Introduction

In a landscape teeming with excitement and anticipation, Yearn.finance developer Banteg made waves by shedding light on alleged irregularities surrounding Starknet's airdrop. The airdrop, meant to distribute STRK tokens, faced scrutiny as over 700,000 wallets, out of 1.3 million eligible, were purportedly linked to GitHub accounts controlled by airdrop hunters. This revelation stirred discussions and cast shadows over what was intended to be a significant distribution event.

Controversies Surrounding Eligibility Criteria

The STRK airdrop encountered further complications as Starknet users claimed ineligibility despite engaging in substantial transactions. The eligibility criteria mandated users to possess a minimum of 0.005 Ether (ETH) — valued at approximately $10 during a snapshot on Nov. 15, 2023. This raised concerns among participants who believed they met the criteria but found themselves excluded from the airdrop.

Unlock Schedule Criticisms

Another point of contention emerged regarding STRK's unlock schedule. Starknet had devised a plan to reward investors and contributors with 1.3 billion STRK, constituting 13% of the total supply, approximately two months after the project's launch. This schedule faced criticism from some quarters, adding fuel to the existing controversies surrounding the airdrop.

Impressive Initial Uptake

Despite the challenges and controversies, STRK's airdrop saw substantial initial uptake. In the first hour and a half after allocations began, a staggering 45 million STRK tokens were secured. This remarkable response underscored the community's enthusiasm, despite the subsequent issues that unfolded.

Claimed Tokens and Total Value Locked

Currently, nearly 430 million STRK tokens, representing around 92% of the total available for distribution and valued at over $790 million, have been claimed by eligible participants. These figures, obtained from Voyager, offer insights into the extent of engagement with the airdrop despite the hurdles encountered.

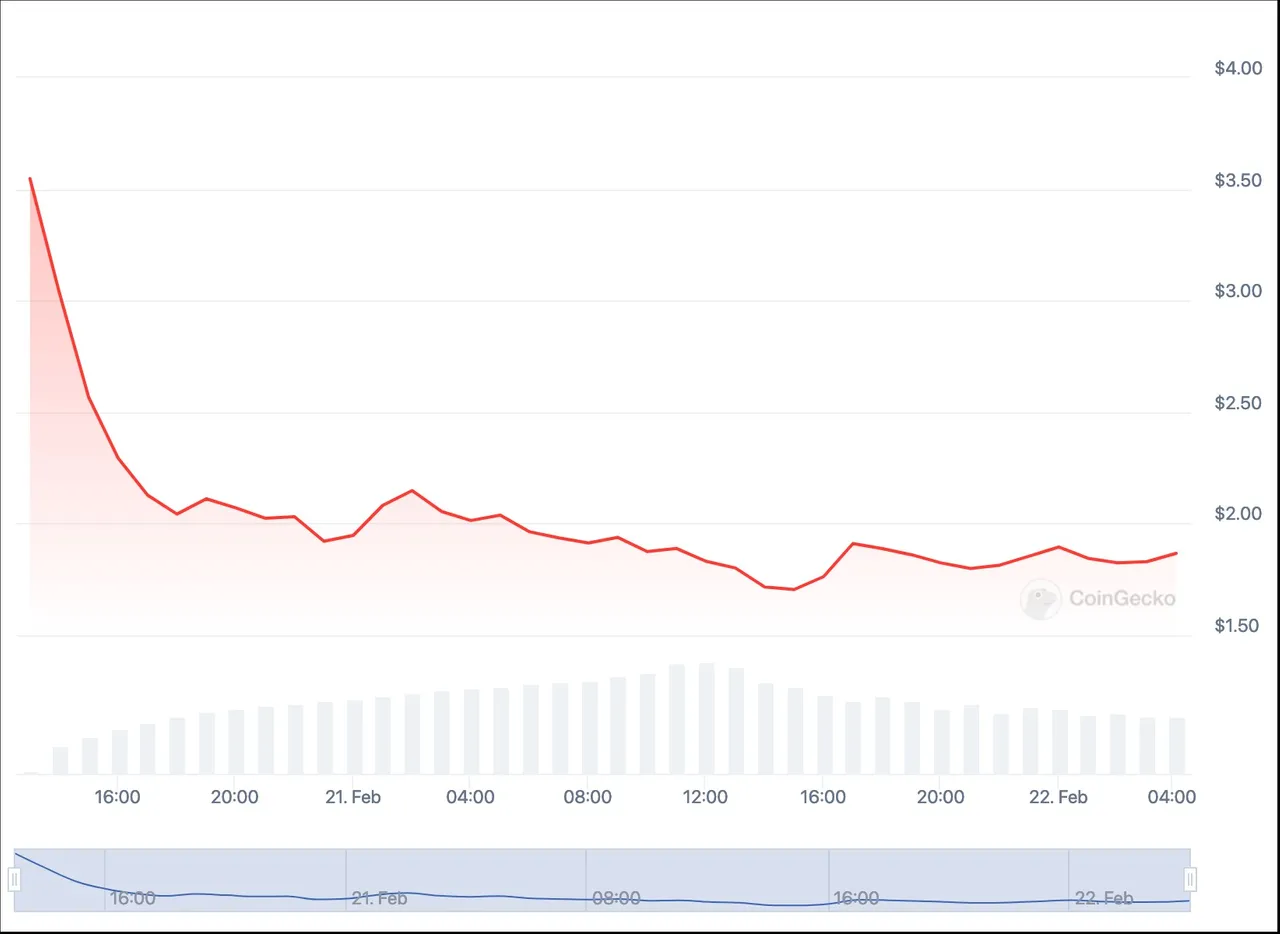

Despite a drop in STRK's price, the total value locked in Starknet has witnessed a substantial increase, surging by nearly 30% in a 24-hour period, reaching $73.5 million, according to DefiLlama. This suggests that, despite the controversies and market fluctuations, Starknet's ecosystem continues to attract and retain value.

Conclusion: Navigating Complexity in Starknet's Airdrop Journey

As the dust settles around Starknet's STRK airdrop, the controversies surrounding eligibility, GitHub account linkages, and unlock schedules have provided valuable lessons for the crypto community. The initial excitement and uptake underscore the resilient nature of decentralized ecosystems, even in the face of challenges.

Stakeholders in the crypto space will be closely watching how Starknet addresses these concerns and adapts its strategies in response to community feedback. The interplay between airdrop dynamics, token value, and total value locked emphasizes the need for transparent and well-communicated processes in the evolving landscape of decentralized finance.

In conclusion, the STRK airdrop journey serves as a case study in navigating complexities within the crypto space, offering insights into both the potential and challenges inherent in these groundbreaking distribution events.

Source :

https://starkware.co/stark/

https://coinmarketcap.com/fr/currencies/starknet-token/

https://cointelegraph.com/news/starknet-strk-falls-nethermind-airdrop-hunters-dump-millions