These last few days in the crypto sphere are a perfect exemplification of what Nathan Rothschild is credited with saying:

the time to buy is when there's blood in the streets.

I thought Warren Buffett said that, with the "even if it's your own" addition.

Oh boy, and there was blood in the crypto markets, following another debacle, this time of the second-largest CEX and trading platform in crypto, FTX!

At a time like this, I wished I had more stablecoins. For example, I had the bad inspiration to move one of my LPs on CubDefi from CUB-BUSD to CUB-BNB before the real crash started. Those BUSD would have been really handy.

But still, I could find some stables. And if the market doesn't recover by the time a portion of the HBD from my savings get unlocked, I'll have more dry powder to use. Otherwise, I'll put them back into savings and would have lost only 3 days of interest.

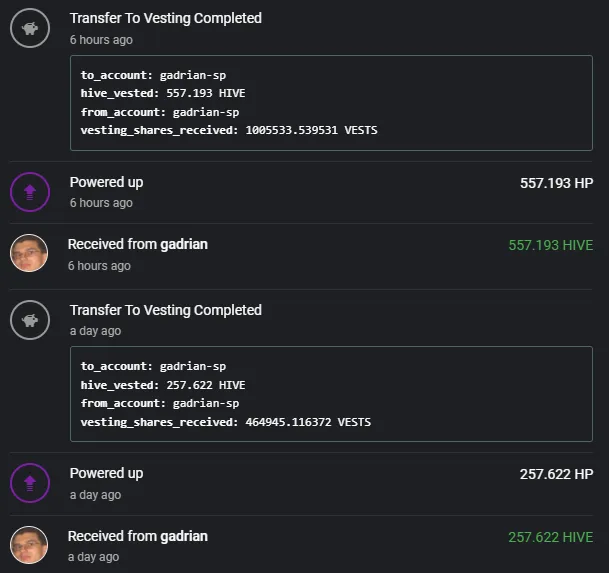

For the time being, I've powered up significant amounts of HIVE twice during the last 24 hours:

This is obviously not planned because I didn't think we'll see these price levels during this bear market. But it's a good adjustment of plans that I'll have to do because of it, so I can't say I regret any of this.

I don't like the level of perfection manipulation has achieved in crypto. I preferred not to pay attention to the drama except for the brief information I took from Leofinance, to have some idea of the situation.

My conclusions from this are that we need to keep Hive as far away as possible from those shady deals (that allowed CZ to sink the price of FTT), continue to have solid tokenomics at the core, and work toward removing or reducing all the points of vulnerability we discover or are revealed to us.

And, of course, without being financial advice from me but rather from individuals far more successful than I am,

the time to buy is when there's blood in the streets.