Statistical analysis techniques are useful in prediction as it generates a model for predicting price of an asset. The result of this model is approximately equal to the price from crypto market.

In this article, I will analyze the price of LEO and MATIC under the following subheadings.

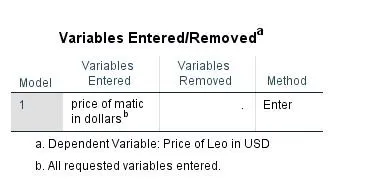

Input variable

As can be seen the variable that’s needs to be inputted is the price of MATIC.

Variables are solution to analysis.

For instance I want to predict price of naira when considering for dollar. Price of naira is a variable likewise the dollar.

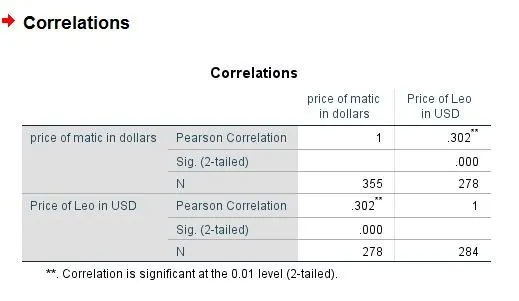

Correlation

The need for correlation test is to measure the level of relationship between prices of both asset. The level of relationship can either be of the following;

Positive – when the price of MATIC is in a bull, the price of Leo will also be in a bull and vice versa.

Negative – when the Price of MATIC is in a bear, the price of Leo will be in a bull and vice versa.

Zero – when there is no relationship at all between variables in consideration.

Correlation can either be strong or weak.

The result of correlation analysis can be seen below.

The coefficient of correlation is 0.302. This shows a positive relationship but not too strong and not too weak.

As the price of MATIC is in a bull, that of LEO will be in a bull but with an average influence. if the price of matic rises 1%, the price of LEO will equally rise by 0.3%

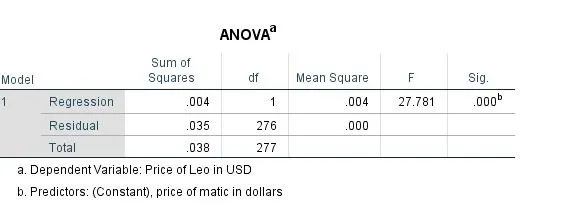

Normality

A condition for carrying out prediction test is satisfying for correlation and normality. Normality uses anova with the hypothesis that there is no relationship between the variables.

From the significance value of Anova table, there seem to be a value of 0.00 which rejects the null hypothesis and proves there is a relationship between variables (MATIC and LEO).

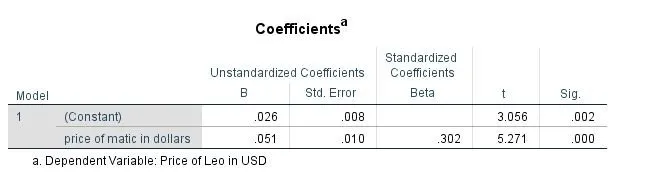

Model

The model for estimating the price of LEO is given by;

Price of Leo = 0.026 + 0.051 * price of MATIC

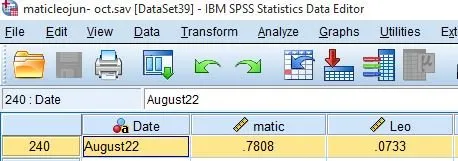

I shall input a test variable for the price of MATIC = $0.7808

Price of Leo = 0.026 + 0.051 * 0.7808

Price of Leo = 0.026 + 0.0398

Price of Leo = $0.0658

However there seem to be a difference of $0.0074 with the entered value.

Conclusively

The model for predicting the price of LEO using MATIC is given by;

Price of Leo = 0.026 + 0.051 * price of MATIC

This model will be more effective if the price of LEO is updated regularly on crypto markets.

Attached images

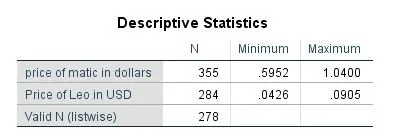

Maximum and minimum price of both asset for a period of June to September, 2022.

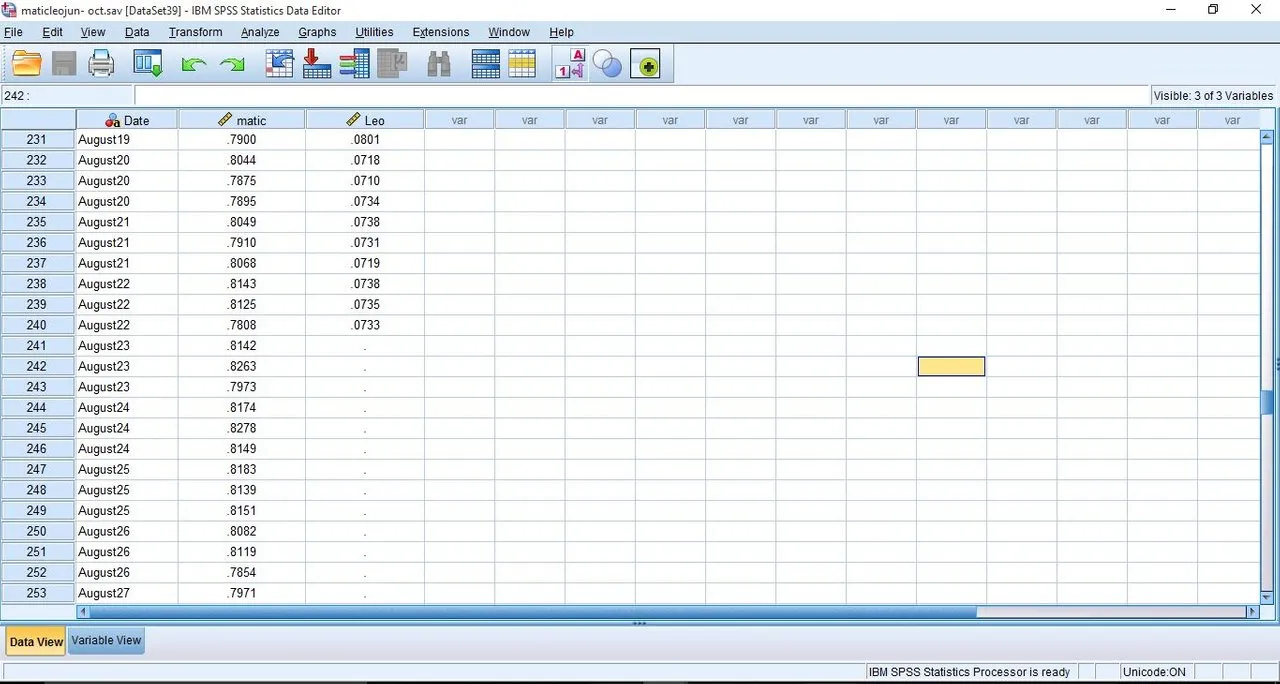

Data view mode

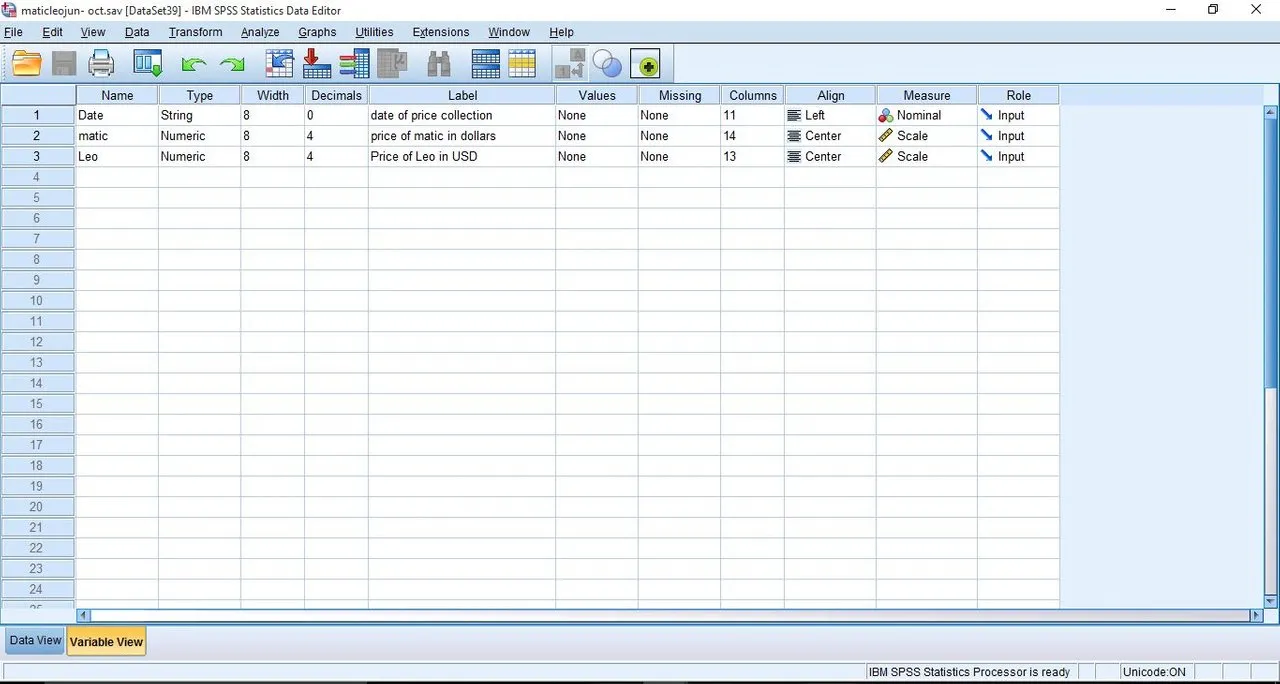

Variable view mode

Thanks for reading, we can actually create an algorithm to predict the price of crypto when the data is untracked.