Direct from the desk of Dane Williams.

In the world of trading, the risk:reward ratio plays a crucial role in determining your profitability and my Master Candles strategy is no different.

Playing with different ratios can have a supreme impact on your Master Candles trading success or failure.

In my original strategy linked above, I talk about always only aiming for a risk:reward ratio of 1:1.

Where the potential reward of a trade is equal to the risk undertaken - That being the length of the Master Candle itself.

In this blog post however, I’m going to explore the potential benefits of managing trades live and trying to achieve a more favourable risk:reward ratio.

By adjusting your stop loss or alternatively letting winners run, you’re able to potentially improve your trading performance and increase your profitability overall.

Let’s delve into the relationship between your winning percentage and different risk:reward ratios to provide valuable insights for those of you looking to enhance your Master Candles trading.

Understanding risk:reward ratios

The risk:reward ratio measures your potential profit gained (reward) in relation to your potential loss (risk) on a trade.

For example, a risk:reward ratio of 1:1 implies that you’re willing to risk $100 to potentially gain $100.

In conjunction with your strategy’s back-tested win rate, the risk:reward ratio acts as a guide to determine whether your trading strategy is likely to yield profits over the long term.

Limiting stops to improve risk:reward

One approach to enhancing your risk:reward ratio is to adjust stop-loss orders as the trade progresses.

By tightening stops, you’re able to reduce your potential loss on a trade while still aiming for the same level of profit.

If you’re still hitting targets, this adjustment allows for an improved risk:reward ratio, increasing the potential profitability of the Master Candles strategy.

However, it is important to strike a balance between reducing risk and giving the trade enough room to breathe as overly tight stops can result in premature stop outs.

Letting your winners run

Another technique to improve your risk:reward ratio is to let profitable trades run.

Instead of exiting a trade at the first sign of profit, in our case that being the length of the Master Candle, allow your trade to continue as long as the favourable market condition remains.

This approach can lead to significantly larger profits on winning trades, potentially offsetting losses from unsuccessful trades.

Again however, it is essential to have a well-defined exit strategy to protect gains and prevent potential reversals.

This is all up to you.

The impact of risk:reward on winning percentages

As I mentioned above, when used in conjunction with your strategy’s back-tested win rate, changing your risk:reward ratio will determine whether your trading strategy is more likely to yield profits over the long term.

When using a 1:1 risk:reward ratio, you need to have a winning percentage higher than 50% to be profitable.

This means that, on average, more than half of your trades need to be winners in order to generate a positive return.

However, if you actively manage your trades and achieve a better risk:reward ratio, the required winning percentage to be profitable decreases.

For example, if the risk:reward ratio is adjusted to 1:2, a trader just needs to have a winning percentage higher than 33% to achieve profitability.

Similarly, a risk:reward ratio of 1:3 would require a winning percentage above 25% and so on.

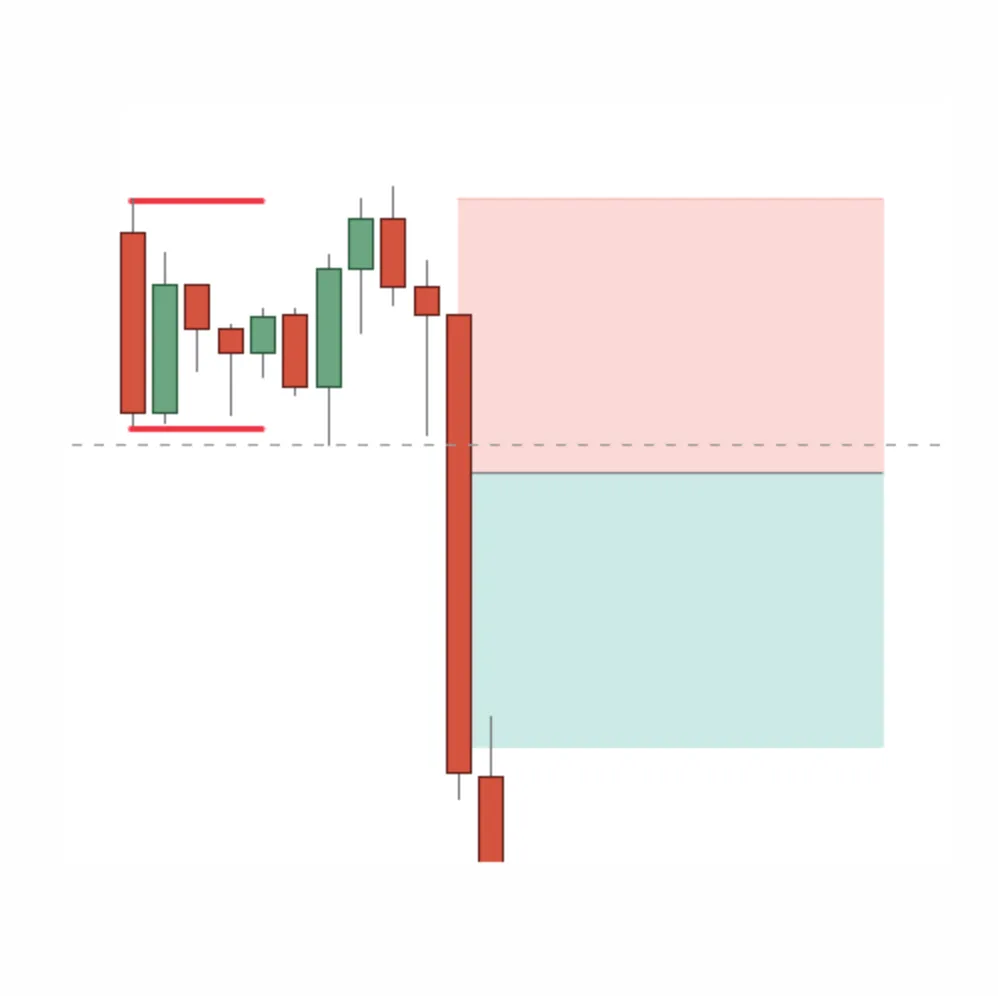

Let’s use the first trade in yesterday’s live Master Candles trading on Bitcoin as an example of how your risk:reward can be tweaked:

That particular trade hit your take profit level within the very first hourly candle, meaning that there was a TON of momentum behind the move.

With those obvious market conditions in mind, you could have left your trade open and instead targeted 1:3 risk reward.

Maximising profits from Master Candles comes from your discretion

It’s true that the allure of my Master Candles strategy comes from the fact it’s a fully mechanical trading system.

But its ultimate profitability will come from those of you who apply discretionary analysis to your trading.

While a 1:1 risk:reward ratio is considered the standard approach for Master Candles, actively managing trades and achieving better risk:reward ratios will significantly impact your profit/loss.

Just as I’ve talked about here, by adjusting stops or letting winners run, you’re able to enhance your profitability.

This is because as your risk:reward ratio improves, your required winning percentage to be profitable decreases.

I’d encourage you to experiment with different risk:reward ratios, while considering your own trading style, risk tolerance and crypto market conditions.

Best of probabilities to you.