Jim Cramer is a TV personality that has his Mad Money show. One of the first books on investing and trading I have read was Jim Cramer's Real Money: Sane Investing in an Insane World. As someone who tries to portray himself as an expert in "real money", he made a statement today that I find absolutely hilarious.

Today on CNBC, he said that he sold his remaining bitcoins and used the profits to pay off a mortgage. Which is great a great story for bitcoin. But then he goes and calls Bitcoin a phony money. To quote him:

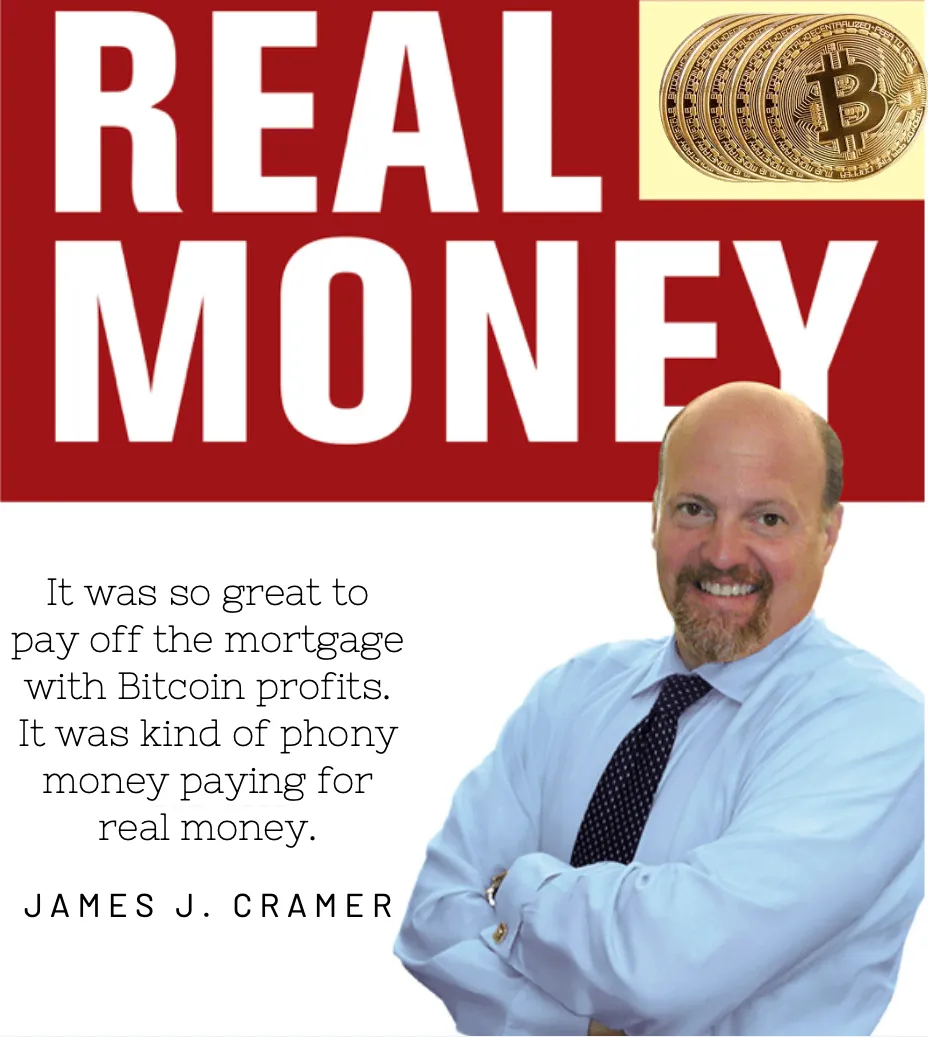

It was so great to pay off the mortgage. It was kind of phony money paying for real money.

You can watch this short, a minute long video here:

The part I find really funny is that, for someone who claims to be an expert in "real money", who wrote a book titled Real Money, and then another book titled Mad Money along with running a "Mad Money" tv show, not being able to pay off the mortgage until realizing profits from Bitcoin and then call it a "phony money".

The question I would ask him is - "Why haven't you paid off your mortgage with real money you have been making over the decades?"

I understand he has multiple houses and properties. I also understand in some situations it might make better financial sense to keep the mortgage and use the money for other investments.

What I don't understand is how can one define something like Bitcoin as phony money when it in the end translates into a real world financial win, like paying off the mortgage.

It must be just one of those Jim Cramer playing a madman on TV moments.

I have both of his books: the Real Money and the Mad Money. The Real Money was one of the first books I have read on investing and trading topics. While it is an interesting read, I haven't learned much that would help me to benefit in the markets. The book fails to provide the path for beginners to get into the markets. In the end the reader ends up with interesting stories that don't convert into actual knowledge to trade or invest.

I didn't even finish reading Mad Money. From the beginning it became obvious that the book was intended to bring readers to watch the Mad Money show and it also made statements like some if not most of the content in the previous Real Money cannot be applied in markets anymore, because market conditions has changed, etc.

Towards the end of last year and beginning of this year many who expressed negative views about Bitcoin as an investment instrument have changed their minds and decided to invest. Among the TV personalities are Jim Cramer, Kevin O'Leary, and others. They will keep changing their opinions. But Bitcoin will keep doing its thing. It will continue redefining what the real money is.

Jim Cramer bought bitcoins at around 12k. When Bitcoin went above 20K and kept going up, he sold some to take out his initial investment and claimed he only left the profits in bitcoin. At that time he also claimed he would buy back if Bitcoin dropped to 18k-20k range. That didn't happen yet.

I guess it was a good decision to pay off the mortgage if he doesn't believe it will continue going up. I hope he is wrong on that one too.