Hey All,

Currently, as we all know that Crypto Winter is ongoing so it becomes imperative for us to have a strategy around crypto winter and adjust our portfolios accordingly. The bear markets is a good time to invest in projects having strong fundamentals as prices of these projects would have tumbled as well. Before we get into as to how to manage our Crypto portfolio during Crypto Winter. We need to understand what exactly Crypto Winter is all about.

A Cryptocurrency Winter terminology is used when there is a long downturn in cryptocurrency prices. And right now we can see the same, where almost all the crypto tokens are trading almost near to their all time low prices. Hence a Crypto Winter is a period where you see blood bath in the markets and it may or may not coincide with other economic declines or a bear market in the stock market. Now that we know what Crypto Winter is now lets look into::

How to Manage Your Crypto Portfolio - During Crypto Winter?

This is how I am trying to manage my crypto portfolio during the Crypto Winter phase. As a crypto investor you would need a solid strategy to navigate through this bearish crypto market. What it will do in return is limit your losses and help frame you a strategy that is going to good returns when the markets are back to normal.

First thing First - Don't Panic & Don't Sell

Normally when cryptocurrency prices are down, it’s hard to decide if you should sell or buy more. Most of the time we land up selling and then regret later that why did we sell so early. The best thing do is first do not panic and at the same time do not sell off your crypto assets too early. Just wait for the right moment for the markets to bounce back. To be honest I didn't sell any of my crypto assets during this Crypto Winter and continue to be invested.

Buy the Dip & Diversify

Think of applying the principle of “Buy The Dip”; which means try to buy Crypto assets after it has dropped in price. But then the question arises where is the bottom? What is the right time to Buy? I don't know about others and speaking for myself one needs to take the call and if they think this is the right time to enter then just go ahead and buy the crypto assets that you had been waiting to buy. Buying the Dip is just giving you an added advantage to buy lower and then just wait for the right moment. What we need to remember here is that buying the dips is definitely going to be profitable in long-term uptrends. If you would have noticed, I have written Diversify along with Buying the Dip. During the markets down turn its the best time to diversify your portfolio. Hence, if you are heavily invested in just one or two crypto assets it best to diversify your portfolio by spreading your investments around so that your exposure to any one type of asset is limited.

Staking & Averaging

I'll get to staking crypto assets in a bit but before that think of deploying a dollar cost averaging strategy. Where possible try to DCA [Dollar Cost Average] as this is the opportunity to buy assets at a lower prices. Now coming to the Staking part, I am referring to the LP [Liquidity Pools] or staking of the Crypto assets to get a certain APR as a reward. In my case, I have been trying to increase my staking portfolio.

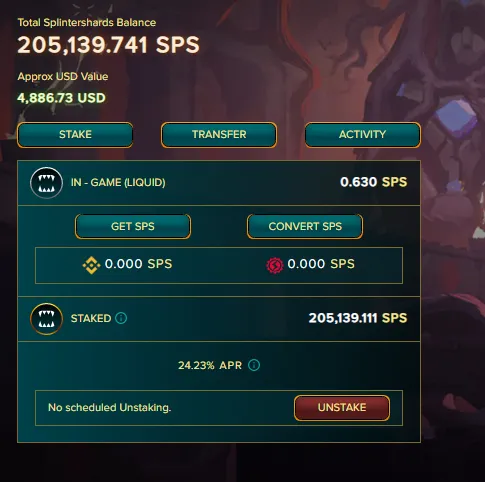

Take the example of $SPS, where currently I have 200K+ $SPS staked and now have embarked the journey to have close to 250K+ $SPS staked in near future. So altogether trying to build the crypto portfolio via the staking mechanism and at the same time earning staking rewards.

Hopefully the above pointers should help one to get through the crypto winter and formulate a right strategy during this phase. We all know nothing is permanent in life and phases like these pass through as well. All what we need to do during these tuff times is stay strong and have a good strategy formulated around it so that are losses are minimized to an extent as much as possible.

Crypto Winter :: How to Manage Your Crypto Portfolio?

Image Credits:: procanva, splinterland

Best Regards