It's been nine days since I added liquidity to my first Balancer Pool. Picking up on a cue (not financial advice) from @jk6276, the plunge into Balancer has been a learning experience. But has it been profitable? I'll share the progress of that liquidity in the following report.

What Is Balancer?

Balancer is an AMM (Automated Market Maker) where smart contracts can be created to form Liquidity Pools. It differs from other AMM's because funds in a Balncer pool don't have to be represented by a 50/50 balance.

The pool I chose carries a 60% BAL / 40% wETH representation. No matter what happens to the price of these two assets, arbitrars will act to keep that 60/40 price balance.

Balancer has many pools with different balances of coins. Pools can also carry three, four, or more coins set at different percentages.

You can see why it's called Balancer. Of course, these are the base details. There's more to it than that. If you want to learn more about Balancer, I'll leave some resources linked at the end of this report.

Report Via Liquidity Vision

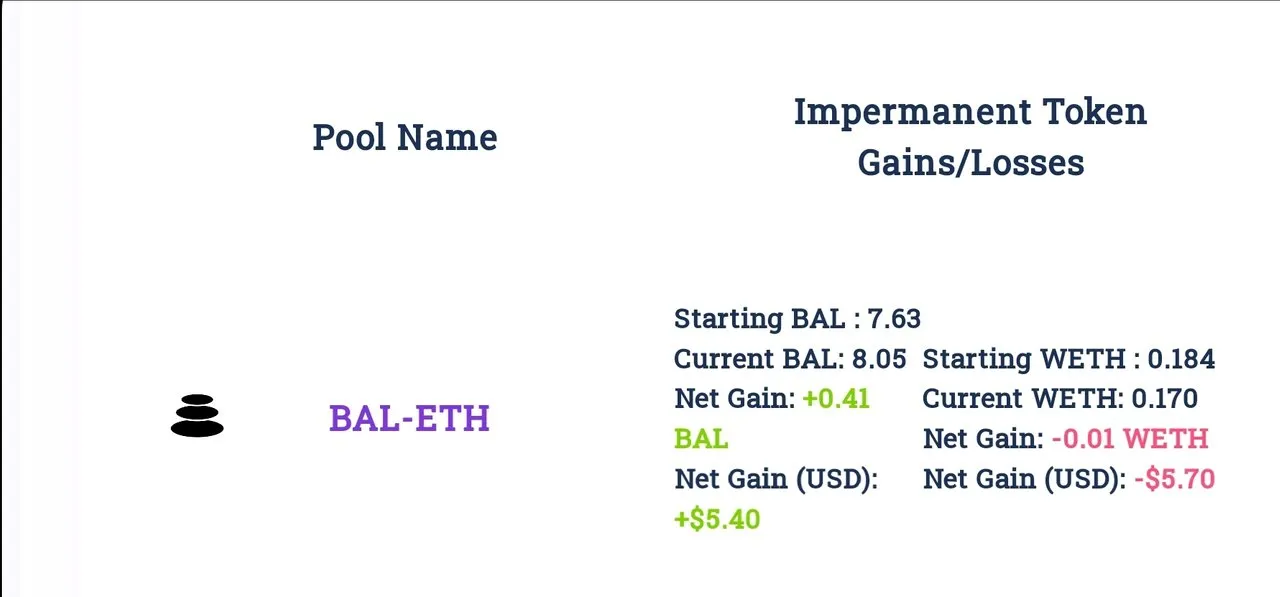

Overall, it was a rough past eight days for the price of BAL. You can see my Hodlings of BAL have increased in this time period. This swing action between BAL and wETH is due to price changes in both assets.

As BAL was losing price value and wETH gaining, arbitrars were acting to profit off the variance. This is the mechanism that keeps the pool at a 60 to 40 split.

60 percent BAL ends up increasing in the LP when the price drops in relation to the 40% wETH. So I end up with more BAL but less wETH than I started with.

Those numbers can be seen in the image above. You might also notice I have an impermanent loss of $0.30. This could all change quickly, as BAL is showing signs of recovery.

Detailed Analysis

Liquidity Vision offers a good look at different aspects of Liquidity Pools. They will also be launching their own VISION token, which will give Hodlers even more benefits.

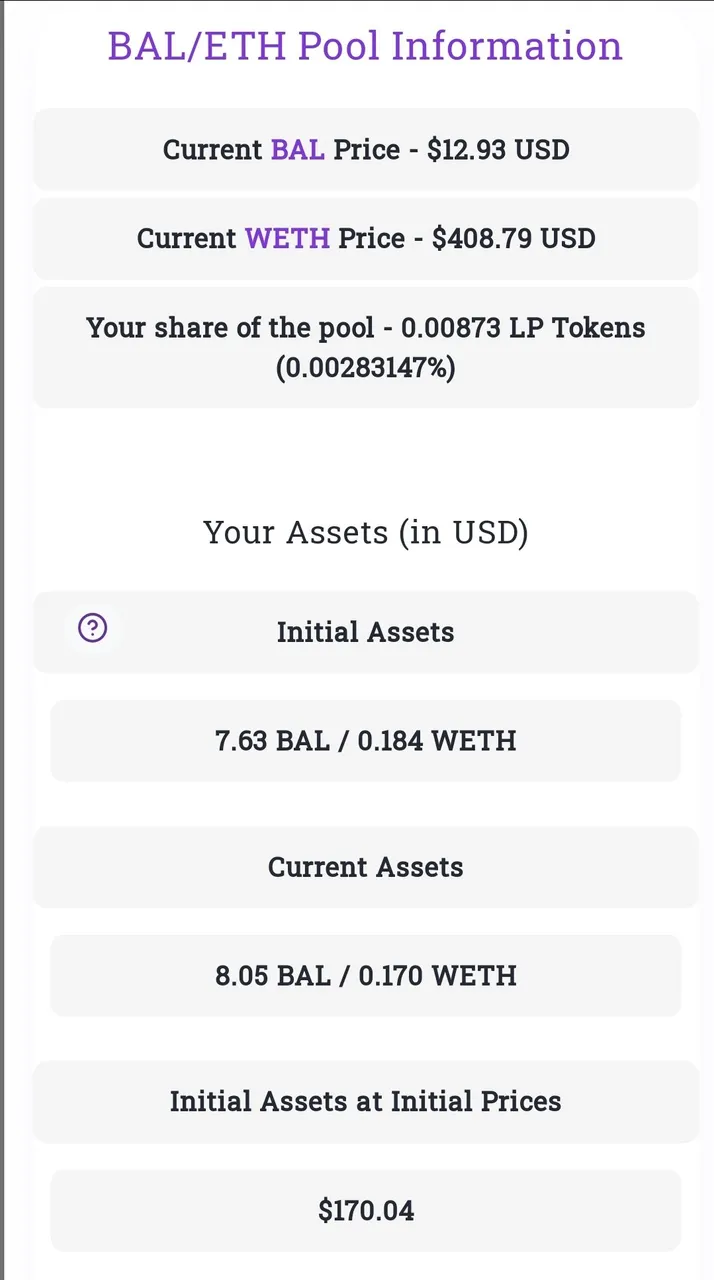

From the top the details show the current value of both BAL and wETH, along with my percentage of liquidity in the overall pool. There's a good amount of crypto in this particular pool.

Next, Liquidity Vision shows my initial assets entered into the LP and my current assets after nine days. It also shows how much my initial assets were worth at the time I entered the LP. And the info continues...

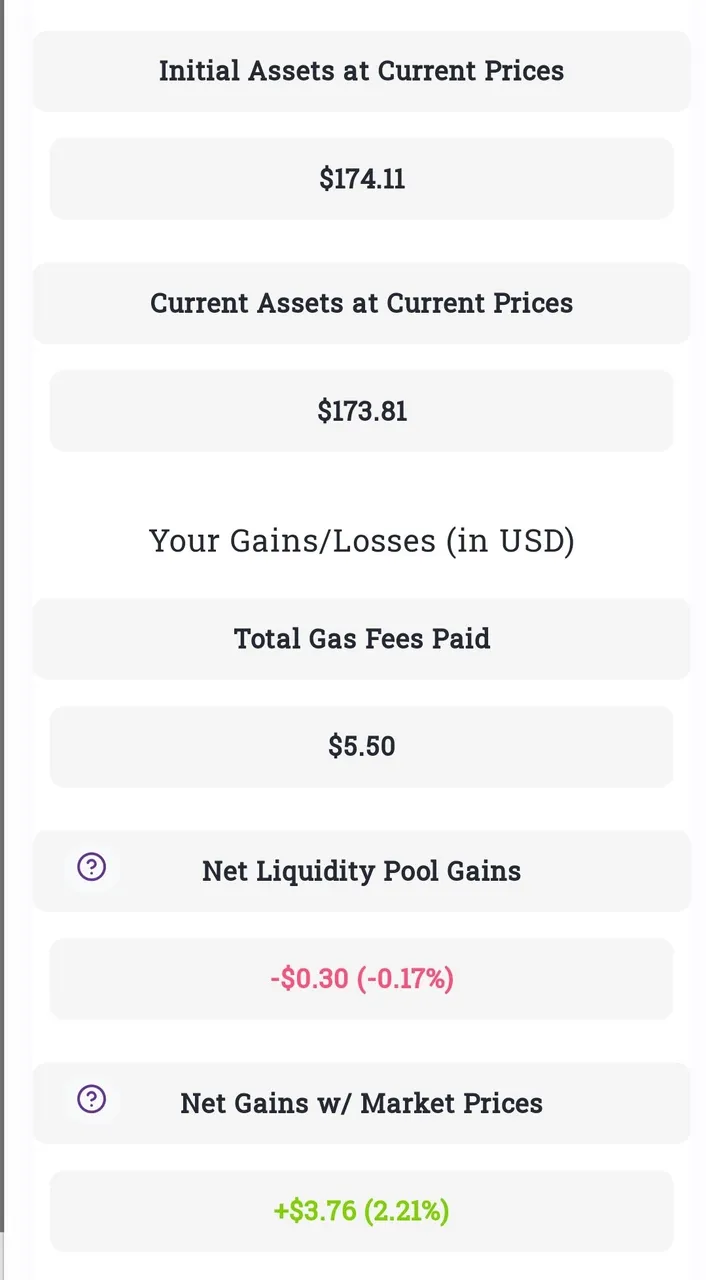

Above we can see the juicier info about how the LP is performing. It shows the value of the initial assets had I not entered the pool at all. Next it shows the current value of my assets currently in the pool. The variance of impermanent-loss is also seen between these two numbers.

Moving down, my total gas fees paid comes to $5.50 and my net LP has that impermanent loss of $0.30. Finally, my assets in the pool have increased in value by 2.21% or $3.76. I still have an overall loss of $2.04. This doesn't include estimated gas fees for exiting the LP.

One Dividend Paid So Far Last Wednesday

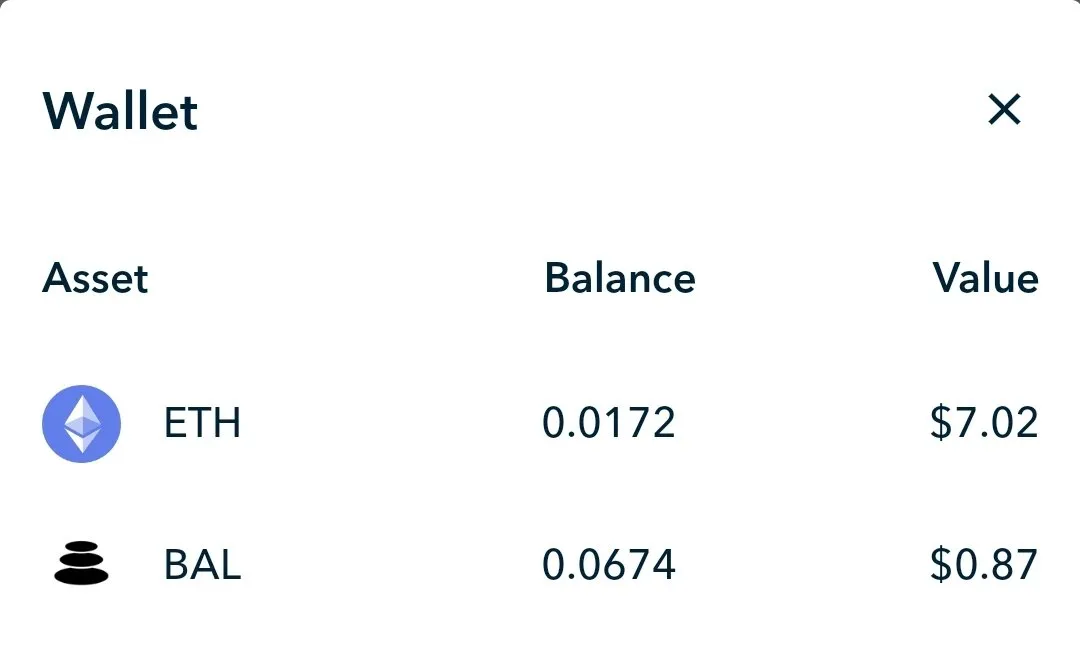

After all this info, I also need to take into account the APY paid each week. That is easily seen by visiting Zapper and checking my wallet balance.

Upon providing liquidity, I put all my BAL Hodlings into the pool. Below is the amount of BAL I earned after about five days.

After five days, I was paid out .0674 BAL with a current value of $0.87. That's not much but it's not bad at all for starting with $170.00. If the value of BAL keeps increasing like I think it will, I should have covered all my expenses by this Wednesday. If not, I may have a couple more weeks before I profit.

Hope this gave you some insight into providing liquidity to a Balncer LP. Links to reading material below.

@inalittlewhile/into-a-balancer-lp-60-bal-40-weth-it-wasn-t-easy

@jk6276/making-bank-in-a-balancer-pool

@jk6276/research-notes-on-setting-up-a-balancer-pool

@inalittlewhile/balancer-usdbal-isn-t-helping-my-eth-balance-yet

Thanks for reading. Don't hesitate to speak up with any questions, and as always...

Images Captured As Screenshots From Liquidity Vision & Zapper.fi

Bottom Image Courtesy Of Hive.io Brand Assets

Metamask Account Hodlers - Use The New LeoFinance.io Two Click Signup Process Through The Metamask Browser

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com