I just had to write another post about PolyCub today, after listening to Leofinance AMA recording. It's actually more about HIVE and HBD, but it links strongly with PolyCub.

Many of us on Hive and especially on Leofinance have seen the need for deep liquidity pools for HIVE and HBD, especially outside our ecosystem, which works both as a bridge and as publicity, besides its main function to allow higher volume transactions with HIVE and HBD.

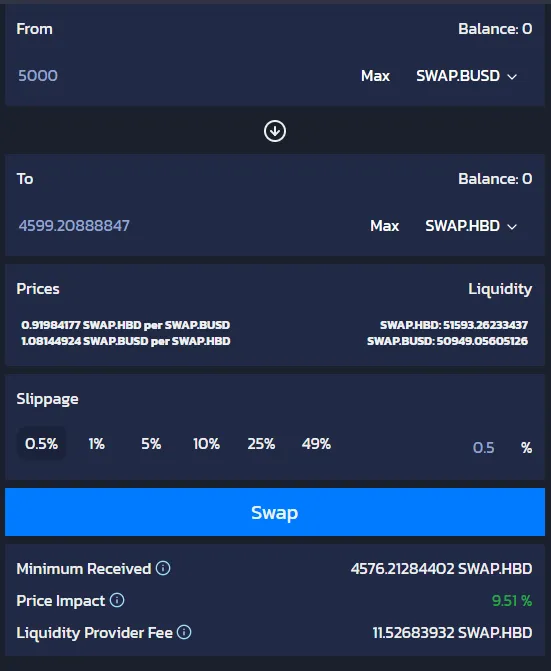

It's true we have a few SWAP.HBD pools on Hive-Engine, one of them even with SWAP.BUSD, but the liquidity isn't very deep and for high volumes 0.25% swap fee + 1% deposit/withdrawal fees isn't something whales are looking for. Not to mention that a 5000 swap from SWAP.BUSD to SWAP.HBD would produce a 9.51% slippage at the time of writing.

A 10000 swap means 19.27% slippage which is totally unacceptable for a swap between two stable coins.

Of course, if you break it down into multiple smaller swaps, the slippage is much lower. For example, at 1000, the slippage is 1.7%. But that may also require a waiting time between transactions, to allow for arbitrages to take place and rebalance the liquidity pool.

This is not something very enticing when you move around a lot of funds.

In the Leofinance AMA, Khal said he plans to add a pool containing HBD and one containing HIVE on PolyCub. Both will be wrapped versions on Polygon of the base tokens from the Hive blockchain, just like pLeo is for LEO. And they will be bridged between Polygon and Hive via LeoBridge.

Exactly what will be the second token in each pool remains to be determined, but for HBD Khal said it'll make sense to be a stablecoin, possibly USDC.

The new pools will probably be farms on PolyCub (just my guess, since they aren't external pools), when they will be launched, and HBD and HIVE collateralization will also be possible.

There is no ETA for this as far as I know, so don't think this is just going to come out next week after LP bonding.

As a bridge to Polygon and back for HIVE and especially HBD and as a collateralization mechanism this will be very useful.

As a deep pool allowing for larger swaps at low slippage, that depends how much liquidity the pools will attract. This is especially a problem for HBD, where liquidity is an even bigger issue than for HIVE. Hopefully some of the big holders of HBD will move a portion of it to that pool, when the time comes to help provide liquidity. Maybe that could be a good reason for a proposal.

We became quite proud of our HBD tokens, haven't we? And to think that many of us wanted SBD to be removed back in the day because it was useless.

And we would like others to appreciate HBD as well, right? To me, there are three conditions for that to happen:

- they should know HBD exists and interest can be competitive at low risk

- they should have an easy way to move funds into it

- there should be enough HBD

Only one without the others won't help much.