"Those who cannot remember the past are condemned to repeat it" [Santayana, G. The Life of Reason, Vol. 1, Reason in Common Sense, (1905-1906). (Accessed June 14, 2022)].

Introduction

Presently in the United States, we are experiencing severe negative economic conditions which in part were created as a result of an unprecedented pandemic but exacerbated by adverse and erroneous economic policies of the Government and Monetary Authorities. Guess those presently in charge have forgotten the economic pain felt by Americans in the 1970s.

So will Santayana's words prove true as a result of the politician's and bureaucrat's forgetfulness? Well, with each passing day now, the current American morass worsens, and while the solutions are present, seemingly the officials in charge are content to stand by doing little or nothing to quell the problems (all while falsely claiming a 'robust' economy exists).

Visiting the Past: The Economy of the 1970s

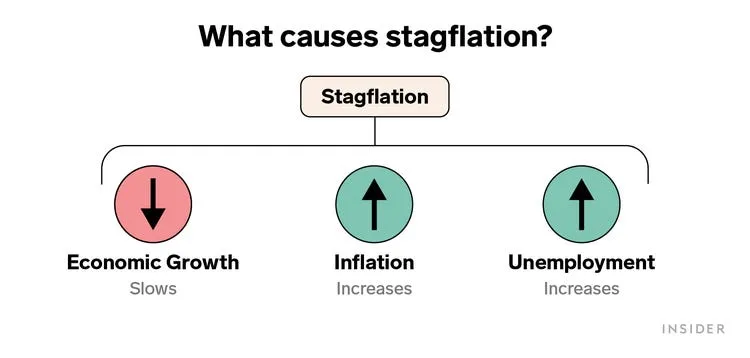

Understanding the Condition: STAGFLATION

"Stagflation is an economic condition that's caused by a combination of slow economic growth, high unemployment, and rising prices" [Folger, J. What is stagflation? Understanding the economic phenomenon that stifled growth through the 1970s. (Accessed June 14, 2022)].

The Prevalent Economic Theory Present in the 1970s

Those that argue that unemployment and inflation are inversely related believe that, when the economy slows, unemployment rises, but inflation falls. Therefore, to promote economic growth, a country's central bank could increase the money supply to drive up demand and prices without stoking fears about inflation. Beliefs about inflation and unemployment were based on the Keynesian school of economic thought, named after twentieth-century British economist John Maynard Keynes. According to this theory, the growth in the money supply can increase employment and promote economic growth.

[Nielsen, B. Stagflation in the 1970s. (Accessed June 14, 2022)].

But the cozy feeling brought on by Keynesian Economics became challenged by the economic conditions that developed in the 1970s. A reconsideration of the inverse relationship between inflation and unemployment became necessary as the conditions presented included slow economic growth coupled with high inflation.

Key Factors Present in the 1970s Economy Contributing to Stagflation

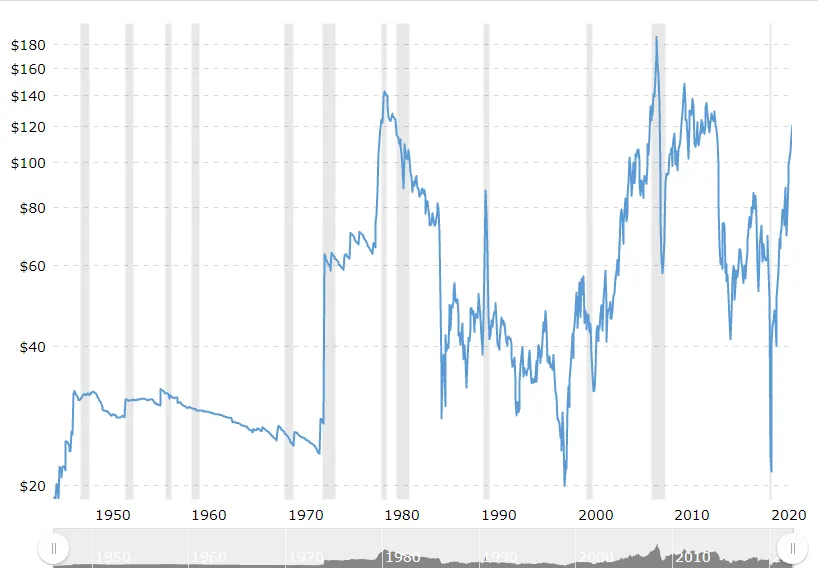

- High Oil Prices: In November, 1979, one barrel of WTI exceeded $100 and in April 1980 the WTI price peaked at $125/barrel. This stood as the high price for oil for 28 years [See, Macrotrends. Crude Oil Prices - 70 Year Historical Chart. (Accessed June 14, 2022)].

Photo Source

It should also be remembered that the 1970s saw an oil crisis caused by the Organization of Petroleum Exporting Countries (OPEC) constraining the worldwide supply of oil. This, combined with the 1970s overall general energy shortages, resulted in actual or relative scarcity of raw materials. The price controls resulted in shortages at the point of purchase and increased production costs for industry [See, Time. Panic at the Pump. (Accessed June 14, 2022); and, Wikipedia. Stagflation. (Accessed June 14, 2022)].

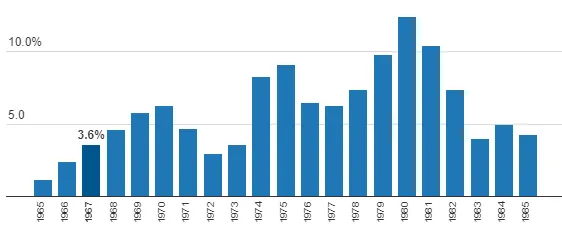

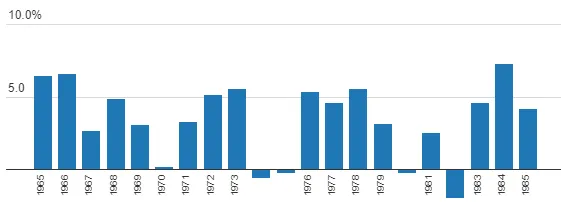

- Inflation: By historical standards, U.S. inflation was high in the 1970s with core consumer price index inflation (excluding food and fuel) reaching an annual average of 13.5% in 1980. A core CPI chart for the period 1965 through 1985 is demonstrative of this:

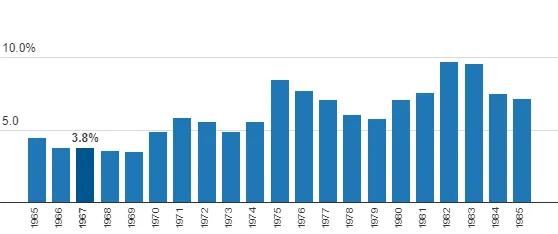

- High Unemployment: As per data obtained from the U.S. Department of Labor Statistics, the 1970s showed high levels of unemployment [See U.S. Bureau of Labor Statistics Labor Force Statistics from the Current Population Survey. (Accessed June 14, 2022)]. An Unemployment Rate chart 1965 through 1985 is demonstrative of this:

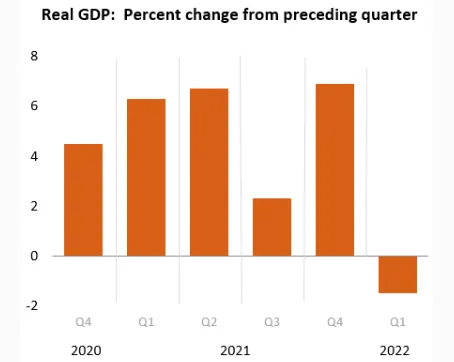

- Recession: In the 1970s GDP growth was uneven at best and the economy was in an actual recession from December 1969 to November 1970, and again from November 1973 to March 1975 [See National Bureau of Economic Research. US Business Cycle Expansions and Contractions. (Accessed June 14, 2022)]. A chart showing various GDP readings for the period 1965 through 1985 follows:

Monetary Policies Utilized Contributing to Stagflation

Most historians agree with contemporary journalistic accounts that the inflation grew out of President Lyndon Johnson’s decision to escalate the Vietnam War in July 1965 without moving the U.S. economy to a “war footing”—by not instituting excess-profits taxes, wage-price controls, or, at the very least, a wartime income-tax increase to accompany the war. The only “bump” in federal expenditures during the previous period of inflation occurred in defense spending.

[Elrod, A. Austerity policies in the United States caused ‘stagflation’ in the 1970s and would do so again today. (Accessed June 14, 2022)].

It was these fiscal austerity drives that created the “stag” in stagflation. This was deliberate policy—and recognized as such at the time. After the 1972 elections, for example, the Nixon administration put an economy-breaking ceiling on federal expenditures, which the Ford administration tried to continue until the 1974 recession forced up unemployment claims.

[Id].

To be sure, there were real policy errors that allowed this runaway bout of inflation to happen—but they were microeconomic as much as macroeconomic errors. Just when austerity was imposed to reduce demand, the Nixon administration released controls over profit margins and allowed producers to recoup revenues in price increases. By freeing the corporate sector to drive up prices swiftly and sharply before supply had caught up to the administration’s election-year demand, the Nixon White House produced double-digit inflation.

[Id].

Federal Reserve Actions That Ended Stagflation

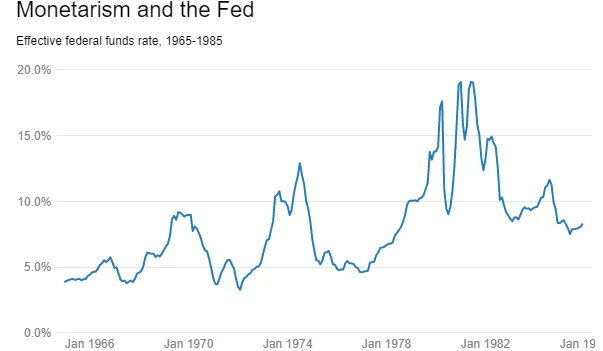

By the late 1970s, the public had come to expect an inflationary bias to monetary policy. And they were increasingly unhappy with inflation. Survey after survey showed a deteriorating public confidence over the economy and government policy in the latter half of the 1970s. And often, inflation was identified as a special evil. Interest rates appeared to be on a secular rise since 1965 and spiked sharply higher still as the 1970s came to a close. During this time, business investment slowed, productivity faltered, and the nation’s trade balance with the rest of the world worsened. And inflation was widely viewed as either a significant contributing factor to the economic malaise or its primary basis.

[Bryan, M. The Great Inflation. (Accessed June 14, 2022)].

So the policymakers of the time faced the dual dilemma of unacceptably high rates of inflation coupled with unacceptable rates of high unemployment. "Fighting high unemployment would almost certainly drive inflation higher still, while fighting inflation would just as certainly cause unemployment to spike even higher" [Id].

In 1979, Paul Volcker became chairman of the Federal Reserve Board. And during this timeframe it became clear to the policymakers that combating inflation was necessary to achieve the objectives of the Humphrey-Hawkins dual mandate (requiring the Federal Reserve to pursue full employment and price stability) even if the fight resulted in higher unemployment and disruption to the economy.

Under Volcker, over time, "greater control of reserve and money growth, while less than perfect, produced a desired slowing in inflation... Over the course of 1980, interest rates spiked, fell briefly, and then spiked again. Lending activity fell, unemployment rose, and the economy entered a brief recession between January and July. Inflation fell but was still high even as the economy recovered in the second half of 1980" [Id].

But the Volcker Fed continued to press the fight against high inflation with a combination of higher interest rates and even slower reserve growth. The economy entered recession again in July 1981, and this proved to be more severe and protracted, lasting until November 1982. Unemployment peaked at nearly 11 percent, but inflation continued to move lower and by recession’s end, year-over-year inflation was back under 5 percent. In time, as the Fed’s commitment to low inflation gained credibility, unemployment retreated and the economy entered a period of sustained growth and stability. The Great Inflation was over.

[Id].

The Present - The Economy in 2022

Let's look at the same factors presented above as they exist today in 2022.

- High Gas Prices: As of June 13, 2022, the average cost per gallon of gasoline nationwide (U.S.) weighed in at an all-time record high price of $5.01 per gallon. WTI Crude Oil Spot Price is at a current level of $118.41.

The price of gasoline has doubled since President Biden took office. In that period of time, as a result of purposeful administration policy, the United States has transformed from being energy independent to once again being dependent on foreign oil. Coupling the oil dependency with the results of Biden's war against domestic oil production has had the effect of increasing the price of gasoline.

While presently gas is up, it is not up as far as the magnitude felt in the 1970s (where gas prices first quadrupled, then on top doubled) and absent are the long lines to procure gas at the pumps or limits imposed on how many gallons may be purchased. Nonetheless, Americans are seeing high prices at the pump which adds to the system-wide inflation present in the economy.

- Inflation: As reported by CNBC on June 10, 2022, "the consumer price index rose 8.6% in May when compared with a year ago, higher than Dow Jones’ estimate of 8.3%" [CNBC. Inflation rises 8.6% in May from a year ago, higher than expectations. (Accessed June 14, 2022).

The other supply side challenges we confront today are driven not by politics primarily but by market dynamics—although the efforts to isolate Russia will make the supply chain issues more challenging. At base, however, the supply chain challenges are result of the inevitable unevenness in opening the global economy after the pandemic induced closures—and will certainly over time lessen as the market signal and business incentives are aligned to resolve the supply issue, although not as quickly as some observers had hoped when they described inflation as 'transitory'.

[Ferguson, R. Stagflation: Real Threat or Imagined?. (Accessed June 14, 2022)].

- Unemployment Situation: "In May, the unemployment rate was 3.6 percent for the third month in a row, and the number of

unemployed persons was essentially unchanged at 6.0 million" [U.S. Bureau of Labor Statistics. THE EMPLOYMENT SITUATION — MAY 2022. (Accessed June 14, 2022)].

However, we face one supply side concern that was not present in the 1965-1982 period. Namely, we have an unexpected decline in labor force participation at the same time as these other supply constraints, which is driving up wages and overall compensation in numerous jobs, from blue collar work to Wall Street bonuses. The labor force challenge, and the possibility of a spiraling of wages and prices ever higher, must be a major concern for the Fed.

[Ferguson. Supra].

- Recession: A recession is defined as "a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters" [Oxford Languages. Recession. (Accessed June 14, 2022)].

Real gross domestic product (GDP) decreased at an annual rate of 1.5 percent in the first quarter of 2022, following an increase of 6.9 percent in the fourth quarter of 2021. The decrease was revised down 0.1 percentage point from the "advance" estimate released in April. In the first quarter, there was a resurgence of COVID-19 cases from the Omicron variant and decreases in government pandemic assistance payments.

[U.S. Bureau of Economic Analysis. Gross Domestic Product. (Accessed June 14, 2022)].

While presently, by definition, the U.S. is not in a recession, serious caution must be exercised by the Federal Reserve in utilizing any restrictive monetary policy so several as not to stunt economic growth.

The Current Status of U.S. Monetary Policy, Administration Actions and Federal Reserve Credibility

Current Status of U.S. Monetary Policy

Turning specifically to the Fed, the May 4, 2022 FOMC statement first observes:

Although overall economic activity edged down in the first quarter, household spending and business fixed investment remained strong. Job gains have been robust in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

[Board of Governors of the Federal Reserve System. Federal Reserve issues FOMC statement. (Accessed June 14, 2022)].

And with regard to Fed action:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in conjunction with this statement.

[Id].

The Administration

Both fiscal and monetary policy were in stimulative mode from the early 1960s through most of the 1970s. This reflected a governmental desire to procure a lower rate of unemployment by allowing inflation to rise.

We similarly today have had a period of stimulative fiscal and monetary policy. However, there is an important difference, which is that fiscal stimulus is quickly reversing as the emergency measures from the fight against the COVID-induced recession is unwound and as President Joe Biden is forced to limit his policy aspirations by a Congress that is less inclined to spend. Monetary policy is certainly likely to become less stimulative....

[Ferguson. Supra].

Some additional background history must be remembered. In the waning years of the Trump Administration stimulative spending occurred as a result of the ongoing Corona virus pandemic. This spending spilled over to the Biden Administration. However, Biden's policy aspirations for America caused additional spending, and would cause additional spending if it remain unchecked. Economics 101 teaches us that adding to an already 'hot' (inflationary) economy fuels additional inflation. (Maybe President Biden did not study Economics - or slept through class that day). Nonetheless, the current political climate has checked the Biden Administrations rampant spending.

Credibility of the Fed

Finally, the long period of upward price movements accommodated by the Fed in the 1960s and 1970s is widely seen today to have reduced the Fed’s credibility during that period and increased inflation expectations among business leaders and workers alike, creating a condition in which a wage-price spiral emerged. Today, most fair observers recognize that the Fed maintains ample credibility, although many would argue that the credibility must be reinforced by an effective response to the recent sharp rise in measured inflation.

[Id].

Final Thoughts

As demonstrated above, there are many similarities between the economic conditions present in the period 1965 through 1982 and those present in today's economy.

Given the similarities and differences between the 1965-1982 period and now, the recent fear of stagflation is legitimate, but seems overstated. The Fed, the economics profession, and the population in general have all learned much from that experience of the 1960s and 1970s and the painful recession that it took to eradicate inflationary pressures that had built over many years. Even the challenges that are like those we faced in the earlier episode of stagflation—oil market dynamics—are not as severe.

[Id].

It is true that the Fed is presently challenged with hard decisions to address the current economic malaise. But by recognizing the similarities and differences between the present situation and 'The Great Inflation' of the 1970s and early 1980s, and by paying homage to the relevant history surrounding that period, the Fed can hopefully gain instructive insight in forming appropriate responsive policy. With this hope in hand, we should be able to avert being condemned to relive the past economic pain associated with recovery from 'The Great Inflation' and stagflation.

In this author's humble opinion, a recession is inevitable given the current economic climate. But if the Biden Administration can be restrained from excessive spending and the Fed's restrictive interest rate manipulation quickly addresses inflation, the recession we face will not be as painful as the recession of 1980 - 1982. If the lessons of the 1970s are heeded, double digit interest rates may be unnecessary to quell inflation and the inevitable recession might not be that deep historically.

[AUTHOR'S NOTE: This article is the culmination of many hours of research into this topic. I hope you enjoyed reading it as much as I enjoyed writing it. And I wish to extend my thanks to the writers of all the scholarly articles employed in the preparation of this work].