Unstaking all my LEO was not the plan. That was the action I took as power downs return liquid LEO in equal quarterly amounts. Each quarter pays out after seven days, giving a full return in 28 days.

Though able to choose any amount of staked LEO to power down, I wanted at least 259 after that first week. With just over 1,000 staked LEO, that meant I needed the full power down.

Once the 250 LEO is liquid (in another 5 days), I can either stop the power down or decide to let it go one more week. That will depend on how much ETH I can come up with by that point.

Procrastination Can Be Costly

The LEO pool is launched. Incentives are already on the 90 day count down and each day I miss is opportunity lost.

Waiting will, at the very least, prevent a full leveraging of the 90 day incentive program. At the time of this writing, I could put my assets into ETH to cover the fees in gas.

It could take most of my liquid Hodlings to gather enough ETH to match 500 LEO. I could pull off 250 with relative ease.

The more the better as I see it, considering the fees in gas will add up. Of course, this is all a mute point. Who knows where the market will be in five days after my first 250 LEO power down.

Who knows what the price of ETH will be? What about the price of LEO? There seems a high likelihood that it's going to keep going up.

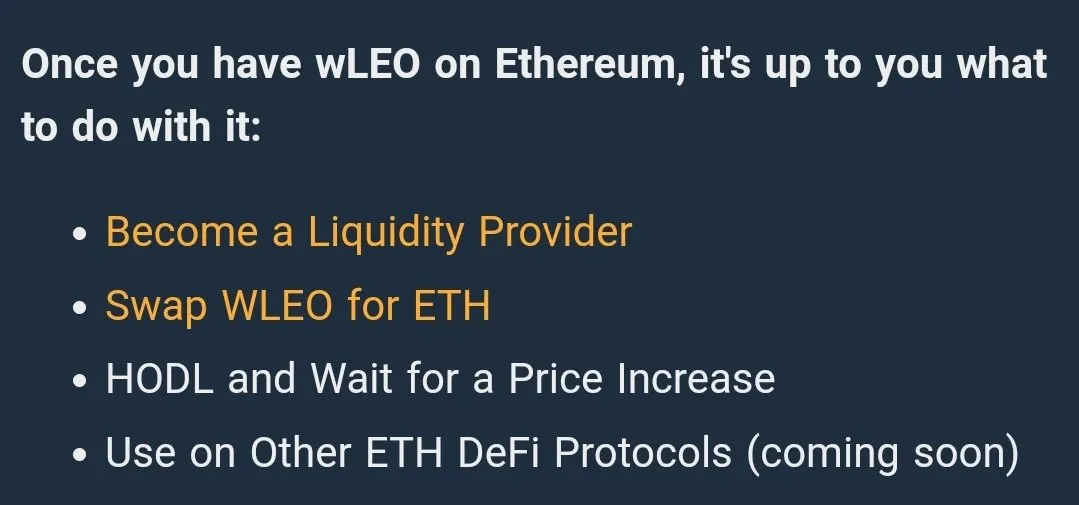

Wrap LEO Then Exchange Some For ETH

Depending on how things shake out, this could work to my advantage. On the flip side, I'm keen on LEO and so would rather not lose any.

Knowing all these variables would exist until I actually have the liquid LEO, I figured I may as well get the ball rolling.

Wallets set, a deeper study of the process of wrapping LEO and then matching ETH to join the pool is on my agenda for now. That and wait and watch the market. And perhaps make a few trades before then if I must.

I'll still be moving HBD into LEO as well as collecting reward from my blog. That part of the plan hasn't changed any. Thanks to LeoPedia and the contributions of Leos before me, learning the Uniswap process will be easy.

With 5 more days to learn it, diving into the pool shouldn't cause me any technical concerns. My small investment will play a part in the development of LeoFinance and earn me a bit of residual coinage to boot!

Are you considering showing up to the LEO pool party a week or two tardy? If you're not already in, why or why not?

Thanks for listening and remember...

No skinny dipping allowed (til the sun goes down).

Please remember to invest responsibly and that this post is not financial advice!

If you're interested in learning more about LEO (including wrapped LEO and the liquidity pool process on Uniswap), visit LeoPedia.io

Images Captured As Screenshots

Bottom Image Courtesy Of Hive.io Brand Assets

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com