Decentralized exchange technology isn’t just about swapping tokens anymore.

It’s becoming the backbone of an entirely new economy—one where content creation, trading fees, and smart contracts converge to create passive income opportunities and constant buy pressure for a native token.

Enter the LEO token and the INLEO ecosystem: a bold experiment aimed at reshaping how decentralized platforms generate and distribute value.

Decentralized Exchange as the Economic Core

The LEO token began as a Hive-based social token rewarding users for quality content.

But with the launch of LEO 2.0, the project shed its inflationary past and took on a new mission: to create a sustainable, deflationary economy powered by real revenue and built around a high-performing decentralized exchange known as LeoDex.

Gone are the days of printed rewards flooding the market. In this ecosystem, every token distribution, every incentive, and every reward must be earned through the success of LeoDex, InLeo Premium, and future revenue-generating products. It's a model based on cash flow, not emissions.

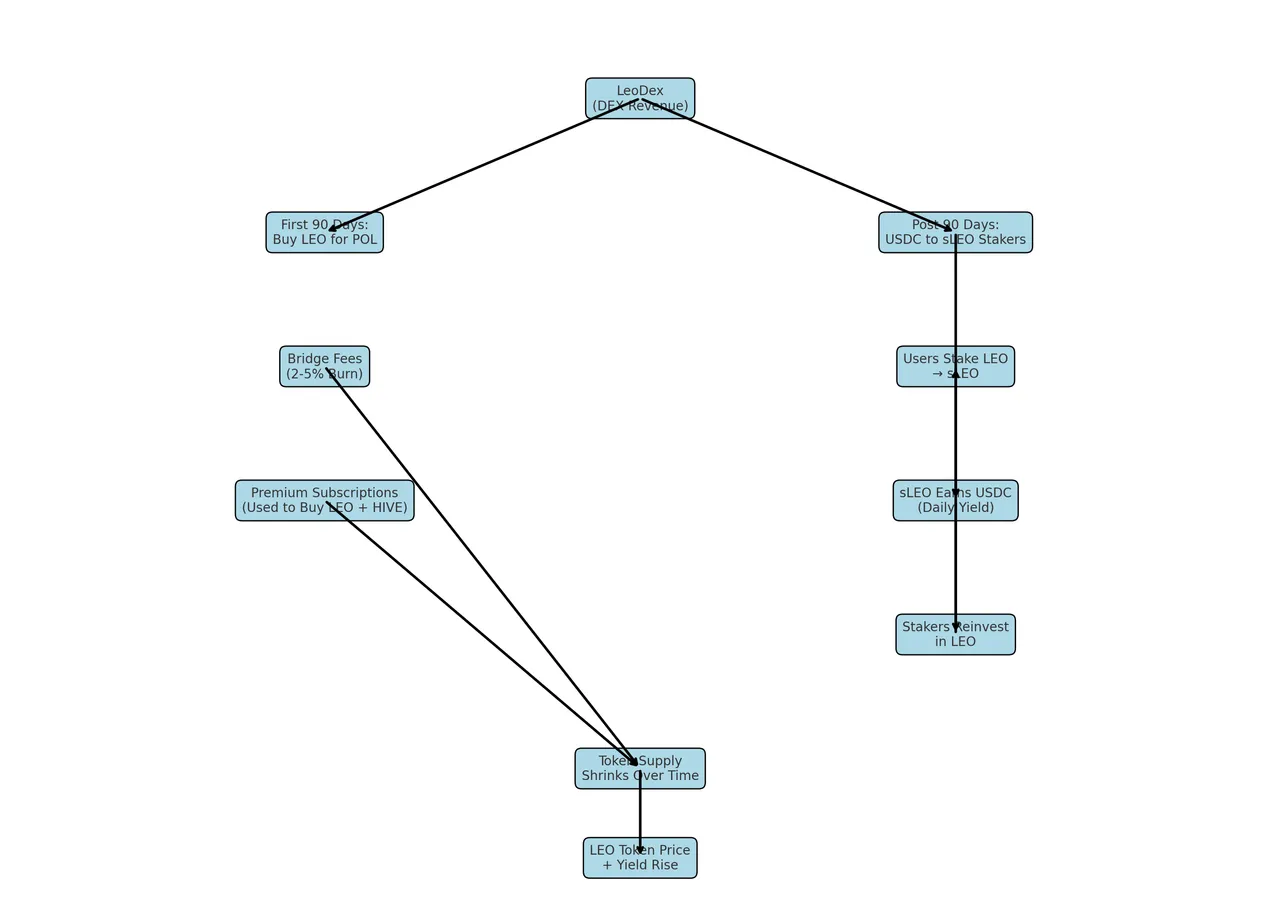

Flowchart: How the INLEO System Works

Diagram Description:

- LeoDex revenue flows to either POL buybacks (first 90 days) or sLEO stakers (after).

- Users stake LEO into sLEO to earn daily USDC yield.

- Bridge fees and Premium subscriptions fuel burns and liquidity.

- This creates constant buy pressure and deflation, driving up yield and value.

The LEO 2.0 Reset: Ending Inflation, Creating Scarcity

In mid-2025, the INLEO team made a decisive move: they burned nearly 970 million LEO tokens, ending years of unchecked token inflation.

They capped the total supply at 30 million tokens and committed to a zero-inflation model.

This wasn't just a symbolic gesture—it was a fundamental shift that turned LEO into a fixed-supply asset.

With no more LEO entering circulation through inflation, every token now becomes more scarce with time—especially as revenue streams are funneled into burns and constant buy pressure on the open market.

This change marked the start of what many now call a 'Web3 equity' model for LEO.

The Master Plan: Five Pillars of Growth

Khal, the founder of INLEO and author of the widely shared "LEO Master Plan," laid out a five-phase vision for turning the LEO token into the centerpiece of a $1B economy.

At the heart of it all is LeoDex, the decentralized exchange powering cross-chain token swaps and affiliate revenue.

Here are the five major pillars:

- LeoDex – A sleek, cross-chain decentralized exchange that earns affiliate fees from aggregator routing (like 1inch, OpenOcean). All revenue goes to sLEO stakers.

- Cross-chain SDK – A toolkit to plug INLEO’s mechanics into other apps, enabling expansion beyond Hive.

- Mobile App – A frictionless experience to onboard users from traditional Web2 social networks.

- POS System – A real-world payment processor integrating crypto and social token logic into physical businesses.

- Ad Network – Monetize attention through ads on InLeo.io, with revenues routed into burns or LEO buybacks.

Each of these elements is designed to feed passive income streams back into the token economy through USDC yield, protocol-owned liquidity (POL), or automated token burns.

sLEO: Where the Passive Income Flows

To supercharge demand and provide yield, the team launched sLEO—a wrapped version of LEO on Arbitrum. When users stake LEO as sLEO, they begin earning daily USDC rewards derived from LeoDex affiliate revenue.

Initially, 100% of LeoDex revenue (currently around $12,000/month) is being used to buy LEO for protocol-owned liquidity.

But after a 90-day ramp-up period, all of that revenue will instead flow to sLEO stakers. If the DEX hits its goal of $100,000+ per month in affiliate fees, that would translate into significant passive income for stakers.

This transforms LEO from a speculative social token into an income-generating asset. As more people stake into sLEO, the circulating supply of LEO drops further, reinforcing the cycle of scarcity and constant buy pressure.

Premium: Subscriptions That Build the Ecosystem

In addition to LeoDex, INLEO offers a Premium subscription product. Users pay 10 HBD/month or 100 HBD/year for benefits like advanced analytics, ad-free browsing, and priority curation.

While relatively small today (with around 150 paying users), Premium revenue is entirely reinvested into buying HIVE and LEO to strengthen liquidity pools.

The protocol takes nothing. That means every new subscriber adds buy pressure to the ecosystem and indirectly contributes to the token’s value proposition.

As Premium scales, it could become a meaningful second leg of the ecosystem’s revenue base, alongside the decentralized exchange.

Deflation by Design: Burns, Fees, and POL

Source: Created with Ideogram.ai

One of the most interesting mechanics of INLEO’s model is the multi-layered deflation engine:

- Bridge fees (2–5%) for moving LEO across chains are burned, removing tokens permanently.

- LeoDex earnings go either into buybacks or directly into USDC rewards.

- Premium revenue is routed into buy-side liquidity.

Unlike inflationary tokens that must constantly chase demand, LEO’s supply is designed to shrink as usage grows. This creates constant buy pressure across all revenue inputs.

A Real Revenue Flywheel

Let’s summarize how this all ties together:

- LeoDex generates affiliate revenue in USDC.

- That USDC either:

- Buys LEO (if during buyback phase), or

- Goes directly to sLEO stakers (after September 2025).

- Stakers reinvest into LEO or grow their stake, reducing float.

- Premium, bridge, and future ad revenue layer on more buy/burn pressure.

- LEO supply shrinks, price goes up, yields rise, repeat.

It’s a self-reinforcing cycle that ties actual usage—via the decentralized exchange and other tools—to real cash flows, making passive income possible without minting more tokens.

The Bigger Vision: Social x DeFi x Ownership

INLEO isn’t just building another app—it’s building a hybrid protocol stack that merges the best of Web2 social, Web3 finance, and DeFi rails.

- You can write a blog post and earn real money.

- You can stake your rewards into a DeFi product (sLEO) that pays USDC.

- You can participate in LPs or Premium to feed liquidity.

- You can see every USDC payment, bridge burn, or buyback on-chain.

It’s a model of transparency, scarcity, and alignment. Every product INLEO builds must answer the same question: does this add value to LEO holders?

What’s Next: Mobile, SDK, Ads

While LeoDex is already live and earning, several more revenue lines are in development:

- Cross-chain SDK could plug the LEO tokenomics into partner sites and dApps.

- Mobile App will be key for mainstream adoption.

- Ad Network could unlock $10k–30k/month in ad revenue if INLEO hits 50k MAUs.

All future products are expected to follow the same template: generate income → reward stakers or buy/burn LEO.

The Decentralized Exchange Era Is Just Beginning

As crypto matures, the real winners won’t be the projects chasing hype—they’ll be the ones that build boring, reliable income streams and turn them into community-owned wealth machines. INLEO and LEO are making that bet.

By combining a social platform with a high-yield decentralized exchange, and routing all value flows into a fixed-supply token, they’re creating a new kind of financial engine—one built on scarcity, transparency, and passive income that rewards long-term believers.

LEO doesn’t want to be the next viral token.

It wants to be the first Web3 dividend stock.

Keywords:

- Decentralized exchange

- Passive income

- Constant buy pressure