I know, I know. All we've heard about and most of my writing's focus has been on wLEO. It's wLEO this, Liquidity Pool that! For the record, I promise to try to give it a rest....for a week. I'll try.

As for today, I woke up in anticipation of making some trades so I could contribute to the wLEO Liquidity Pool. Settling back to check the charts after dropping our youngest off at school, the markets went red.

Down BTC fell in a hurry. What was going on? It didn't feel anything like a typical retracing because of its ferocity in momentum.

Losing another 40% off the value of my altcoin portfolio after the last couple weeks wasn't going to help with my liquidity plans.

Barely Caught It Before The Bottom

Normally I wouldn't have reacted to the dip so much. It would've been more fools selling BTC out of fear and a great time to buy the dip.

Not for me! I had my crypto in MAKER, ALGO, and other altcoins, hoping for a pump before 250 LEO came out of my staking.

No More Losing Crypto On Dumb Trades & Exorbitant Fees

Well, at least not for now. I'm sure once more HBD and LEO rolls in from post earnings, some will go back into altcoins.

For now, I can watch my LEO grow passively as well as from active blogging. That's right, I did it. Once the reaction to the bitMEX indictments settled down, I was able to enter the wLEO Liquidity Pool.

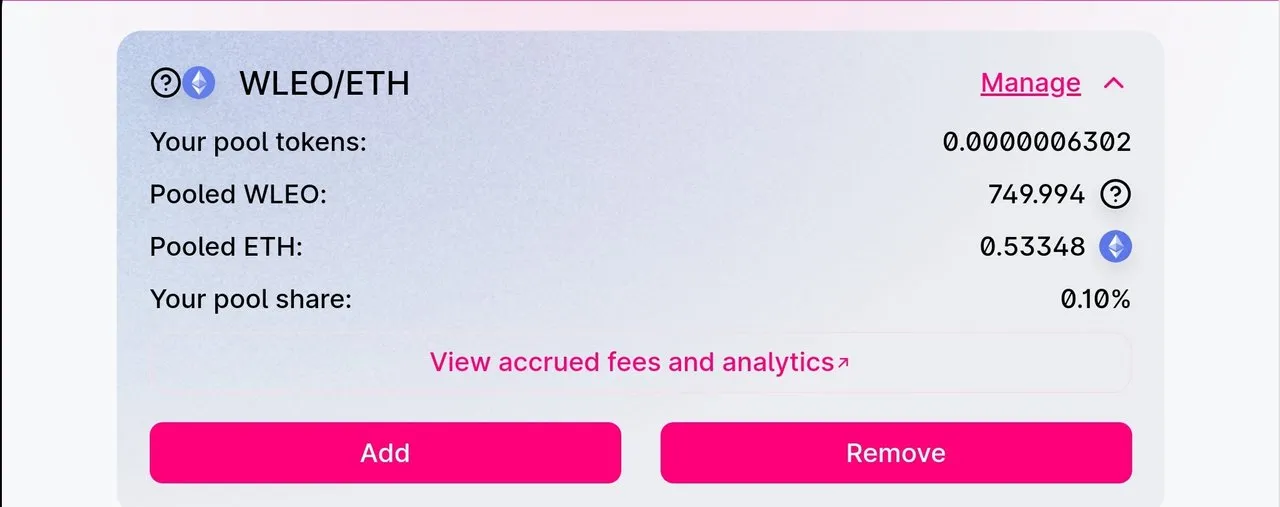

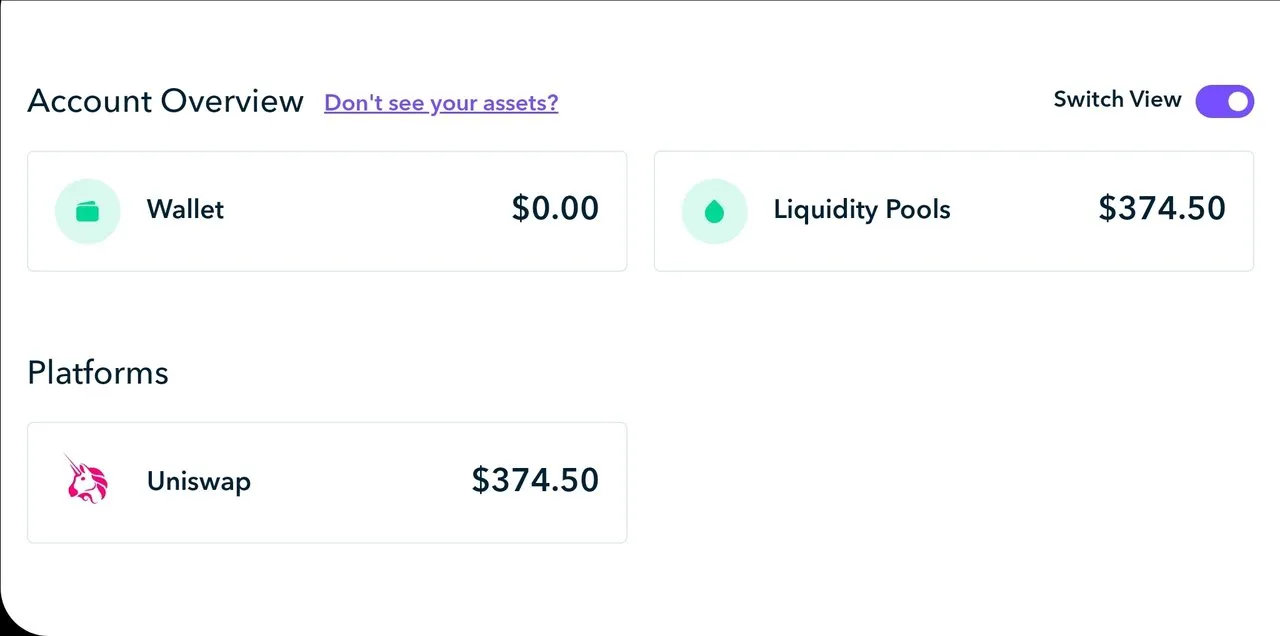

I'm now the proud contributor of a tenth of a percent in the wLEO Liquidity Pool. How much was that in value today?

Using Uniswap & Metamask

I have to say, the LeoFinance team did an excellent job with their guides to Wrapped LEO. There were a couple hickups on my end, and a couple transactions that failed to process on the Uniswap V2 router.

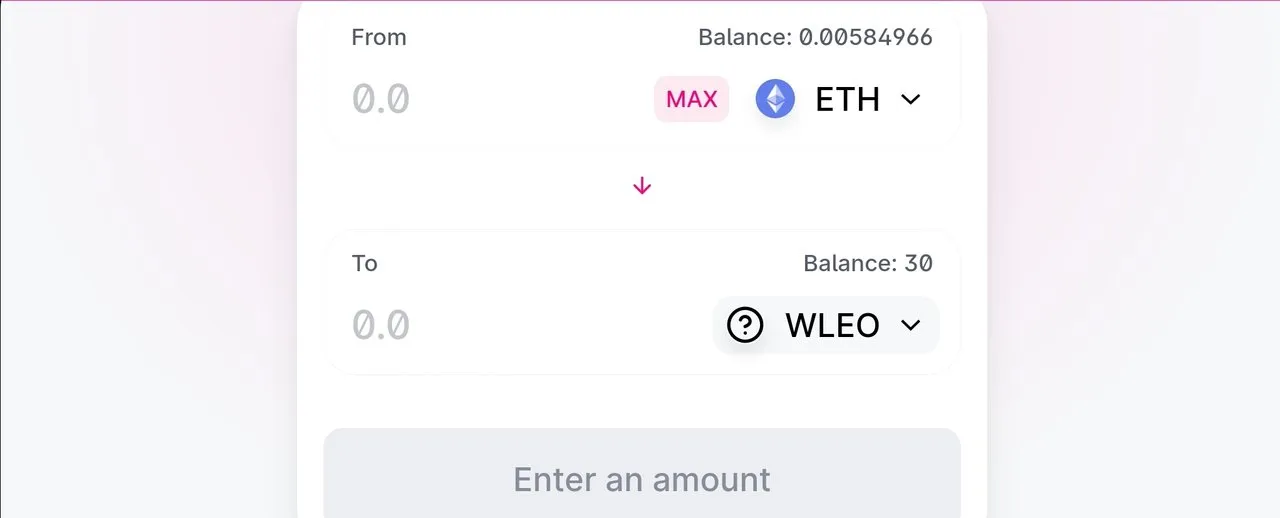

You might find it strange working to make trades using your Ethereum wallet in combo with the Uniswap Protocol. Each time you enact a transaction on Uniswap, it redirects to your ETH wallet for confirmation.

Metamask was slow to respond to the Uniswap redirect a few times. In the end, everything worked out fine and it wasn't too difficult to figure out.

One Extra Account On Metamask

Later in the day, I started thinking more about the distribution of the UNI governance token. With a plan to distribute the full amount over 4 years, there probably isn't any hurry.

Still, why not create another ETH wallet and make a swap on Uniswap? I might try to open more as time goes on, just in case the next UNI airdrop occurs within the same parameters.

I'm pooped after a rather eventful day on LeoFinance, HIVE, and the Cryptosphere in general. Time to relax, not worry about my portfolio, and re-energize for tomorrow.

Thanks for reading and as always...

Bottom Image Courtesy Of Hive.io Brand Assets

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com