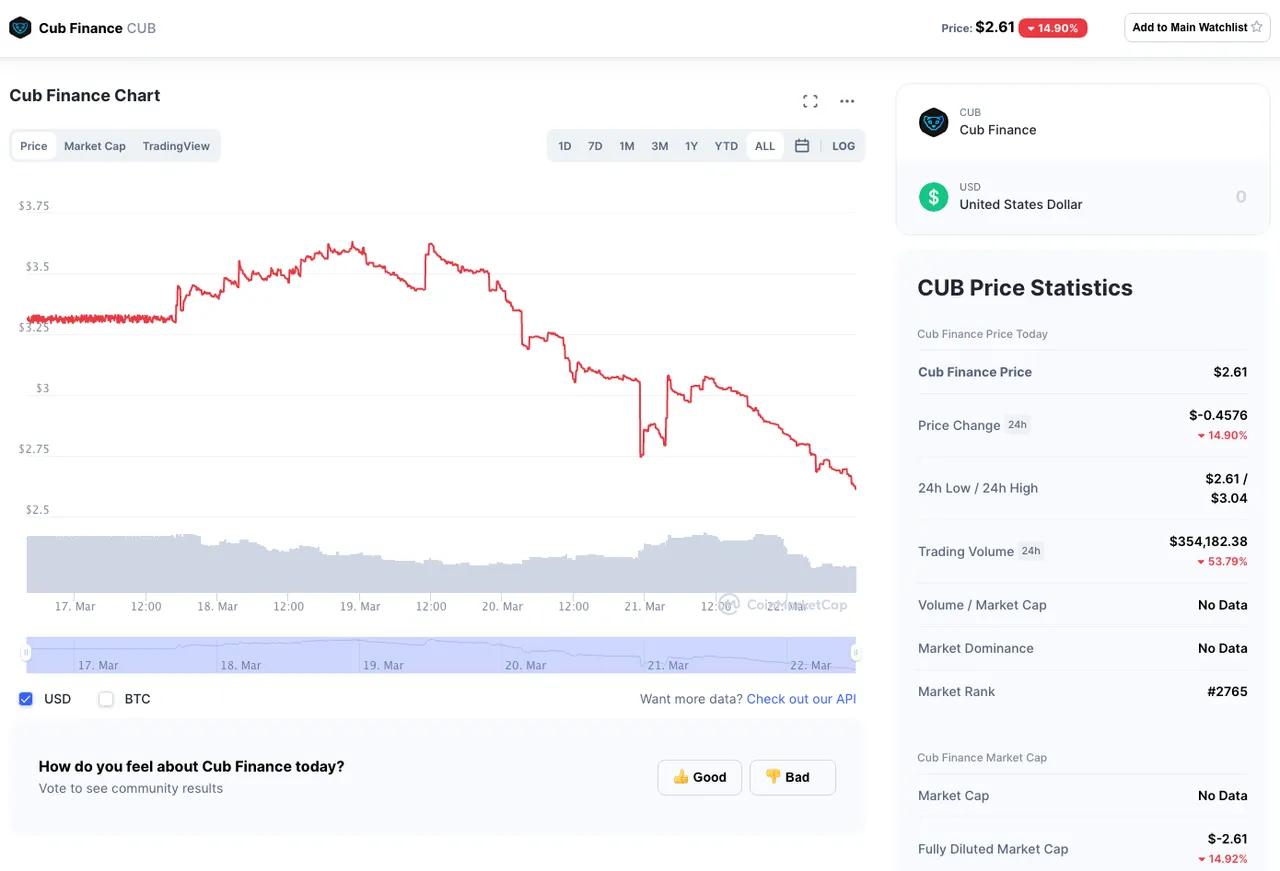

To be honest, the steady decline in the price of CUB brought my excitement a bit down last week. However, inexperienced investors like me tend to let themselves forget about the real factors that drive the price of any serious crypto project.

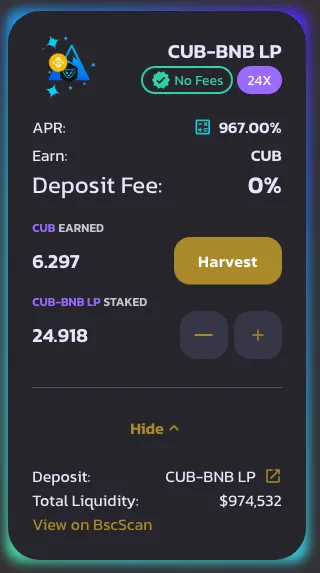

My Farm...

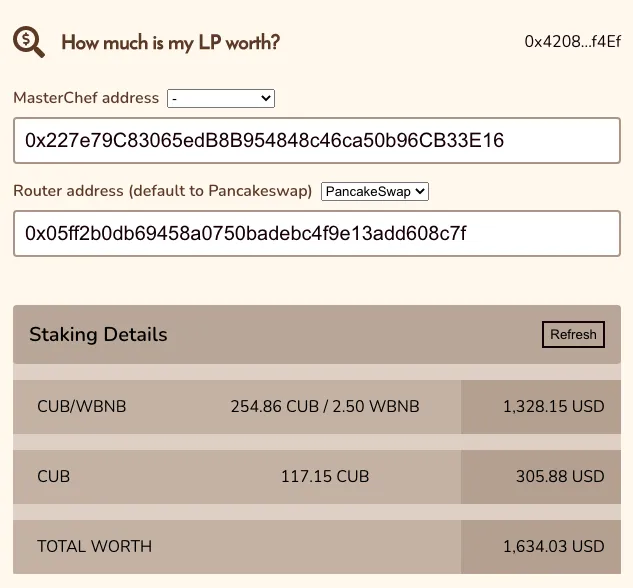

My Den...

From what I've learned by lurking around Leo Finance's Discord is that the price chart does look healthy because the decline corresponds with the decline in the APR of the Dens and Farms which is due to the first "halvening" and now the second, real halvening starting today.

As usual, people's interest in farming and staking decline with the decline of the yields (paper hands bitches).

Nevertheless, there haven't been significant dumps that didn't retrace to the original course of the declining curve. This means we are only getting rid of those who came for the quick buck just before things get better with the launch of LeoBridge.

Why suddenly confident?

When I forget about the charts and look back to how the Leo Finance team has managed to develop their projects through the last bear market, effectively making the price of LEO break the $1 barrier it becomes evident this phase of lower price is only a chance for us to secure more CUB before things start getting serious.

The CUB tokenomics were developed in a way in which each trade pays a 4% fee. This fee is used to buy and burn CUB and bLeo. The deployment of LeoBridge will bring an influx of transactions that will pay the 4% fee. This will be a group of new users that probably didn't hear about CUB, LeoFinance, or Hive before. It's a win-win-win situation for the whole ecosystem, in my opinion.

According to CubDeFi's Docs:

100% of the fees accrued are used to purchase CUB and bLEO and burn them on an ongoing basis.

Burn:

- 80% of the 4% burn will be used to purchase CUB and burn it

- 20% of the 4% burn will be used to purchase bLEO (LEO) and burn it

If scarcity drives value, then we will see a steady rise in price as the new products of Leo Finance come to fruition, the more LeoBridge is used, the more tokens burned, the more scarce the token becomes and therefore the value is appreciated. At least this is how I understand this, so far.

As soon as LeoBridge is working, the users of the Binance Smart Chain will start paying attention to CUB. This will spike interest in CUB and therefore the price will rise as well.

Meanwhile, I'm $500 down from my initial investment, but it's all good ;-)

Let's see how this week's developments affect the chart.

I might be completely wrong about all this anyway, I'm not a financial advisor and this is not financial advice.

What's your price prediction for CUB this week?.