BNB is up to almost $600 (12%+) today which I think goes to show that people are keen on taking advantage of the earning opportunities on Binance. If you didn't already know, ether.fi is launching on the Binance Launchpool and farming will start in less than 12 hours. As usual, any eligible (verified) users can stake on two different pools and earn the token in the next 4 days.

Launchpool

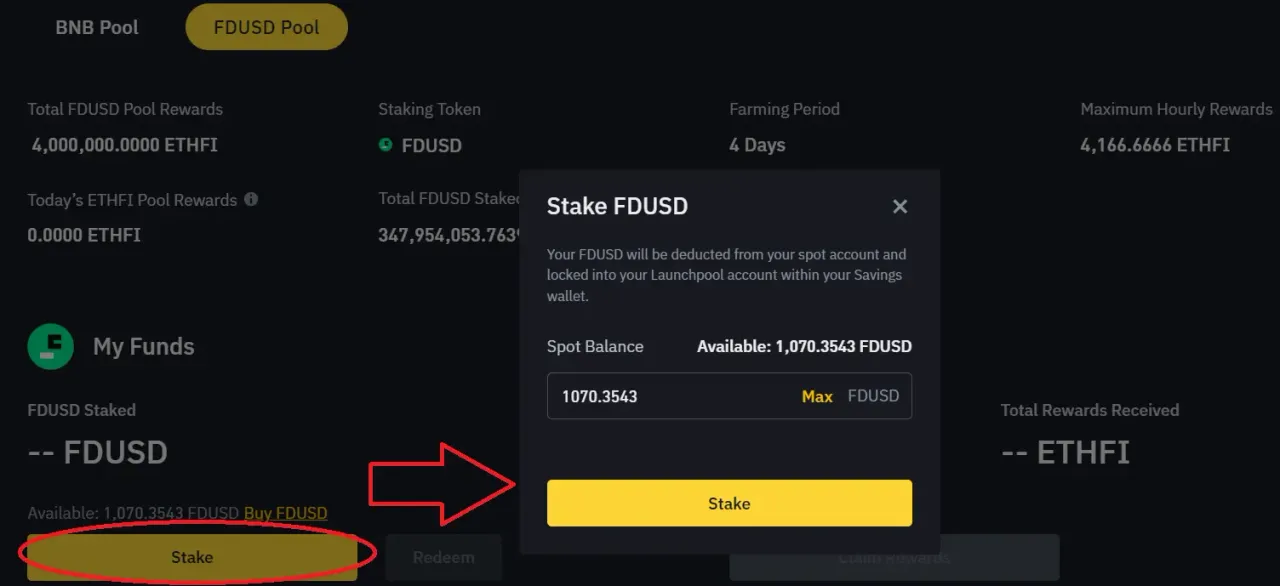

Both the BNB pool as well and the FDUSD pool are now open so anyone can stake early, even before the farming begins.

Here's a quick info on the farming details:

- Farming Period: 14th March at 00:00 UTC to 18th March at 23:59 UTC.

- Total Allocated Rewards: 20 million ETHFI (80% of which is for the BNB pool and 20% for the FDUSD pool), 5 million daily.

- KYC required

- Minimum hourly hard cap per user is 16.66k and 4.16k ETHFI for BNB and FDUSD pool respectively.

- Rewards are claimable every hour or anytime. Unclaimed rewards will be credited to the user's spot wallet when the farming ends.

Staking

To stake on the FDUSD pool, go to this link and make sure your funds (FDUSD) are in your spot wallet. Click on "Stake" and a pop-up will open where you input how much you are going to stake. Confirm and that's it. You can just wait for the farming to start and then claim your rewards whenever you want.

It's the same process when staking BNB. Just go to the BNB pool and stake the amount you wish. No need to do it if your BNB is in the BNB Vault or on any of the locked products. They will automatically be eligible (except those BNB that are collateralizing against Binance Loans). Rewards will be credited to your spot wallet.

Token Listing

ETHFI will be listed on Binance spot exchange under the Seed Tag (extremely volatile asset) on the 18th of March 2024, 12:00 UTC.

For more information regarding the mechanics, terms, and conditions, check the announcement post.

Introduction to Ether.Fi

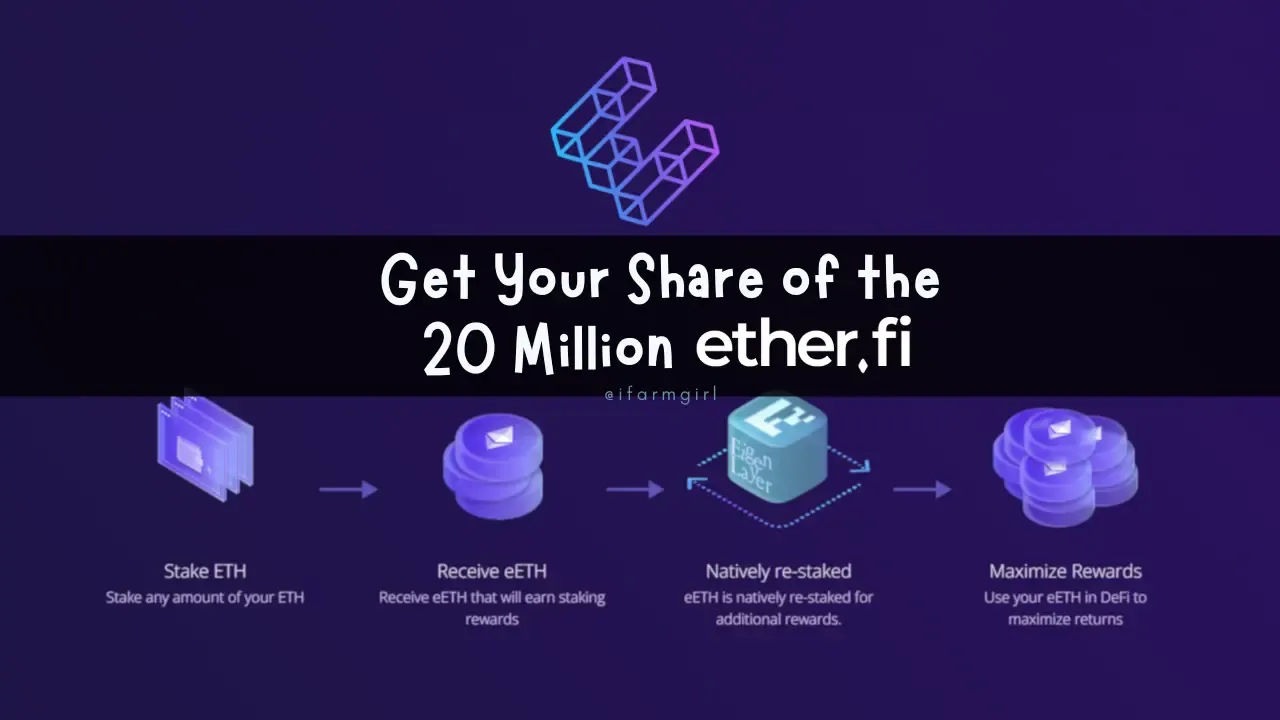

Ether.Fi is a decentralized, non-custodial liquid restaking protocol for Ethereum. According to the introduction video (below), it is the only protocol that allows users to maintain control of their validator keys, hence they control their funds on delegated staking. That explains their tagline: "ether.fi: Truly decentralized staking. Keep your keys. Build the network."

The protocol offers eETH as a liquid staking token that allows users to stake ETH and receive reward dividends. For further information, here's the intro video obtained from their Whitepaper.

One of the distinguishing characteristics of ether.fi is that stakers control their keys while staking. The ether.fi mechanism also allows for the creation of a node services marketplace where stakers and node operators can enroll nodes to provide infrastructure services.¹

To stake your ETH on Ether.Fi, just go to the platform, connect your wallet (make sure it's on the Ethereum Mainnet network and click on Stake to mint eETH.

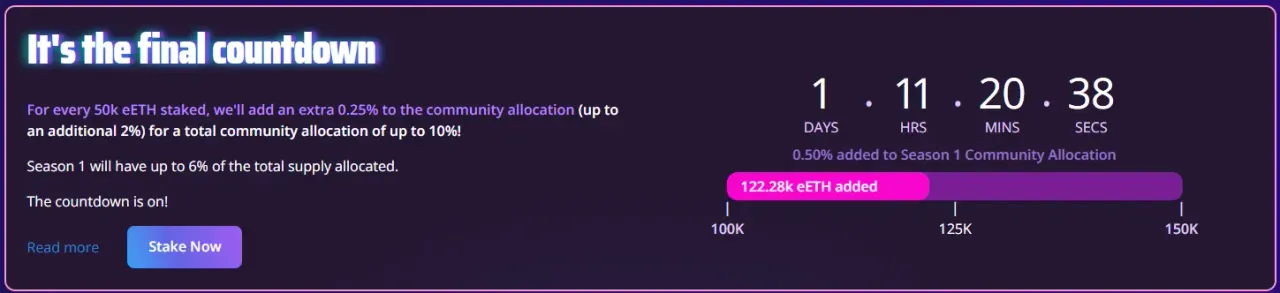

They are currently running a promotion with additional rewards for every 50k eETH staked and the countdown is on.

Ether.Fi Token

ETHFI is the native utility and governance token for the protocol.

- Ticker: ETHFI

- Token Type: ERC-20

- Total Maximum Supply: 1 billion ETHFI

- Initial Circulating Supply: 115.2 million ETHFI (11.52% of total supply). This will be upon listing on Binance.

The token is used for the governance of the Ether.Fi treasury, key protocol upgrades, and protocol fees and distributions.

Token Allocation

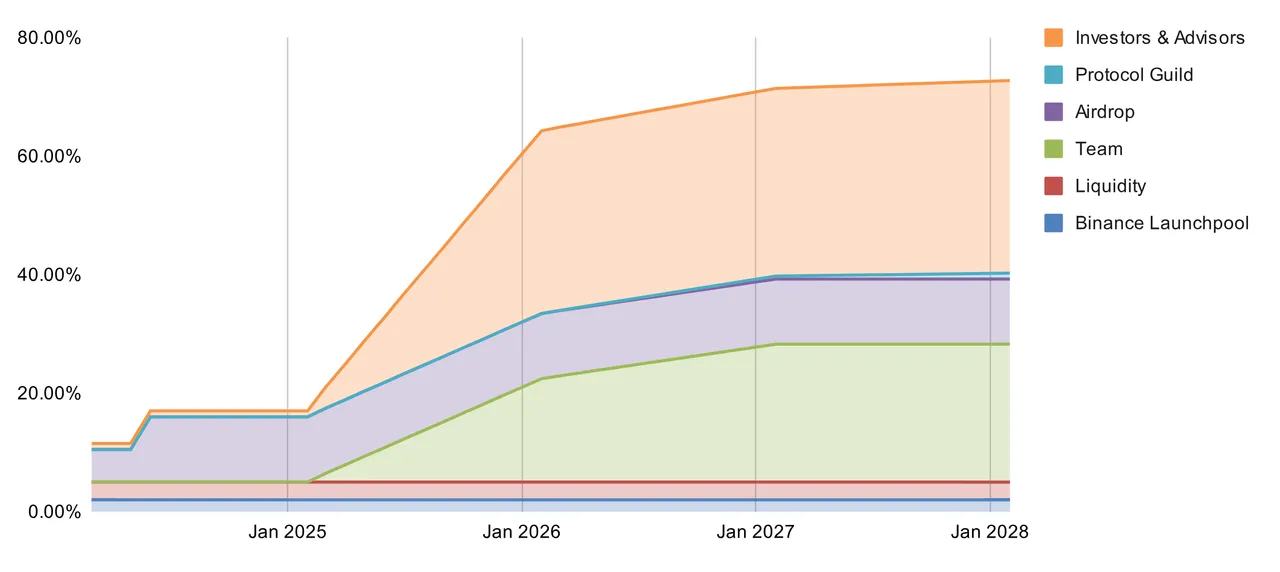

- Binance Launchpool: 20 million (2% of total token supply)

- Airdrop: 110 million (11% of the TTS)

- Investors & Advisors: 325 million (32.5% of the TTS)

- Team: 232.6 million (23.26% of the TTS)

- Protocol Guild: 1 million (1% of the TTS)

- DAO Treasury: 272.4 million (27.24% of the TTS)

- Liquidity: 3 million (3% of the TTS)

Token vesting is until January 2028.

Summing Up

Ether.Fi is a protocol that allows non-custodial staking. Users can stake their ETH by delegating it to the Ether.Fi platform and retain control of their validator keys.

The project's utility token, ETHERFI is being launched on the Binance Launchpool and users can farm it for 4 days by staking BNB and FDUSD.

For further info, consult the official project links (Website / Project Roadmap / Whitepaper / X / Medium / Discord)

For infotainment only. None of these are investment or financial advice. DYOR.

[Sources: Ether.Fi / Binance / Whitepaper / Research / Ether.Fi App]

Lead image created on Canva (photo from Ether.Fi). Screenshots are linked to their sources. No copyright infringement intended. 13032024/21:25ph