It has been a big couple of weeks since my last post on Akash, heaps of news with partnerships, liquidity and growing adoption. Lets take a look.

Partnership with Skynet (SIA)

The latest new to come out of Akash is a partnership with Skynet, to enable a "Full Stack" cloud solution. Basically, Akash is decentralized cloud computing, Skynet is decentralized cloud storage. The combination means a more complete offering from both parties, and a smoother alternative to AWS and Google cloud.

The full announcement post can be found here. A new project called Filebase enables the link between the two platforms.

With this integration from Filebase, apps running on Akash can now backup, restore, and migrate a database by connecting the containers running on Akash to persistent storage on Skynet.

Quote from the above linked blog.

The connection of the two projects makes a lot of sense, it was inevitable that Akash would partner with one of the decentralized storage solutions, with SIA, Storj or Filecoin being the most likely. SIA Skynet looks to be a good fit, both projects have strong communities and active developer networks, and the synergies should give a boost to both projects adoption rates over time.

Osmosis.

The new Osmosis Dex and blockchain launched just over a week ago, and has already grown to have around $70 million worth of TVL so far. The tokens available there are all the projects that have integrated IBC, with Akash being one of them. Akash pools have proven popular on Osmosis, with the AKT/ATOM pool holding nearly $10million TVL, with 1.7 million AKT tokens and 315,000 ATOM in a 66/34 split (Osmosis allows uneven pools). The AKT/OSMO pool has more than $6 million with over 800,000 AKT and just under 700,000 OSMO in a 50/50 split.

That means that there is around 2.5 million AKT tokens available in liquidity pools, which vastly improves the availability of AKT for more investors. In particular, US investors could have difficulties with some of the tier 2 Cex's that AKT was on, and Osmosis makes it so much easier for anyone to acquire AKT. Simply buy some ATOM (which is available pretty much anywhere), download Keplr wallet (if you haven't already) move your ATOM's there. Then in the Osmosis you simply deposit your ATOM's into Osmosis (this is using the IBC to move your ATOM tokens onto the Osmosis chain) and then swap easily for AKT. It sounds like a complex process, but once you try it, it really is quite intuitive and easy to understand.

The Akash team also put out a full guide on how to buy AKT and provide liquidity on Osmosis that you can find here

To learn more about Osmosis, here are a couple of links for you of my previous Osmosis posts:

Price and Adoption.

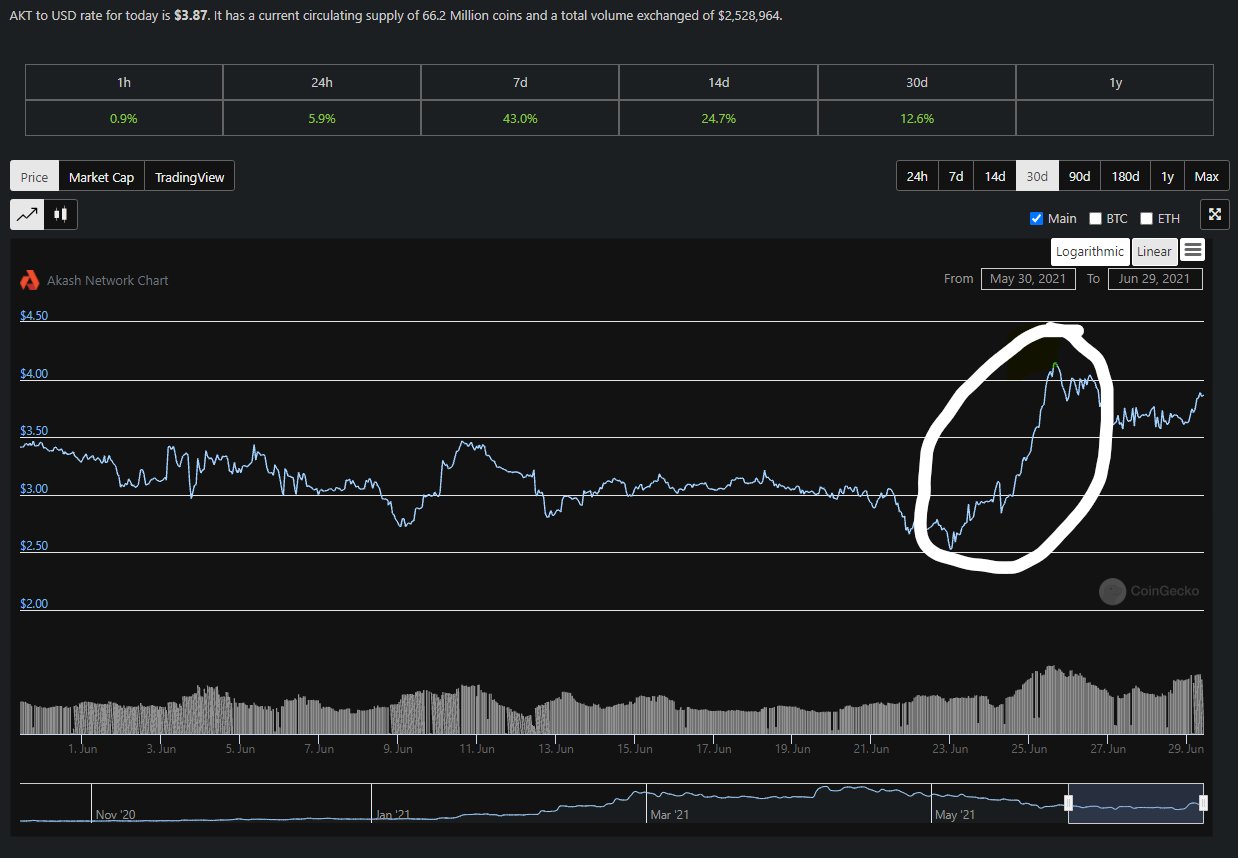

The Akash token has enjoyed a positive run of late, with much of the demand attributable to the Osmosis launch. The APR of the AKT pools has enticed people to buy more AKT to add into the pools, and at one stage the amount of AKT available on the larger Cex's diminished. AKT is a token where over 80% is locked in staking, and any significant increase in demand can push the price quickly higher.

Here is the chart for the last 30 days, thanks to Coingecko. I have highlighted the run up in price, which can mainly be attributed to Osmosis and a burst of demand.

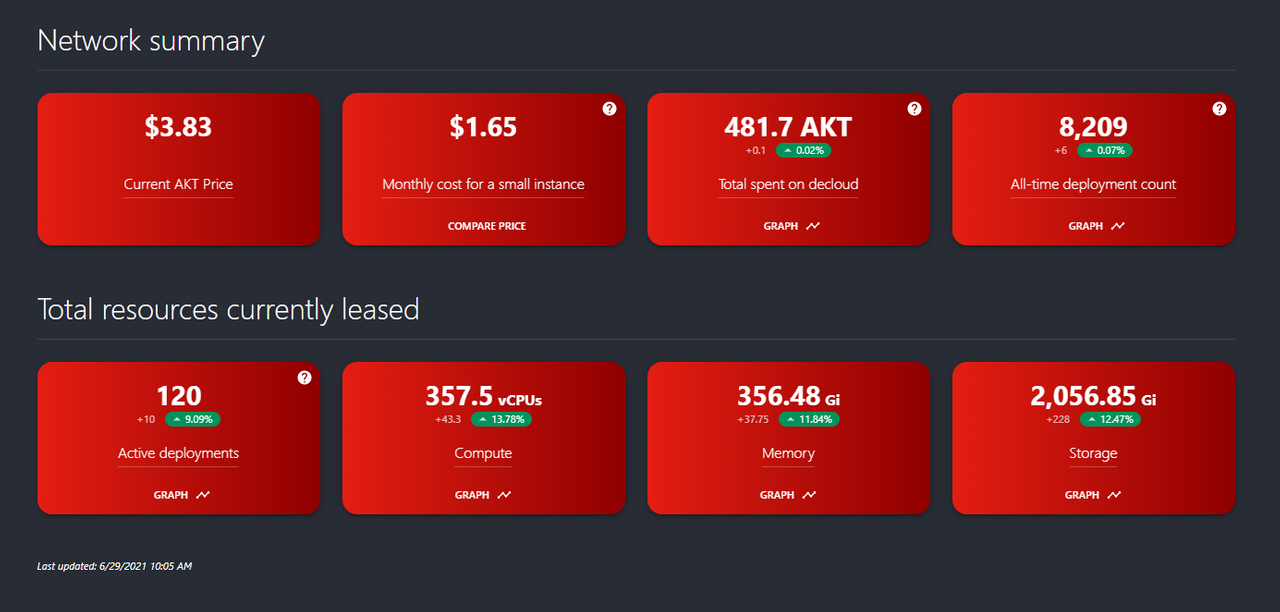

Usage of the Akash network has also grown, with a the addition of new active deployments being the most notable increase.

Here are the overall stats for the network:

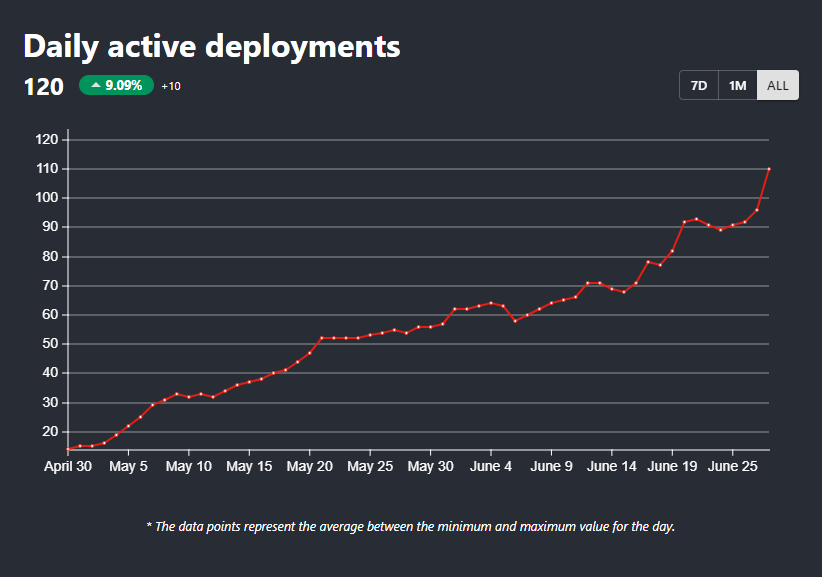

And here is the chart of "Active Deployments" since the network went live:

Both images above are sourced from the Akashlytics website, a community built site tracking key Akash metrics data, straight from the blockchain.

The increase in active deployments is most relevant, and this is one of the most important (imho) metrics to watch to see if the Akash network is gaining traction and real usage. Eventually, AKT holders with staked tokens will share in the revenue of the network, with 20% of the fees payed in the marketplace shared to token stakers once "take income" is activated. Obviously, token holders will benefit from more usage and adoption over time.

As usual, lots going on for Akash over the last couple of weeks. A couple of weeks ago, it was announced that US billionaire Tilman Fertitta had acquired a stake in AKT, and was planning to run a validator and explore moving his companies websites over to Akash, which I discussed in this post two weeks ago. Since then, Akash has continued to push forward with the Osmosis Dex listing, partnership with SIA Skynet and more giving the project continued momentum and growth.

Nothing in this post is financial advice, please dyor.

Thanks for reading,

JK.

Read more about Akash in some of my previous posts:

- Billionaire Tilman Fertitta onboard with Akash

- Akash and Osmosis

- Akash goals - target 10,000

- More good news for Akash

- Akash Dreaming

This post was created on LeoFinance, a tokenized blogging community focused on Crypto and Financial content. It is free to join and a great place to learn more or create content about your favorite crypto projects. Just click the "Get Started" link in the top right. Creating your account is simple with Metamask and Twitter options.