The major importance of data is; it’s to be analyzed from which information can be derived through interpretation of an analysis. In this article, I will be predicting the price of LEO using ETH coin.

The article is summarized by the following contents.

Input variable

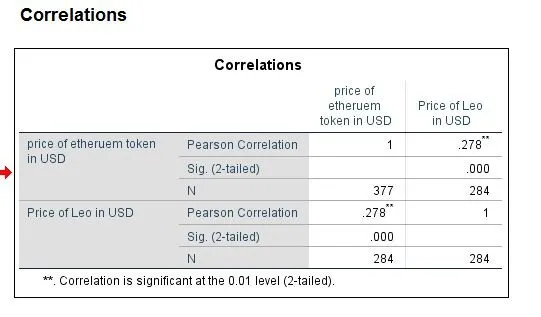

Correlation between ETH price and LEO price.

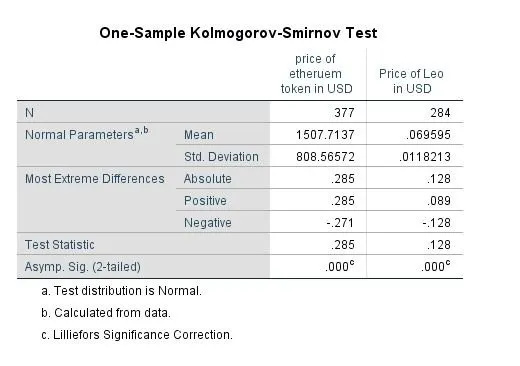

Normality test

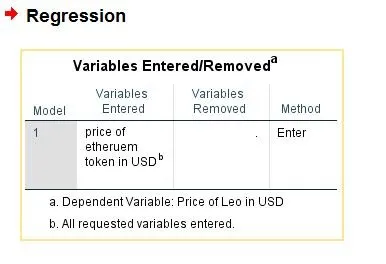

Model to predict LEO price using ETH price.

Conclusion

Reccommendation

Other images.

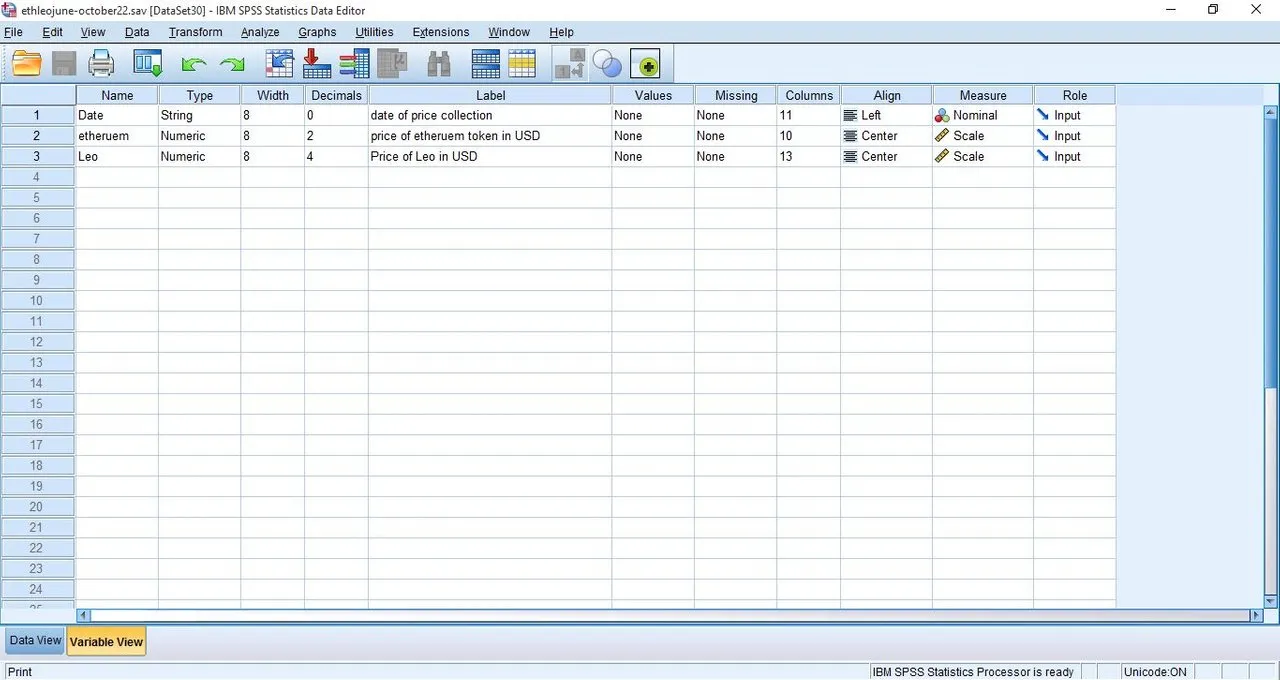

Input variable

The input variable been considered is the price of ETH.

Correlation between ETH price and LEO price

Correlation analysis between the price of LEO and ETH shows a coefficient of 0.278.

This is a positive correlation but weak one. Positive correlation indicates that as the price of ETH rise, that of LEO rises as well but not at same rate probably at a weaker rate for LEO. This means increase in price of ETH is influential in determining increase in the price of LEO but at a weak rate.

Normality test

Normality test proves if samples are drawn from a population and useful in prediction. We can see our sample is normal and useful for prediction.

Model to predict LEO price using ETH price

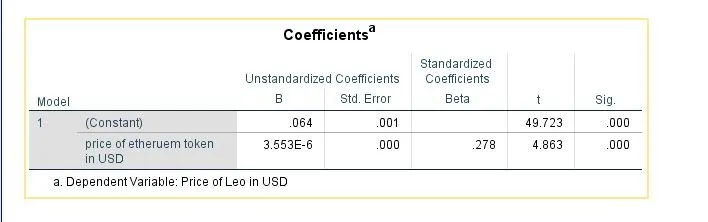

The model used to predict the price of LEO using ETH can be seen in the unstandardized coefficient column.

Given by;

Price of LEO = 0.064 + 0.000003553 * ETH price

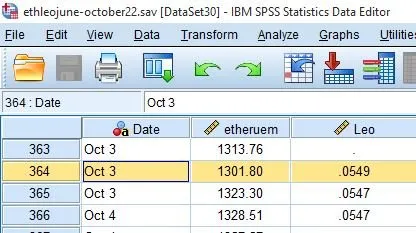

We shall test this value to when the price of ETH was $1301.80

Price of LEO = 0.064 + 0.000003553 * ETH price

Price of LEO = 0.064 + 0.000003553 * 1301.80

Price of LEO =0.064 + 0.00462

Price of LEO = 0.06862

As compared with the entered value for price LEO which was $0.05459, There seem to be a difference of $ 0.0140.

Conclusion

This article has been able to present a model for prediction of LEO price using price of ETH.

Recommendation

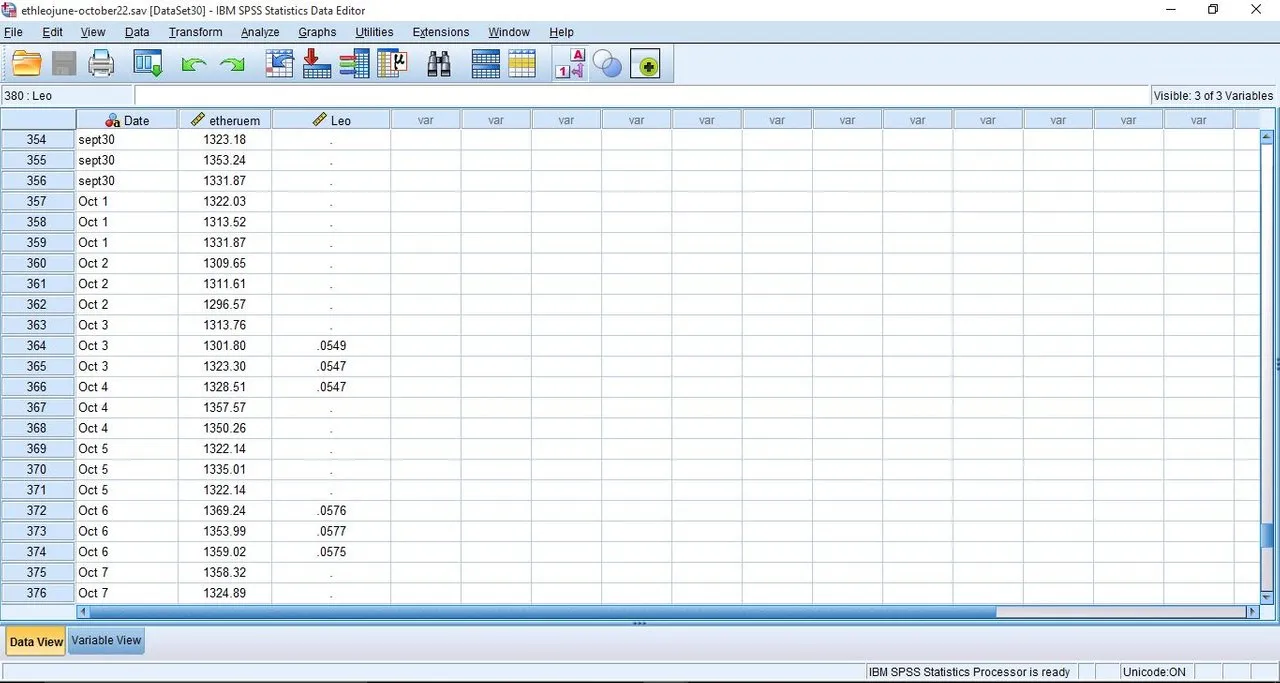

The estimated value of our model seem to have a big difference, this is due to insufficient data as regards the price of LEO. The price of LEO should be made available on coingekco and coinmarket cap for crypto analysis.

Other images includes

###data view

variable view