Hey All,

So it was yesterday that I minted stAtom via staking my 59+ $ATOM on the Stride platform. Stride Staking - Experience - here on the Stride platform users can stake their tokens on Stride platform from any Cosmos chain. This staking of $ATOM got me $stATOM tokens which has a liquid staking APR of 16.8% at the moment.

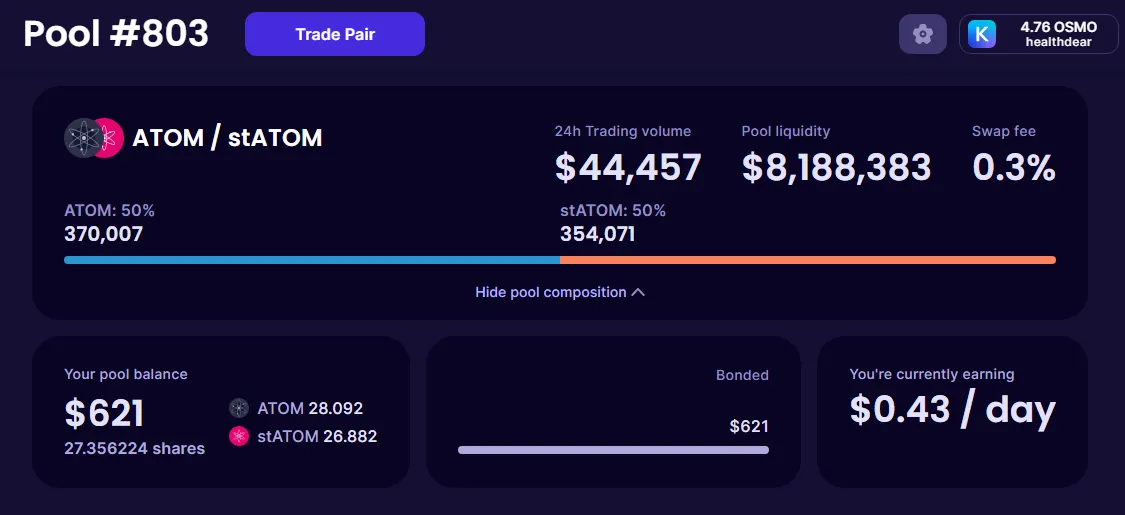

I did not stick with liquid staking of stATOM and went ahead with the step 3 of entering DeFi with liquid staking on Stride platform. What I did next was moved my stATOM to Osmosis chain and pooled the assets ATOM / stATOM to the Pool#803. So basically what happened he is that Stride allows you to use your staked assets to further compound your yield.

Bonding ATOM/stATOM on Osmosis

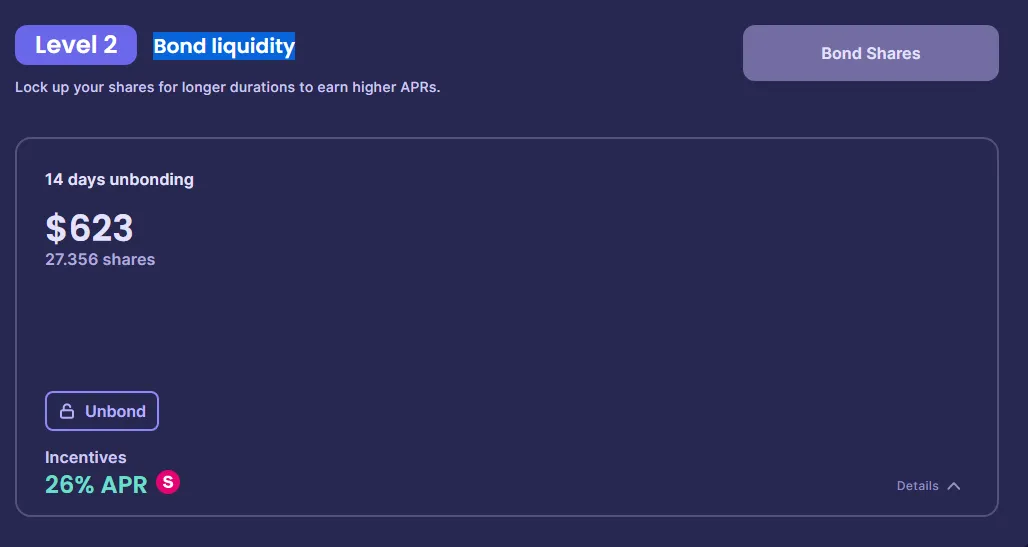

In return you continue to earn staking yield, and earn additional yield by LPing, as I did for ATOM / stATOM. Based on your risk appetite you can set our own risk tolerance in Cosmos DeFi accordingly. In my case, I entered level 2 by bonding liquidity to receive incentive to 26% APR. By doing so I am going to earn close to half a cent $0.5+ daily; for bonding assets worth $650+. Unbonding assets period is as usual i.e. 14 days to get my liquid assets back. I'll continue to see and monitor how this whole process of liquid staking and then entering the DeFi business churns out. But for now looking forward to some great returns and accumulate some $Stride tokens via the yields.. at the moment price of $stride is also doing good where it currently is trading in the range bound of $0.30 to $0.35 cents.

DeFi with $Stride - Bonded $ATOM/stATOM liquidity for nice APR...

#strd #rewards #stake #statom #defi #staking

Image Credits:: stride.zone, app.osmosis.zone

Best Regards