I was reading the Monthly Burn Report for November and the growth of both bHBD and bHIVE liquidity pools on the Cub Farms is quite impressive despite the turmoil in the market. It only shows that people are bridging some of their Hive assets to Binance Smart Chain and investing them on DeFi via CubFinance which is evident in the increase of the liquidity especially that of bHIVE and bHBD pools.

According to the summary, the CUB DAO has generated a total revenue of $9,125 in the month of November from wrapping and unwrapping fees, some from oracle staking and almost 50% of it from internal arbitraging. 100% of it was used to buy back and burn $CUB. As the CUB DAO generate more revenue, the more CUB it will buy and burn which will consequently lessen the quantity of the token in the market.

To date, the DAO has burnt 1.8 million CUB and I believe this will cross the 2M mark before the year ends. Things are getting really interesting and exciting on CubFinance. And with the Arb Bot 2.0 in the works, I can only imagine home much more revenue it will add when it finally gets deployed.

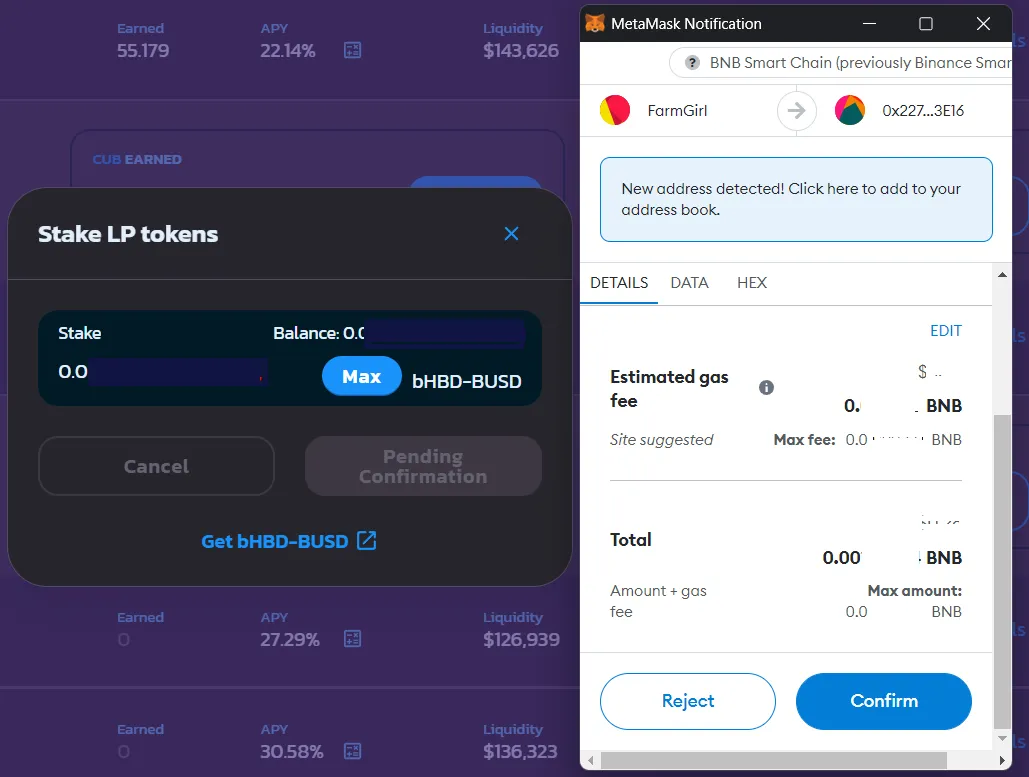

Anyhow, I added a bit more to my existing share on the bHBD-BUSD pool using some assets withdrawn from Binance. I initially planned on adding to the bHIVE-bHBD pool but decided to go for the Stablecoin pair instead.

The Annual Percentage Yield (APY) on the pools are hard to ignore with bLEO-BNB leading at 41.15% at the time of this writing. So yeah, instead of keeping my assets idle, I sent them to work and farm CUB. Any CUB earned will be accumulated and then locked (staked) for long-term in the Kingdom vault.

Liquidity pools also pose some risks, i.e. impermanent loss so we must take these into consideration when investing. But because majority of my LP is on the stablecoin pair, the risk is at least minimized.

Note: None of these are to be considered Financial Advice. DYOR before making and investment.

Screencaptures via CubFinance. No copyright infringement intended. 141222/22:00ph