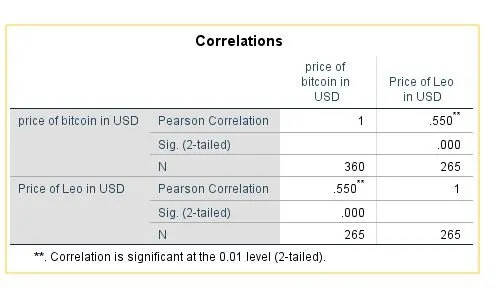

Correlation analysis measures if there is a relationship between variables which in our case is the price of BITCOIN and that of LEO.

The result of correlation is either positive, meaning as BITCOIN price is in a bull, it influences the price of LEO to be bullish and vice versa. The more the value tends to +1 axis the stronger the relationship.

The result of correlation is either negative, meaning as BITCOIN price is in a bull, it influences the price of LEO to be bearish and vice versa. The more the value tends to -1 axis the stronger the relationship.

The result can also be zero indicating no relationship at all.

Analysis of correlation result

From the analysis there seem to be a positive correlation with a coefficient of 0.55 which tends to positive one.

This relationship is closer to been strong.

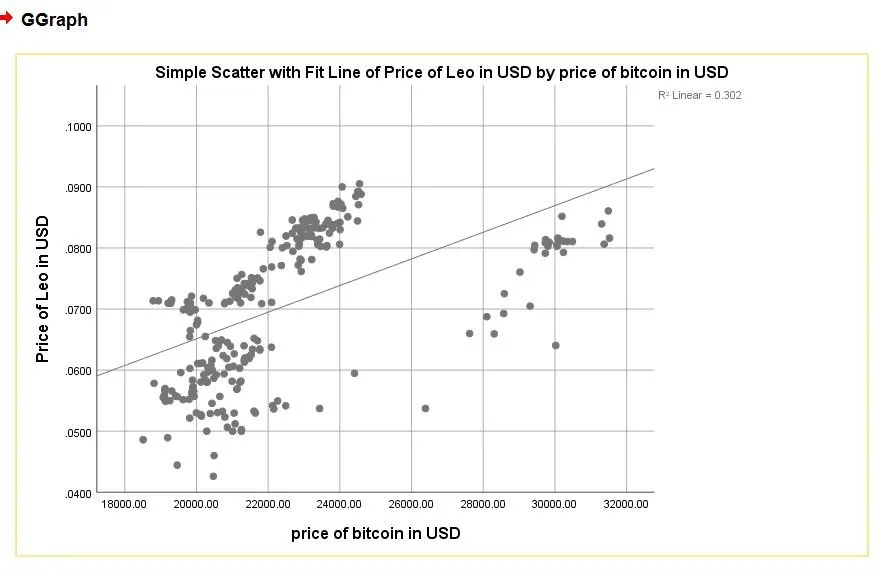

Details of this can be seen in the scatterdot diagram.

Scatterdot diagram

The scatter dot diagram can be seen below that when the price of BITCOIN is known, it can be traced to identify the price of LEO.

Conclusion

There seem to be a positive relationship between BITCOIN and LEO price in the crypto market.

Other images includes

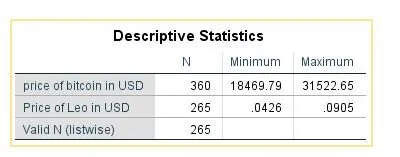

Maximum and minimum values

Data view mode

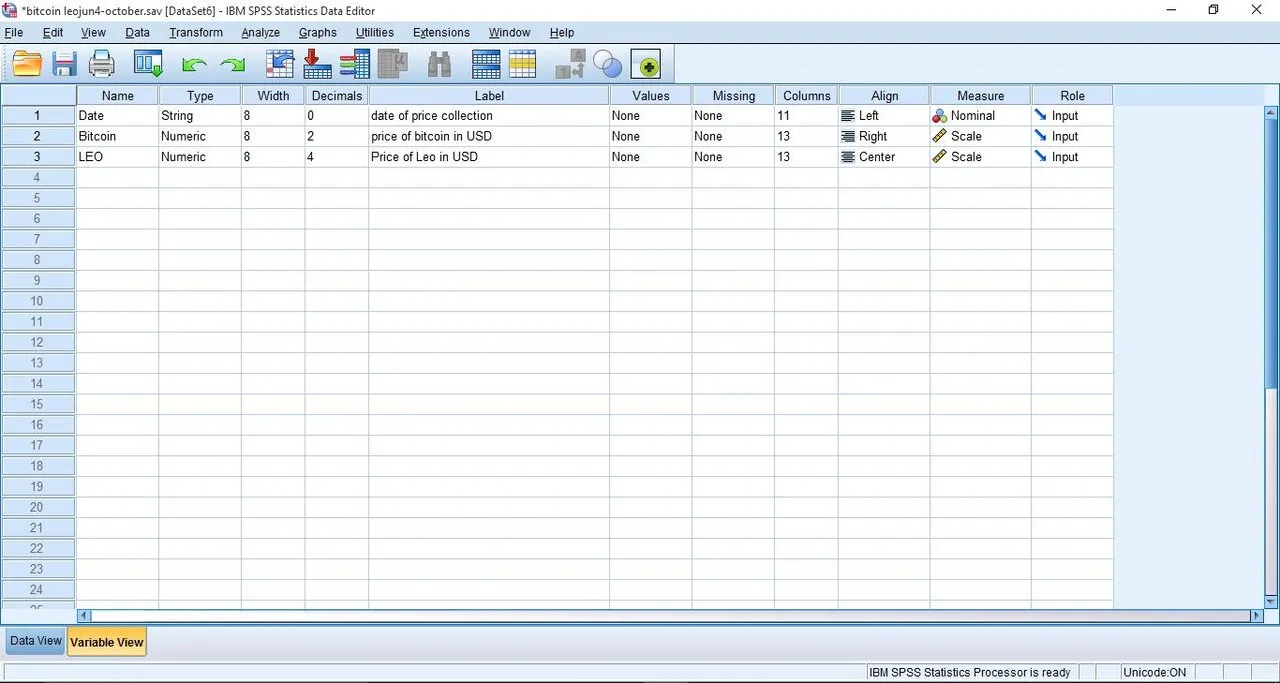

Variable view mode

Thanks for reading