Since the WLEO launch, I've been spending on a lot of time on the Uniswap platform. Using different aspects of it, learning about the different projects leveraging it and more recently; reading about the future of Uniswap in a macro sense.

Uniswap is an incredibly interesting platform. It has shaken up the entire crypto space as it leads the change from CEXes to DEXes - Centralized Exchanges to Decentralized Exchanges.

Centralized Exchanges have already started taking drastic measures to try and take back some of the volume and liquidity that Uniswap and other DEXes have drawn out of their platforms. Almost every major CEX - including Binance - have recently launched some form of "Yield Farming" "DeFi" "insert_buzzword" aspect into their exchange.

Some of the dumb money seems to be flowing toward these projects, but the smart money (and the vast majority of capital) remains in the true DeFi protocols. Open source platforms that aren't built on the back of a centralized corporate entity.

Recently, I talked to a relatively large Centralized Exchange about listing WLEO. While I'm not completely against the idea of listing with an exchange like that - as it would provide a great deal of liquidity, volume and legitimacy to our project - I have started to realize just how impactful the DEX movement is on this crypto world.

Wash trading and market manipulation is far from new in the crypto space, but I got in contact with some pretty well-known people in the space recently and I asked their advice about listing WLEO with a CEX.

Most of them had an answer resembling the same underlying idea:

Listing on a CEX is no longer worth it. All they offer you is fake volume and "market making"

The exchange that I won't name offered to list WLEO for 1-2 BTC. Their listing "packages" ranged in price based on the type of "market making" we wanted for WLEO.

I pushed back a bit as they provided more details. Trying to fish out more about what they were selling. These exchanges will do just about anything to encourage you to list with them. Including - but not limited to - offering you fake market making.

The DEX movement is making them very desperate.

Uniswap V3 and The Future of Crypto Trading

A lot of the advice I got surrounding future steps for WLEO was to focus on Uniswap. Focus on driving volume and liquidity to the decentralized exchange that has become the powerhouse of crypto trading. While listing on a CEX is not totally out of the question - they are absolutely right.

DEXes offer a lot of things that CEXes can't.

The major complaint I see about trading on Uniswap are the fees and the complex structure of trading. People are accustomed to trading on orderbooks the whole LP structure is confusing to many people.

Additionally, paying $3 - $30 to make a single trade can make it hard for people to actively be involved in different trading pairs.. especially when they're not using thousands of $ per trade.

Uniswap V3 is said to be around the corner - although, we'll have to wait on the edge of our seats for an official release date - and will aim to solve many of these issues and more.

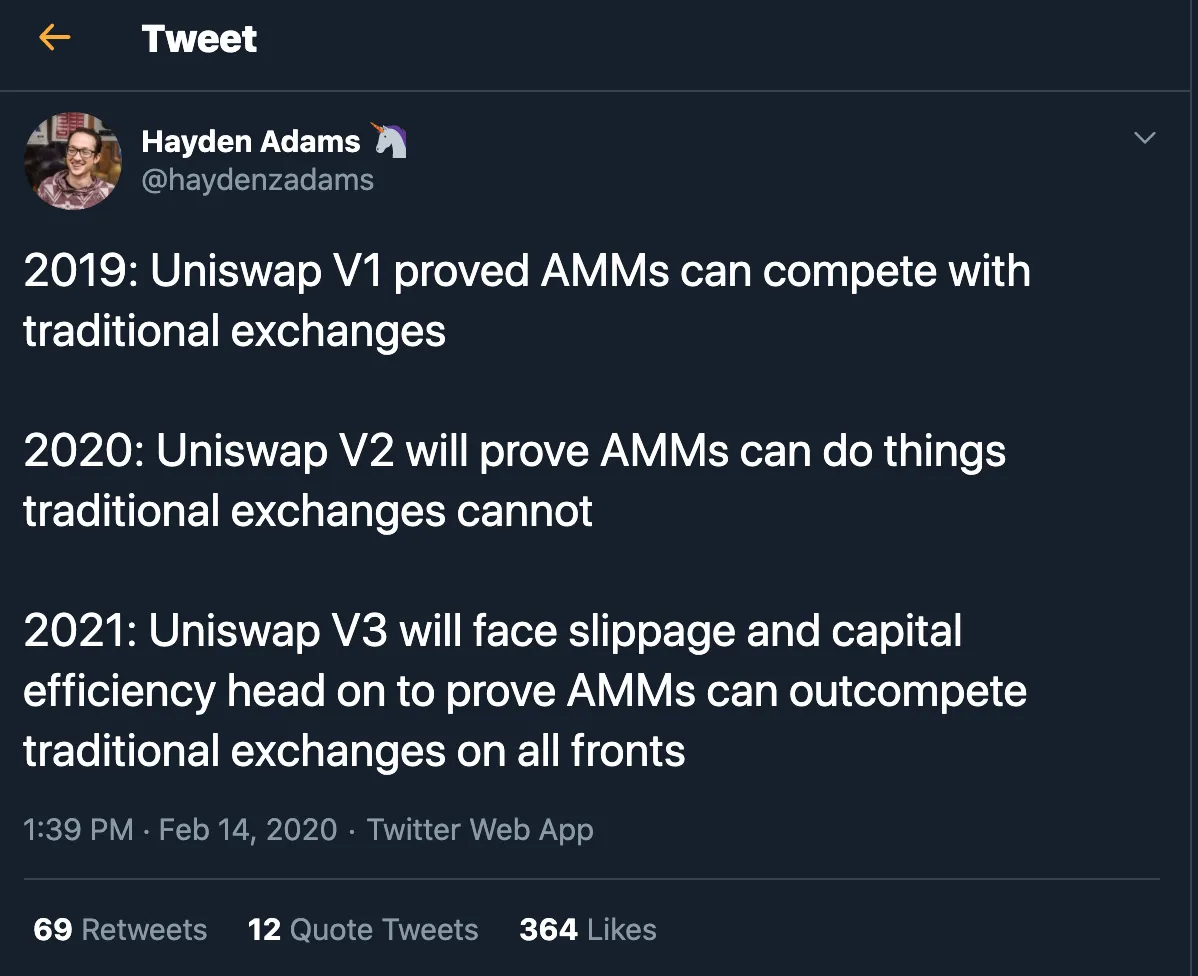

The founder of Uniswap tweeted this out back in February and talked about the broader vision of Uniswap and what the major versions accomplished in the past and will accomplish in the future.

In a couple of other Twitter threads and resources about the miscellaneous mentions of Uniswap V3, you can find a lot of info about these updates. One thing that we might also see in V3 is the inclusion of Optimistic Rollups.

I won't go into the technical details of all the things I've heard about - especially since we still don't know exactly what is and isn't true about V3 - but I will say that if V3 addresses the high gas fees, slippage and other inefficiencies that are present in V2, the CEXes will be in major trouble.

In my opinion, the only thing keeping CEXes in business are:

- Ease of Use

- Lower Fees

As time goes on, I think the CEXes will continue to lose more and more business to protocols like Uniswap. We're still in the very nascent stages of what's possible with AMMs (automated market makers) and the more I use Uniswap, the more bullish I become about this DEX narrative. It's a true revolution - an imperfect one, but a revolution nonetheless.