As part of my ongoing efforts to join the wLEO liquidity pool, I've been trading HIVE for LEO on the LeoDEX. Bit by bit, those trades are helping to reach my goal of 500 liquid LEO.

LEO has been bouncing off parity (equal value to HIVE) for the last couple weeks now. Today I traded 15 HIVE for 14 LEO. The exchange rate was 1.03900.

That may not be much over parity, but it may be one of the last times we see LEO anywhere near the value (per token) of HIVE. Not to be confused with market cap.

3 Days Until Power Down

With three more days to wait for a 250 LEO power down, I'm keeping an eye on the market. A small trade today as well as some post rewards brings me to 221 liquid LEO. Adding in the 250 coming three days from now, all I need is another 29 LEO to make the 500 token target.

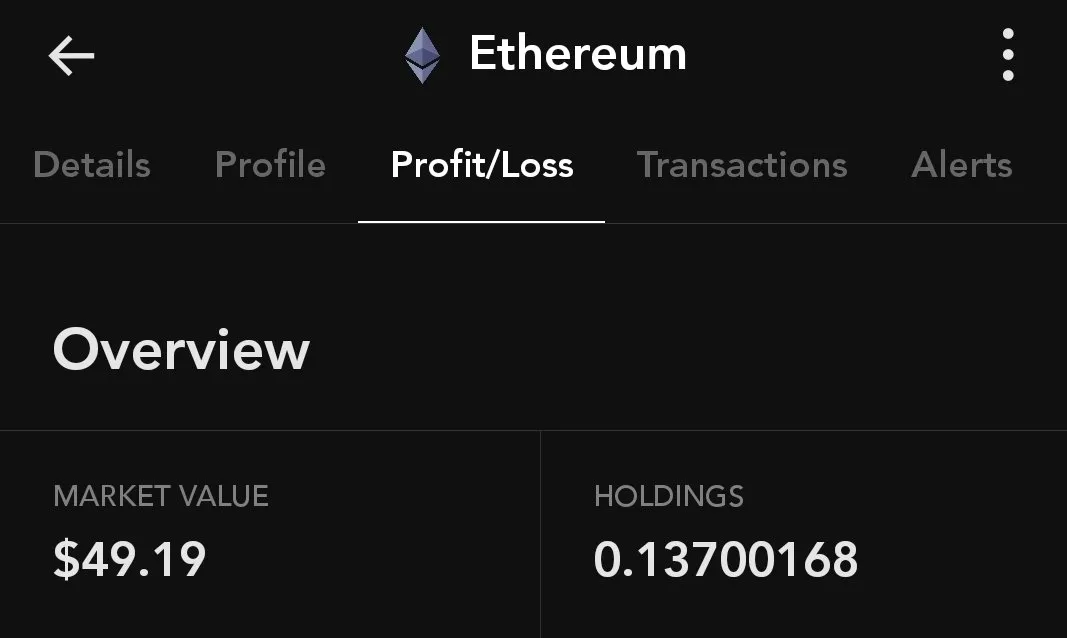

Securing ETH

As I posted in yesterday's update, I made an exchange and picked up roughly $50 worth of Ethereum. I'll need that and more to match the wLEO for the liquidity pool.

Knowing how much ETH I'll need three days from now is impossible. There's no way to foretell the price of Ethereum or wLEO.

Assuming the value of LEO is going to keep rising, I can give it an estimated price. If LEO goes up a few cents to .20 in three days, I'll need $100 worth of ETH to match my 500 token target.

It's safer to shoot for $125 in Ether due to fees and potential order slippage. That's something I can easily pull off, though I'll need to exchange some of my other Hodlings.

Having a residual accumulation of LEO tokens from a yield can really pay off in the future. Especially if LEO shoots the moon.

This post is not financial advice.

Thanks for reading and as always...

Bottom Image Courtesy Of Hive.io Brand Assets

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com