The 50th project on the Binance Launchpool is Ethena (more details about it will be shared toward the end of this post). Farming of the token ($ENA) starts tomorrow, 30th March. It could be one of the reasons why BNB surpassed the $600 mark today.

Anyway, here's a quick summary about farming the token on Launchpool.

Farming Details

- Farming Period: 3 Days from 30th March (00:00 UTC) to 01 April at 23:59

- Total Rewards: 300 Million ENA (2% of maximum token supply)

- Eligibility: KYC

- Rewards are claimable at any time within the farming period. Any unclaimed rewards will be credited to the users' Spot Wallets as soon as the farming ends.

Supported Pools

1️⃣BNB Pool

- 240 million ENA (80% of the total rewards) are allocated for this pool (80 million ENA per day)

- Each user's reward is capped at 333,333.33 ENA per hour.

- BNB Vault and BNB on locked products are automatically considered participants and will receive ENA on their Spot wallets.

2️⃣FDUSD Pool

- 60 million ENA or 20% of the total rewards for this pool (20 million ENA per day)

- Maximum reward per hour for each user is capped at 83,333.33 ENA.

Token Listing

ENA will be listed on the Binance Spot exchange on 02 April 2024 at 08:00 UTC with the following trading pairs:

- ENA/BTC

- ENA/USDT

- ENA/FDUSD

- ENA/BNB

- ENA/TRY

Info Sources: Binance

What is Ethena

Ethena is a decentralized finance protocol built by Ethena Labs on the Ethereum network that aims to change the DeFi landscape through its USDe, a censorship-resistant synthetic dollar that is fully backed by ETH which is used as collateral and by 'delta hedging' strategy where "they also take an equal short position in ETH perpetual futures. This helps offset any volatility in the ETH price and keep USDe stable at around $1."¹

Ethena offers yields for users who stake their USDe tokens. This drove rapid growth, making it the fastest USD-denominated asset to surpass the $1 billion milestone.² USDe is available on Curve, Uniswap V3 and Helix, according to the data on Coingecko.

According to its Whitepaper, Ethena will "provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible dollar-denominated savings instrument - the Internet Bond."³

Tokenomics

ENA is the governance token for the Ethena protocol. Holders will be able to vote on proposals on matters such as general risk management frameworks, USDe backing composition, Exchange exposure, Custodian exposure, DEX integrations, Cross-chain integrations, New product prioritization, Community grants, Sizing and composition of Reserve Fund, Distribution allocation between sUSDe and Reserve Fund.⁴

- Ticker: $ENA

- Network: Ethereum

- Maximum Supply: 15 Billion ENA

- Initial Circulating Supply: 1,425,000,000 ENA (9.5% of max token supply)

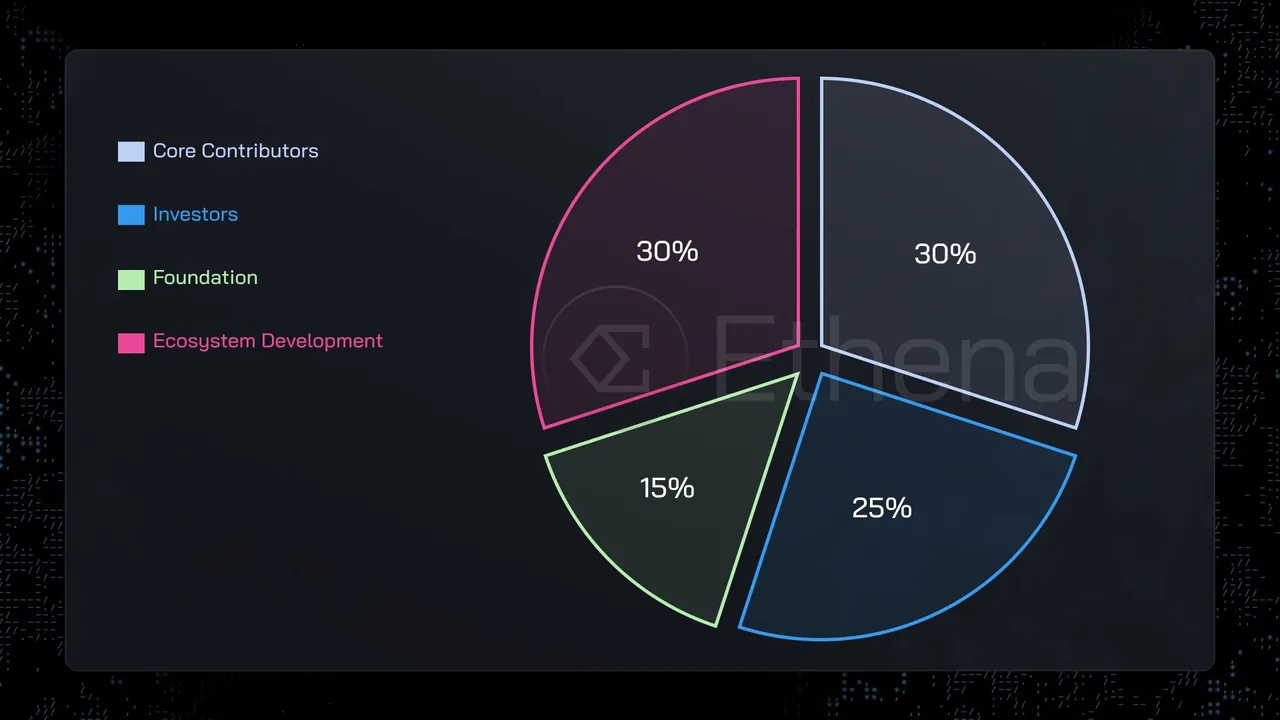

ENA Allocation

- Core Contributors: 30% of the total token supply or 4.5 billion ENA

- Investors: 25% of the TTS or 3.75 billion ENA

- Foundation: 15% of the TTS or 2.25 billion ENA

- Ecosystem Development: 30% of the total token supply or 4.5 billion ENA. 5% of this is airdropped to Ethena users during the first season of the Shard Campaign.

Note: Ethena raised $20.5 million in two funding rounds last year from investors like Galaxy Digital, OKX, Dragonfly, Binance Labs, and Bybit, among others. This has given the protocol a valuation of $300 million.⁵

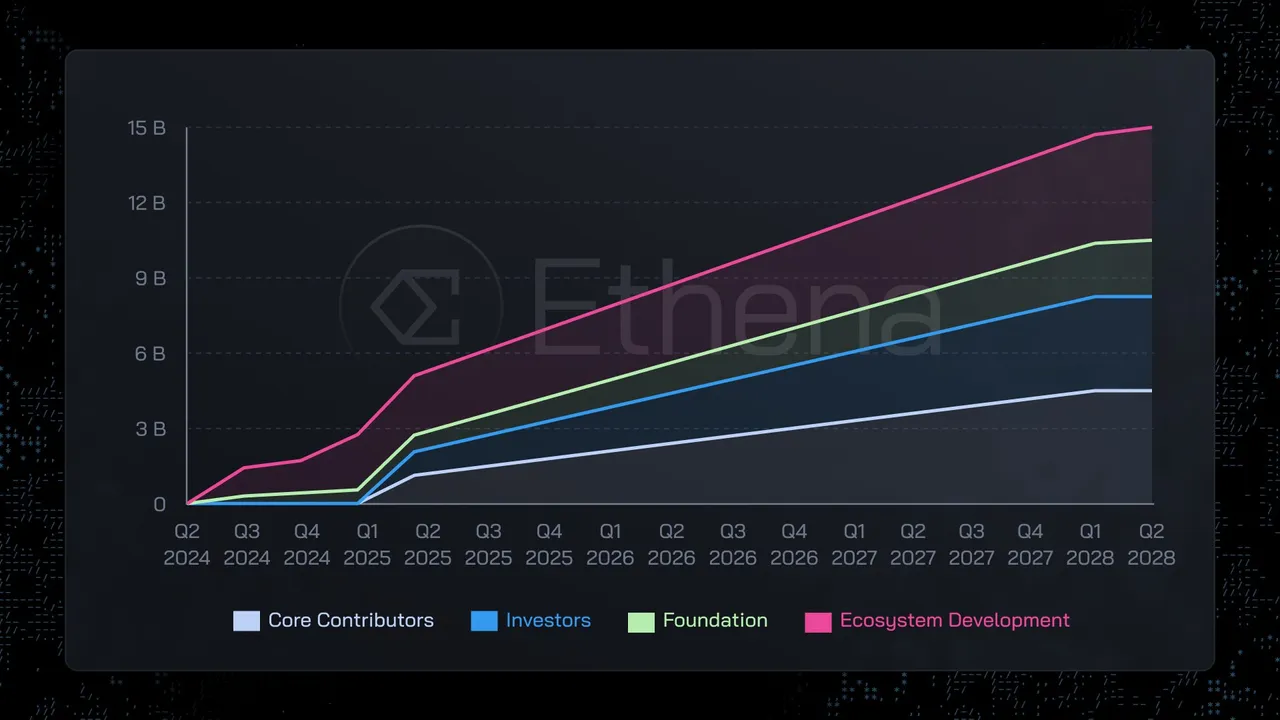

Vesting Schedule

Core Contributors and Investors will have 1 year 25% cliff, then 3-year linear monthly vesting.

It is also mentioned that the top 2000 wallets out of 90k+ users participating in the Shard campaign will be subject to a vesting schedule where 50% will be liquid on April 2 and the remaining 50% will have a 6-month linear vesting period.⁶

Summing Up (Airdrops & Sats Campaign)

Ethena Labs has allocated 750 million ENA as airdrops users who participated in the Shards Campaign by staking and holding USDe. Rewards can be claimed by eligible users on 2nd April 2022. For further details, check this post.

Immediately after April 2, the Sats Campaign will commence and will run for another 5 months until the 2nd of September 2024, or when USDe supply reaches $5bn, whichever comes first. More information HERE.

Check this guide on how to mint USDe. You can also acquire it from the Ethena platform by swapping your USDT, USDC, DAI, GHO, mkrUSD, or crvUSD).

The synthetic dollar (USDe) is not risk-free.

According to Beincrypto, USDe can be subject to funding, liquidation, custodial, exchange failure, and collateral risks.

Eligible users on Binance can farm ENA for 3 days by staking BNB and FDUSD. The token will be listed on the exchange on April 2.

DISCLAIMER: For infotainment only. None in this publication are investment or financial advice. DYOR.

[Info Sources: Ethena / Whitepaper / X / Beincrypto / Yahoo / Mirror / Binance / Ethena App / Coingecko]

Image Sources: Allocation & Vesting. Screenshot linked directly to the source. Lead image edited on Canva. Logo from Ethena. No copyright infringement intended. 29032024/20:20ph