Hey All,

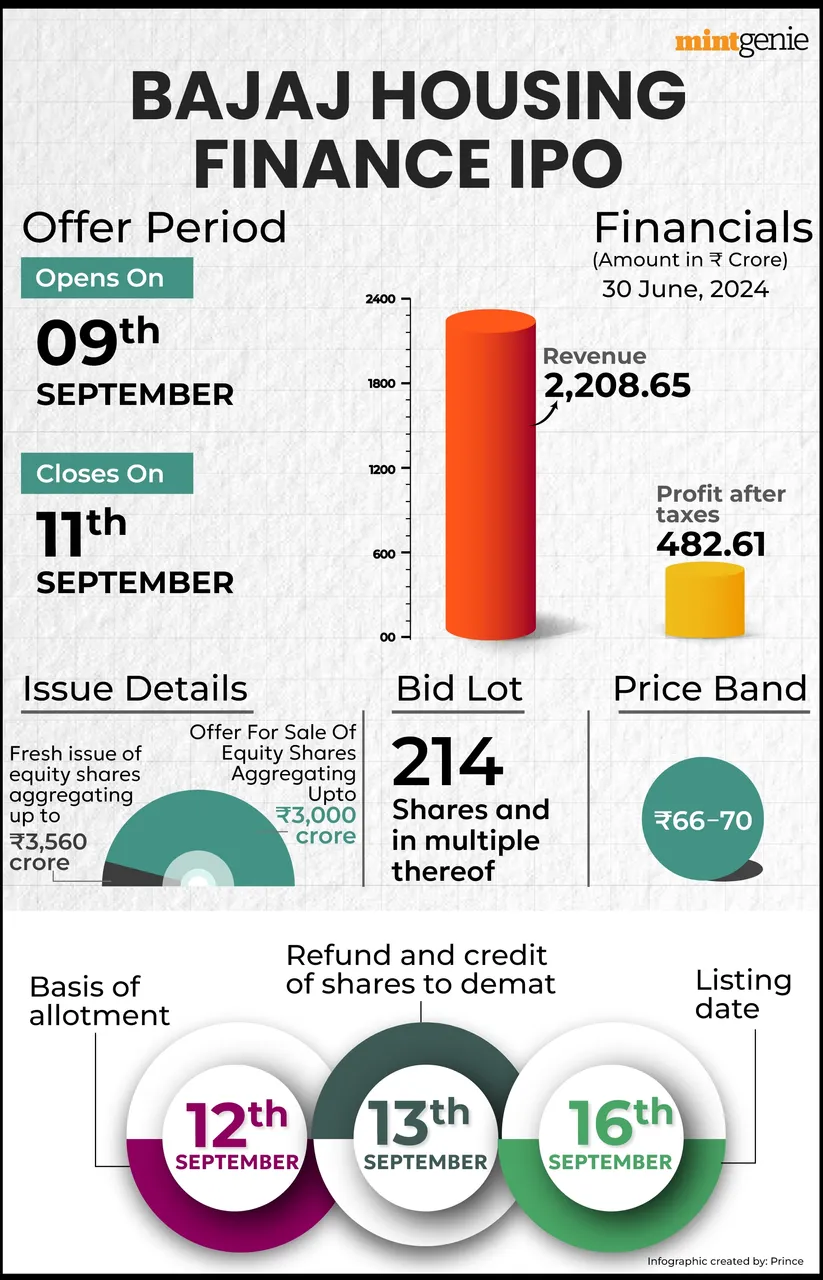

The finance industry is a multi-billion-dollar sector in every country, and India is no exception. In India, the financial sector's market capitalization is estimated to be over $1 trillion, though this is a rough figure based on various research articles that I have read online and it indicates the same. The finance sector here includes banks, non-banking financial companies (NBFCs), insurance firms, asset management companies, and other financial services, with an estimated market cap of around $800 billion to $1 trillion approximately. Given the size of this market, you can imagine the demand when a well-established company like Bajaj Housing Finance - launches an Initial Public Offering (IPO) in the financial sector. The full details of the IPO you can see from the above image; i.e. price band, ipo issue details, bid lot and various other parameters that one would look into before applying for an IPO.

Applied for Bajaj Housing Finance IPO - My Strategy Ahead...

Well, I have applied for the IPO in the shareholder category as I do hold Bajaj Finserv 50 stocks and hence I am eligble to apply in the shareholder category. With respect to lots then I have applied for 2 lots which is equvalent to 428 shares at a cutt off price of Rs.70 per share - so the total investment here is around Rs.30K+ which sums upto $360+ dollars. While applying for the IPO, I did learn a new thing which is around the bidding hours. See the image below::

I applied for the IPO today i.e. before 10:00 AM and if one does so this order goes to the after hours section and will be executed only after 10:00AM which means that your stock broker will send request for UPI mandate only after 10:00AM which means it will not be immediate and will take time to ensure that the bid was submitted successfully and then you will receive message from your stock broker on the payment to be paid and in my case it was UPI - I got the message and once confirmed the status of IPO changed to authorization - success.

See the above image, which means you have applied for the IPO successfully and now need to relax and wait for the allotment date if you were allotted shares or not incase not then the INR amount will be refunded and incase you are allotted shares then the shares will be credited to you demat account directly. So what next here, well my plan ahead is that if I am allotted the shares and if the IPO opens at a good premium say 100% then I will be booking profit there itself and move on. There is no intention to #hodl the Bajaj Housing Finance shares for a longer term. It could be that I may be inclined to get my intial investment back but all will be decided at its opening price in the market and what mindset I have at that point in time. Who doesn't like immediate profits and that too in a very short span of time and the bonus being 100% of your investment. Well that should be it for today post on applying IPO for Bajaj Housing Finance IPO & My Strategy Ahead...Before I conclude, it's worth noting that the current status of the IPO is that it has already been subscribed four times and this number would further increase as there is still some days to go before the IPO subscription ends. In the grey market, it's trading at a premium of 80%, indicating high expectations for this IPO to outperform when it opens for trading on Dalal Street, which includes both the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Happy investing! Cheers.

IPO:: Applied for Bajaj Housing Finance IPO - My Strategy Ahead...

#stock #stockmarket #nse #bse #ipo #bajajhousingfinance #bajajhousing #investment #finance #strategy #sensex #indiastockmarket

Have Your Say On - Bajaj Housing Finance IPO - Short Term Vs Long Term...

Do you invest in India Stock Markets? What are the different criteria you look into before picking a quality stock? Are you planning to invest in Bajaj Housing Finance IPO? Short term Vs Long Term? Please let me know your views in the comment section below...cheers

Image Credits:: screener, pro canva, sharekhan, zerodha, livemint

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain, Stocks & Cryptos and have been investing in many emerging projects.