"There appears to be a need of some bold man who will say outright what is best... opposing the mightiest lusts and following reason only."-Plato - Laws, VIII, 835-

Following up on my previous article about GAMESTOP, it has come to my attention that Redditors in /r/wallstreetbets keep on buying stocks during Thursday and Friday, making GAMESTOP shares skyrocket towards 480$ due to the amount of MARGIN CALLS being issued for many hedge funds which where withstanding MASSIVE losses.

Is this something bad for the free market? Absolutely not, many Hedge Funds have been shorting stocks to the ground during many years and causing many companies to go bankrupt. The difference is now many free individuals have decided to buy shares of a number of companies they believe still hold value and can grown in value during the coming days/weeks/months. Shorting the markets is an extremely risky position to take and should only be taken when we are sure we have enough information about a stock showing how it is currently overvalued and will/should drop in value in the long term, either because it no longer has the same amount of attention from the public or because it is quickly becoming obsolete (KODAK someone?).

The risks involved in shorting should be pretty clear, when one takes a long position on a stock/asset one is positively influencing the price of said asset/stock in the hopes of such an asset/stock continuing to grow in the future. If the asset/stock does not grow in the long term and we begin to suffer losses our position has a CAP in the amount of loss we will suffer, for if the asset/stock's value goes to 0$ we will only loose the amount of shares we bought. When we are shorting, on the other hand, our potential losses are infinite, because when we short we will profit the close the price approaches 0$ and begin to loose money the further away it moves from 0$. This means we could loose not only the price of the total amount of shares we bought but also all the balance of our account (if using some exchange) as we approach a MARGIN CALL.

THIS is the key reason why GAMESTOP has jumped to public awareness, many hedge funds have lost BILLIONS of dollars by positioning strongly with short positions on a stock which FREE and SOVEREIGN individuals in this FREE MARKET have decided to maintain alive by buying their shares every time they pushed the price lower. From this point of view we can clearly see how this is extremely positive news for the free market, since it is individuals who have decided the future of a stock as is the case with GAMESTOP. Those actors involved in shorting this particular stock and many other are now suffering the damages caused by an extremely risky short play which proved not to be the most intelligent move.

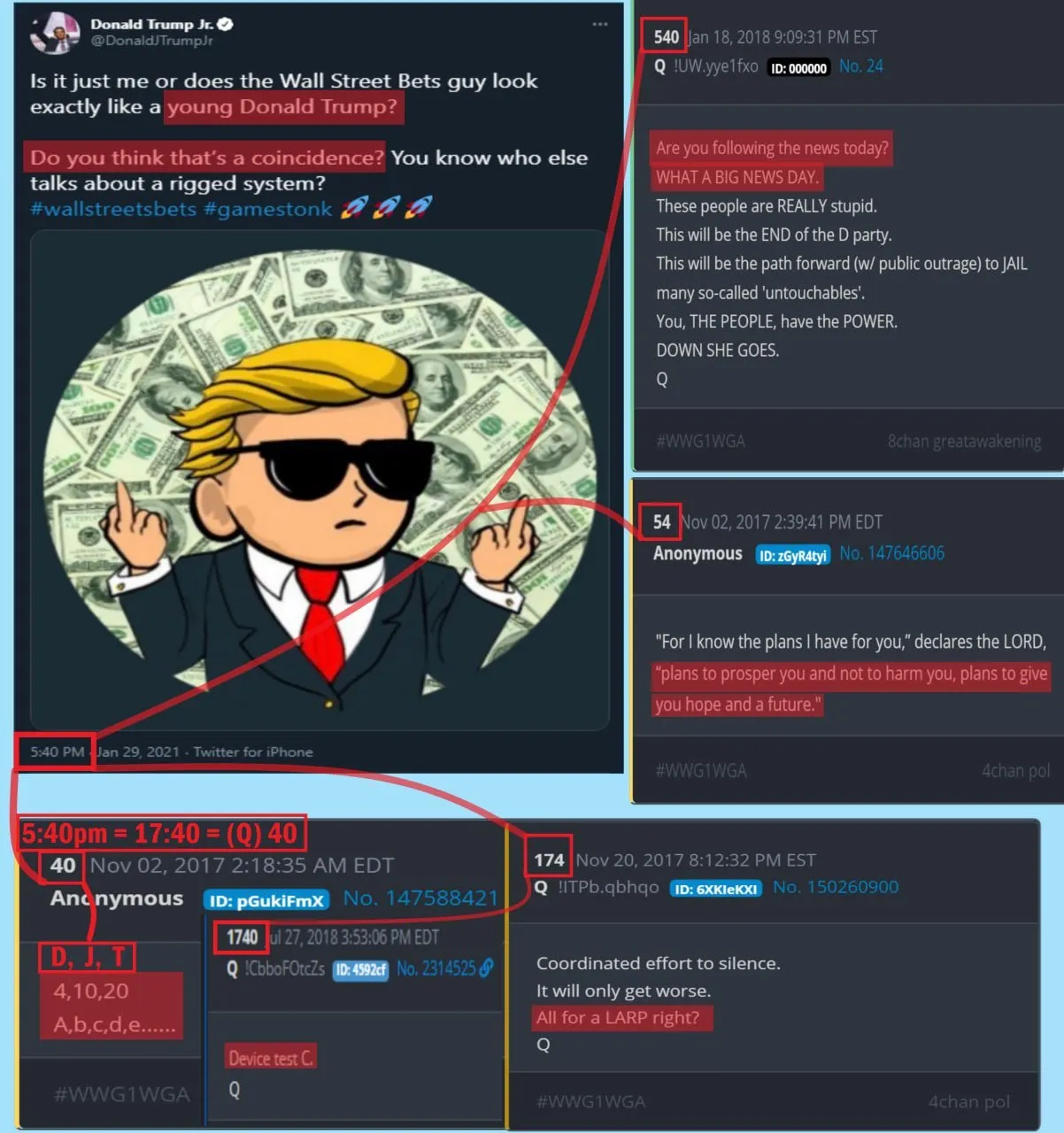

For those familiar with Q and Q+, here is a message from the son of Q+ himself showing us there is more than meets the eye with this particular situation going on. Enjoy your free money and for anyone who did not catch the move, FTX has allowed users to buy shares of GAMESTOP through their app. Simply go to FTX, sign up and deposit cryptocurrency or dollars to start trading.

I hope you are not missing on the action. Make sure to investigate as much as you can and get ready, the next months are a time of GREAT AWAKENING towards the serious evil which has been living behind the curtains.

Chad trader from ClearThoughtCrypto