One of the most awaited financial news this week was undoubtedly the CPI announcement, which is a crucial element for the US monetary policy, which of course affects everyone and even cryptocurrencies. Previously, I explained how liquidity is affected in this type of announcement and how it correlates with the crypto sector, however, this time I want to take a different approach and put on the table my perspectives on the banking sector, compared to the current Bitcoin news.

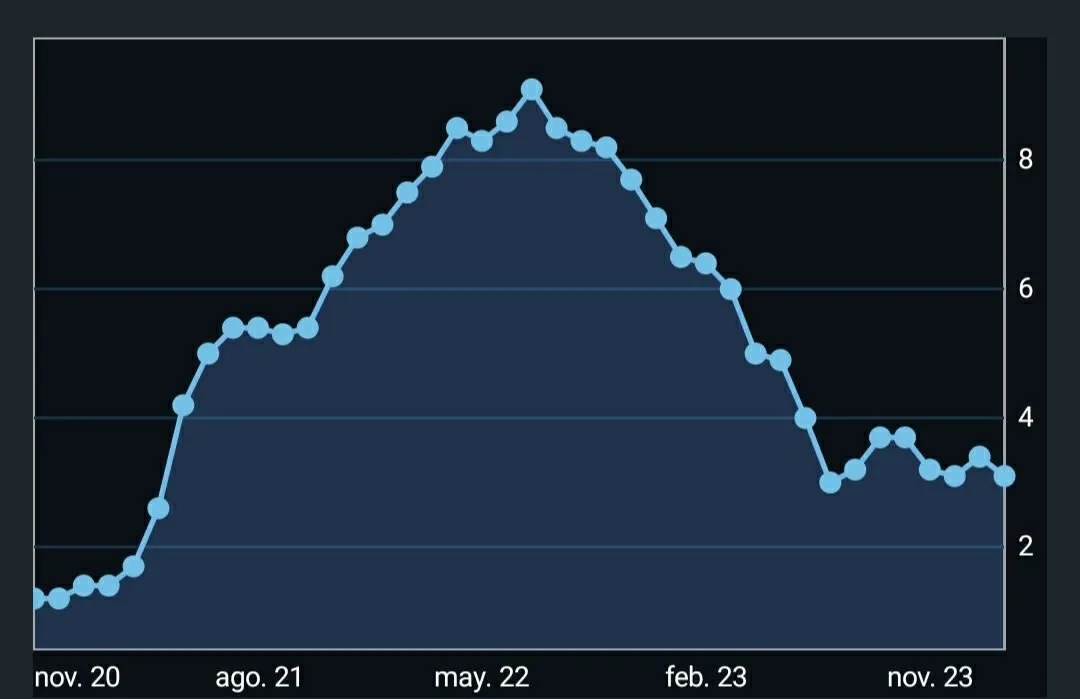

The CPI announcement has caused volatility in the markets which mostly moved negative, with the major US indices retreating between 1% and 2%, following the announcement in which a lower CPI was expected (CPI Reports, Underlying CPI and Annual CPI), however, all these numbers were higher than many analysts expected. The direct consequence of this announcement is for the FED to maintain its rhetoric of not lowering interest rates so as not to add more liquidity to the markets, keeping borrowing expensive, so investors have reacted to this possibility.

Screenshot from my Investing.com account

Although indices fell in price after hitting record highs, this is not the worst news, in fact, the banking sector is obviously the one that is most affected by this announcement, lowering confidence in the sector.

Screenshot of my TradingView account

Banks At Risk (Nasdaq Bank)

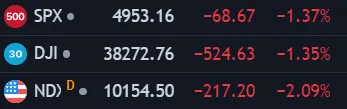

One of the indices that I use to study the banking situation is the Nasdaq Bank, which gathers information on the shares of the banks registered in Nasdaq, they are the main ones and from my point of view this is a chart to take into account to study the banking health at certain moments at a macroeconomic level.

If we look at it from a technical point of view, this chart shows a sharp drop in 2023, the strongest correction since the post-pandemic era, this corresponds to the wave of bank failures where we remember mainly the failure of the well known startup bank SVB. This chart shows a remarkable recovery following the bank failures and mergers of other banks, however, this chart itself does not show very encouraging news at present and in the near future if interest rates remain high.

The banking sector had its recovery in the face of a more flexible speech by the FED on the interest rate situation, however, everything changes since Powell's speech in the last interest rate announcement.

Screenshot of my TradingView account

The chart shows a bearish divergence from January 30th, showing a bullish rebound of recovery until February 12th, following the uptrend of the main indices, however, the charts are very different with respect to the banks' shares. Following that recovery, Nasdaq Bank falls with a lot of volatility on February 13th after the CPI announcement, pulling back this banking index by almost 5% in just one day with a small not very encouraging rebound at the end of the day.

Screenshot of my TradingView account

This is a Warning Signal for the Banks.

Investors may feel that banks cannot maintain control at current interest rates as their revenues are eroded, plus the spectre of borrower defaults, so their stocks suffer the consequences, especially with the possibility of the Fed not cutting interest rates soon due to inflation, so we must keep a close eye on the next few weeks as the US banking sector unwinds.

Bitcoin Remains Strong

The leading cryptocurrency is still in a favourable price development, even with the possibility of interest rates not going down, Bitcoin is today a value option that can really interest many investors, despite the fact that rates just a few days ago reached all-time highs. This phenomenon occurs because Bitcoin and cryptocurrencies are not common or traditional assets within the financial system.

Screenshot of my TradingView account

Confidence in Bitcoin Rises as Confidence in Banks Falls.

The banking problem may influence the cryptocurrency sector, as many can analyse the behaviour of Bitcoin in recent weeks and compare market movements with the banking sector, many investors may see the possibility of investing in Bitcoin after the approval of ETFs and knowing that Bitcoin Halving is approaching, so on an investment level, BTC and even cryptocurrencies such as ETH may be seen as a viable alternative in the future.

Bitcoin in the face of Financial Crises

Bitcoin has more and more presence in the financial world every day, in fact, large companies such as BlackRock have mentioned that they are betting on Bitcoin in the face of the economic situations in the United States. It is possible that in the coming days or weeks we will find unfavourable news for the banking sector, even risks of bankruptcy in small and medium-sized banks, this kind of news makes many investors worldwide may panic and seek a shelter to protect the money, although many bet on the US dollar, the debt crisis in this country makes its currency is not so attractive in the long term, however, Bitcoin may be the new refuge of value to these possible bad news that arise from the banking sector.