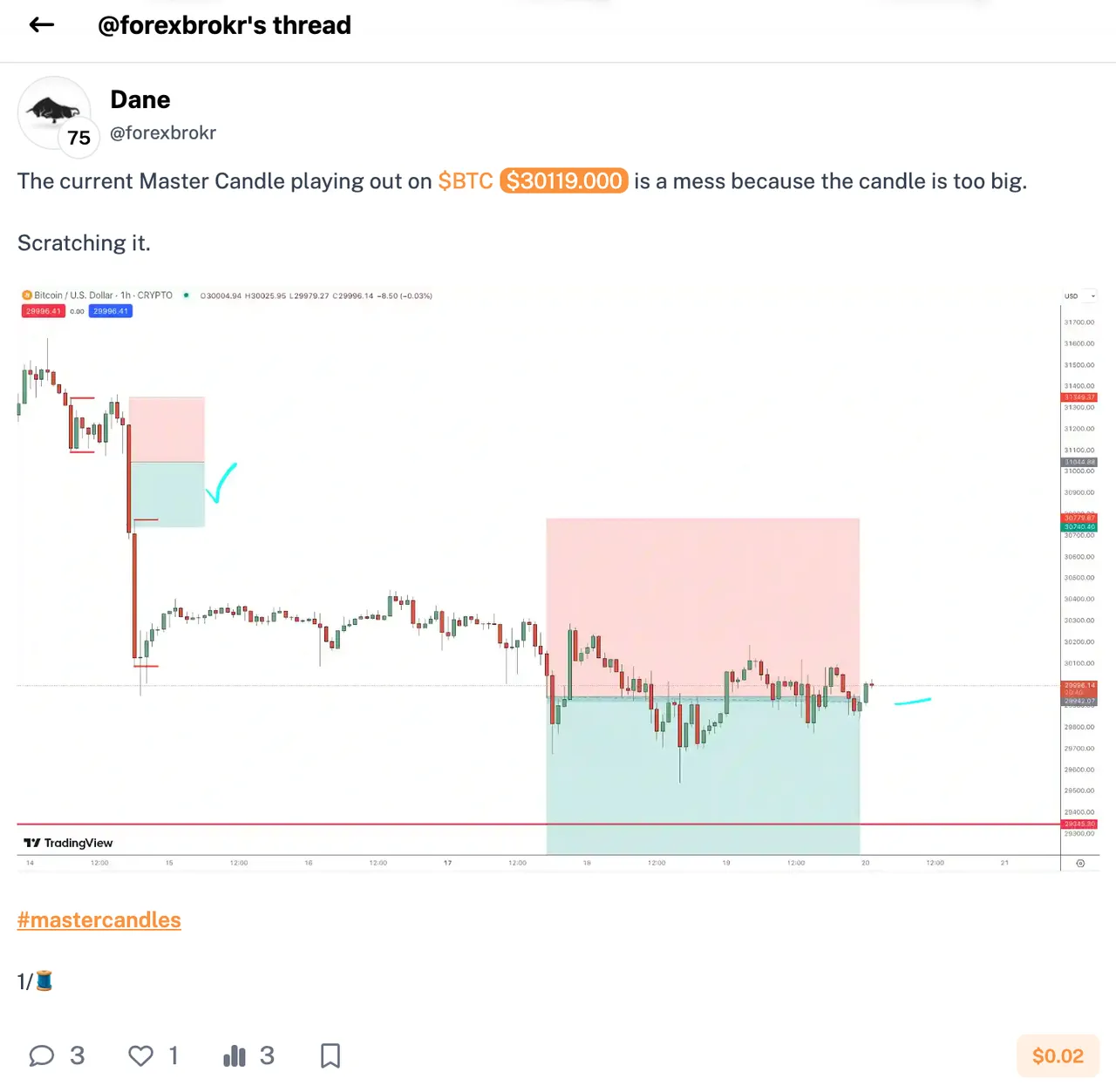

In this blog post, I’m going to explore the challenges posed by large Master Candles, specifically focusing on the substantial $700 Master Candle on BTC.

For anyone playing along at home, this is the 2nd of our Bitcoin live Master Candle trades that I blogged about the other day.

Discussing the importance of implementing filters to enhance the effectiveness of my Master Candles strategy.

The problem with large Master Candles:

My Master Candles trading strategy revolves around identifying a significant price range formed by the Master Candle, which encompasses the subsequent smaller candles.

This range is seen as a crucial area for potential breakouts or reversals.

If you want to make money trading, we need to always be refining and trying to optimise our strategy.

While the strategy continues to prove successful for a lot of trade setups, large Master Candles certainly present unique challenges that should not be overlooked.

One standout example is the colossal $700 Master Candle on BTC that I’ve been blogging and threading about here on LeoFinance.

Such a massive price range might initially appear promising, as it suggests significant support/resistance and thus potential for profits.

However, the reality is that trading such a massive range can be exceedingly difficult due to the prolonged periods of sideways price movement.

Sideways trading, something we might also call a period of consolidation, occurs when the price remains within a sideways range for an extended period.

Large Master Candles, like the $700 BTC one currently in play, can lead to extended periods of sideways movement, lasting days or even weeks.

During these periods, it’s really challenging to take advantage of the strategy, resulting in trades that go nowhere.

Ultimately leading to frustration and bad decisions outside the bounds of our strategy.

Given this trade's continuous sideways trading, I have decided to scratch it and get out of my position as close to break even as I can.

Moving forward, I will implement a filter to avoid getting stuck in similar unproductive trades in the future.

Implementing large Master Candle filters

Filters serve as a set of criteria that can help us identify the most favourable and promising setups.

While at the same time, assisting us to avoid the less favourable setups.

Here are some possible filters for large Master Candles you can consider implementing:

- Size threshold: Establish a maximum size threshold for Master Candles, such as $500. Any Master Candle exceeding this value would be considered off-limits for trading, reducing exposure to extended sideways price action.

- Volatility checks: Implement indicators to assess market volatility before initiating a trade. Avoid trading during periods of low volatility, which are more likely to lead to prolonged sideways movements and multiple Master Candles forming within Master Candles.

- Time-based limits: Consider setting a maximum duration for holding trades derived from large Master Candles. If the trade fails to yield results within a predefined time frame, it may be wise to exit the position to prevent prolonged stagnation.

Final thoughts on filtering Master Candles by size

Master Candles remain a viable, n00b friendly mechanical trading strategy, but the challenges posed by large, $500+ Master Candles can’t be overlooked.

The current $700 BTC Master Candle serves as a stark reminder that prolonged sideways movements can impede even the most promising setups.

However, by implementing thoughtful filters for large Master Candles, we can enhance our strategy's performance, sharpen our risk management and trade the strategy more effectively.

Best of probabilities to you.