Any where data can be gotten simply implies that such data can be analyzed if it’s a normal one.

What do I mean by a normal data?

A normal data is a data drawn from a population. This means as I usually carryout analysis of Leo and other alt or major coins, the population is crypto market where I obtain their price.

Benefits of statistical analysis in crypto

Behavioral determination

It tells the behavior of a crypto asset. Though the market cannot be controlled but it can be measured.

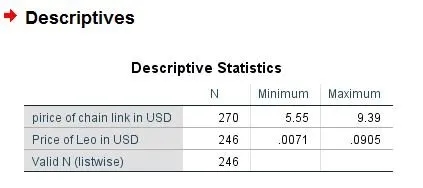

The image below shows the minimum and maximum price of an asset.

This tells the investor the price range so far of such asset between a specific time. As seen this a description of the price of leo in combination with chain link showing their minimum and maximum prices for the period of June to August.

Correlation test

Some crypto asset actually have relationship with other in the real life and this relationship can be measured to see if it’s a strong one, it simply means that one can influence the other at same rate.

When the price of one asset climbs, that of another will also climb, when it goes dip, the price of another will be dip too and this can happen at same rate or different rate.

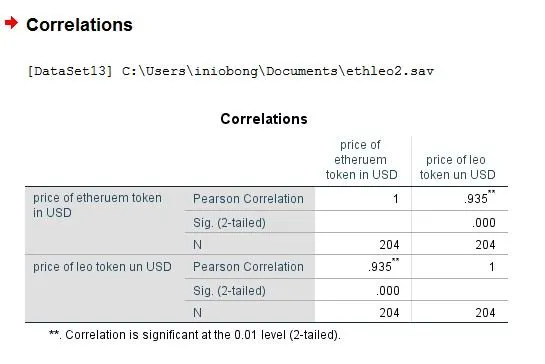

You can see from the image that I found the correlation between the price of ethereum and that of leo.

There seem to be a positive correlation which means when the price of ethereum goes high at 2%, that of leo will experience same likewise for a dip.\

Prediction

You can actually predict the price of a crypto asset when you have enough data that is normal and can be generalized unto the population.

The software will generate a model inform of a formular that can be used for predictive analysis especially when the input is known to determine the dependent variable.

What is a dependent and independent variable?

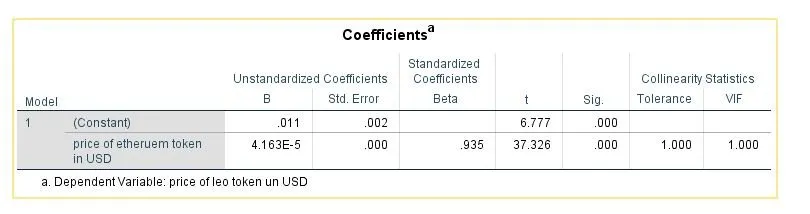

I actually carried out a prediction test to see if the price of the price of ethereum can be used to predict the price of leo. The price of leo which am looking for is my dependent variable because it’s the variable am concerned about whereas the price of ethereum is the independent variable because its useful in answering the question.

It can be observed that a model is been generated when you consider the unstandardized coefficient which is useful in prediction.

Conclusion

The importance of statistical analysis cannot be over emphasized as it helps to provided detail meaning to data. Thanks for reading.

Recommendation

I want to recommend that the price of @leofinance token @leo should be made available or updated in a simpler form so that analysis can be carried out and be trusted enough when there is much of leo data.

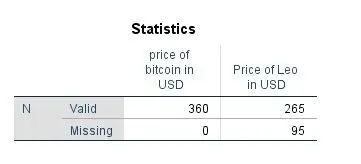

As can be seen there are spaces where I did not fill the data of leo due to the fact it wasn’t updated for sometimes though not everyone can interpret candle stick from @leodex market.

There are 95 missing Leo data. It makes more sense if there are more of the data.

Thanks for reading, do have an awesome day.