Institutional investors are in the early stages of building their crypto portfolios, but the best is yet to come. The financial industry and the world as we know it is changing at a rapid pace and we will eventually have an open, transparent and programmable financial system.

The question is what will trigger the mass adoption of crypto currency on a global scale?

In my opinion the key for converting the current financial system successfully lies in changing the opinion of the masses. Every day people should learn to trust, understand the strength of trust-less block chains and ultimately every person should own crypto currencies.

Strategy to target medium sized business for staking assets.

What if a strategy is built to around targeting ordinary, yet profitable medium sized businesses to purchase crypto currency from various exchanges and stake these crypto currencies in the same way that they currently save money in their business bank accounts? The key here lies in the thousands of profitable medium sized businesses globally. The sales cycle to Institutional Investors is long-term as the red tape and regulations complicates the sale. Medium sized business has a much shorter sales cycle which may speed up the opportunity for growth exponentially.

Why Medium Sized Businesses?

A well-established medium sized business will ensure to have at least 3-4 Months’ (If not more) worth of operating capital in their business bank accounts. A bank account is most definitely not an investment, but crypto currencies most certainly are. Operating capital can be turned into investments by earning returns.

Enable this strategy by empowering a global sales force using automated smart contracts

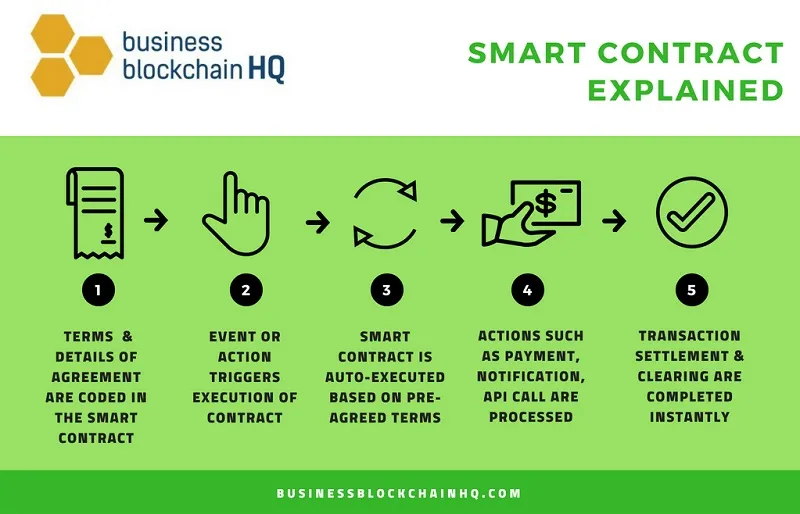

Crypto Incentives are here to stay, and many crypto enthusiasts are searching for various ways to earn crypto on an ongoing basis. Processes and procedures should be automated by using smart contracts to allow the global sales force to earn a fraction of a percentage of the staked assets which were secured from medium sized business.

Automated smart contracts with user friendly interfaces must offer medium sized business owners’ easy access to investment and the opportunity to yield a higher return with relation to their ordinary bank accounts or short-term fiat investments. Business owners must have the ability to earn higher returns, when staking for longer periods. As an example: Start earning returns after 7 days with a sliding scale of higher earnings after 30, 60 and 90 days.

Happy blogging!