Because my emotions still mess me up when day trading, I decided to get back and have more practice without risking any of my real assets. Thanks to SanR for making that possible. I was on to it before and was enjoying the experience but due to certain commitments, I had to pause it for over a month and only went back to it a week ago.

The funny thing (not so) is that whilst I am aware that I'm not going to lose any real funds while doing the trades on SanR, there are still times when I feel attached to my trades. That is glaring evidence that I'm nowhere near emotional maturity when it comes to the market.

Controlling emotions when trading is a tough job

We often hear or read the widely accepted belief that to be able to succeed when trading, we should have the ability to take out or control our emotions. That of course is easier said than done.

Per my personal experience, it is one thing that I still struggle to apply. I understand that we do need to have a strong conviction of what we are trying to achieve when trading, set our targets, stick with them within a reasonable timeframe, and not pay attention to FOMO or FUD, whatever they may be. But then, we also need a decisive attitude to take appropriate actions in certain market conditions or circumstances to mitigate losses or when to take profits.

Here on-chain, I tend to not have that fear or nervousness when buying $HIVE. For some reason, it feels safer here compared to trading off-chain which is a lot different, at least that's how it is for me. In simple words, buying HIVE here doesn't make me think twice like it does when I'm doing it for example on Binance. Perhaps, I'm just too attached to Hive to the point that it makes me miss the opportunities that the internal market is presenting me with. I know some people here who are making good trades by simply buying and selling on-chain assets like HIVE.

Working on my patience

Back to SanR, I opened a signal (RUNE-BTC pair) on the 9th of November with a 5x leverage. 3 hours later, I closed it prematurely with a meager imaginary profit of 1.66% or a leveraged performance of over 8%. From a really conservative standpoint, that is still good but then, I'm not trading with real assets so why not wait a bit longer to see some real price action?

Well, that was just me being impatient and scared too, lol! That's another aspect that I definitely need to work on.

A few days later, I decided to open another San.rise signal with the same pair (RUNE-BTC) because I believed RUNE was going to hit higher prices. I was to close the signal on the 12th but constrained myself from doing so because I was still confident that the price was going to rise further.

I was quite excited when it went up to $5.35 on Binance and after a careful observation of my own emotions, I finally set a target close price before heading to bed.

This was probably one of those imaginary trades that I've done quite well. That 'yay' feeling to have finally executed a good trade with just the right amount of excitement and conviction, resulting in nice profits (although not real), emotions in check, and enough patience.

The irony was that whilst I did that on SanR, I did not apply it to my trade on Binance, missing out on real profits. Although I've already decided that $RUNE is a long-term HODL for me, I don't feel sour.

Whilst there have been good trades made in the past, I still have a long way to go before I can confidently say that I've really worked on the very basics of my emotions (and patience). So yes, the trading practice will continue.

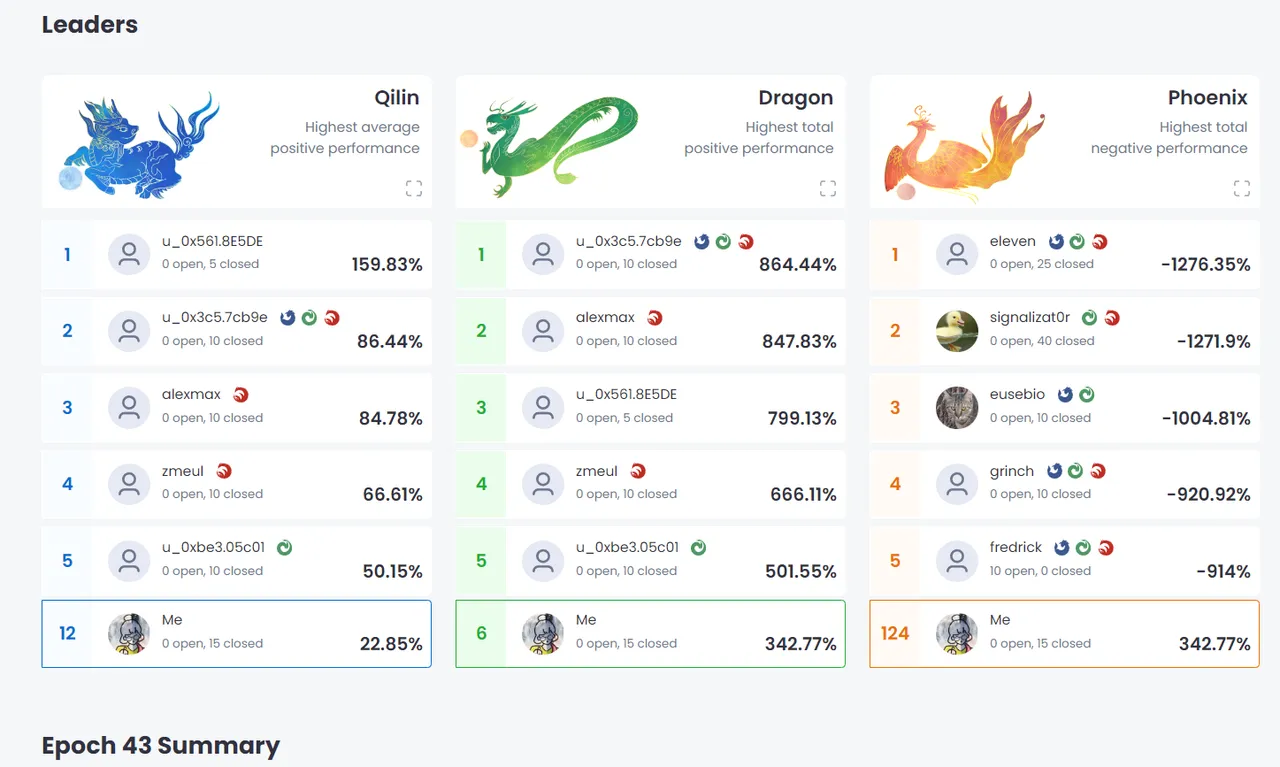

If you haven't tried SanR yet, I invite you to check it out and let's learn to trade better. You may even win some SAN tokens when you top the leaderboards.