Ethereum - the world's second largest crypto - was down 22% in August, which is the worst monthly performance it's had since Terra collapsed in June 2022 (it went down 45% that month). For contrast, Bitcoin went down 8% in August.

While I'm not one for short-term market predictions, the short-term can often give us a lens into the long-term. Many are eying this lackluster ETH performance and wondering if the network is dying. There are a few reasons people are citing for this and as someone who holds a significant amount of ETH and has for years, I wanted to dive into their perspective to see the other side.

ETH's Lackluster Price Performance in 2024

In 2024, ETH is basically unchanged. Starting the year at about $2,300 and currently sitting at $2,400.

Meanwhile, Bitcoin (chart below) started the year at $44k and is currently at $57,416 (up 30% year-to-date).

This lackluster performance from ETH relative to BTC has some people worried. While many of us who have been in the industry for several cycles (I've been invested in this industry for the past 9 years) are accustomed to the BTC Dominance increasing before "alt season" arrives, the price of ETH has some people wondering about other fundamentals related to the ecosystem.

We'll dive into those factors below. Again, being someone who's bullish on ETH in the long-run, I will need to set aside my personal biases and try to see the other side of things.

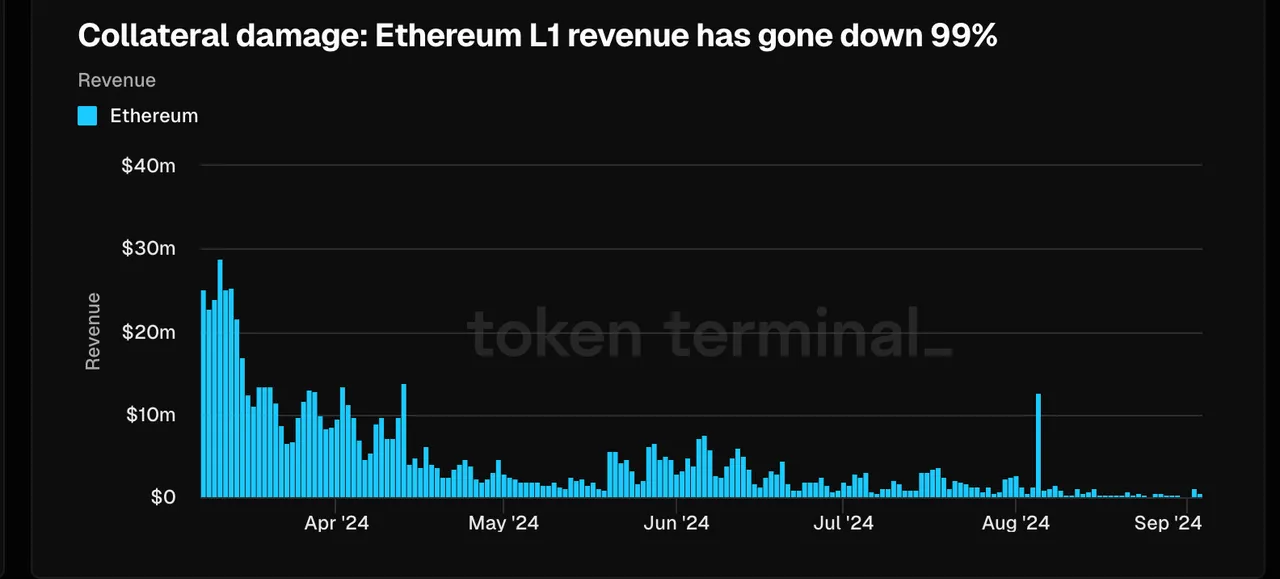

Ethereum L1 Revenue Down 99%

Following the Dencun upgrade in March 2024, ETH L1 fee revenue has plummeted. At the beginning of this year, there was a lot of excitement about ETH's ability to generate fee revenue and essentially be "deflationary" because the fee revenue surpassed the expected inflation rate on the network.

Dencun introduced a few new features to the chain including proto-danksharding which allowed for cheaper L2 transaction data to be stored/retrieved from Ethereum.

This ultimately became a net positive for ETH L2's but a net negative for ETH L1 Fee Revenue - since it made it cheaper for L2's to operate.

You can see a dramatic increase in L2 activity, a reduction in L1 fees and the obvious impact being a reduction in L1 Fee Revenue.

While L1 Fee Revenue is an important narrative for Ethereum, I was never convinced that it was the entire value proposition.

That being said, nobody wants to see a 99% decline in revenue from any company, protocol or ecosystem. That's happened on Ethereum and it's become a focal point for people when they make bearish cases about the ETH price.

We have to remember that crypto is still a nascent industry and runs largely on wild sentiments. The volatility in crypto both from a price and from a sentiment perspective is not for the weak.

In a future post, I'll explore ways this L1 revenue problem can be solved. But continuing to look at it from the bearish case side of things - this doesn't look good for ETH and until it's fixed, it will continue to be a great "I told you so" for the bears.

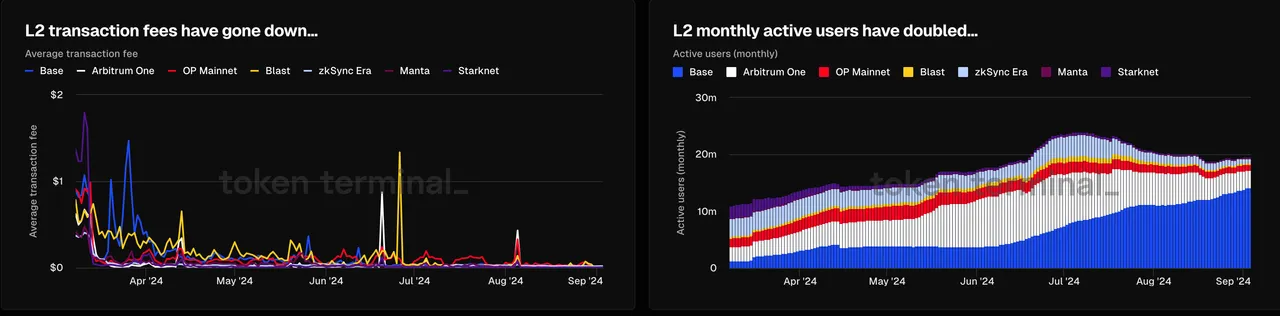

L2 Activity Up, L1 Activity Down

L2's are gaining more traction and many cite this as a reason for less activity on the L1 which ultimately leads to less revenue for ETH itself.

According to L2Beat, activity on Layer 2s like Arbitrum, Optimism, and Base, has been trending upwards and is now near a record. Value locked sits at $33 billion, which might be down from its $48 billion June peak, but is still three times higher than just a year ago.

The question is: are L2's ultimately a net positive or net negative for the L1 and future revenues. I personally believe that they can be a net positive in the long-run, but tend to agree with Nolan (quote below) that it is a momentary cannibalization and we could see them be a source of growth in future revenues:

Nolan called this “a momentary cannibalization” with the future bringing a distinctive split in segments. L1s will be for high value transactions such as institutional transactions and critical infrastructure demand, whereas L2s will become low value, but time sensitive. He highlighted mass-market applications and interoperability solutions.

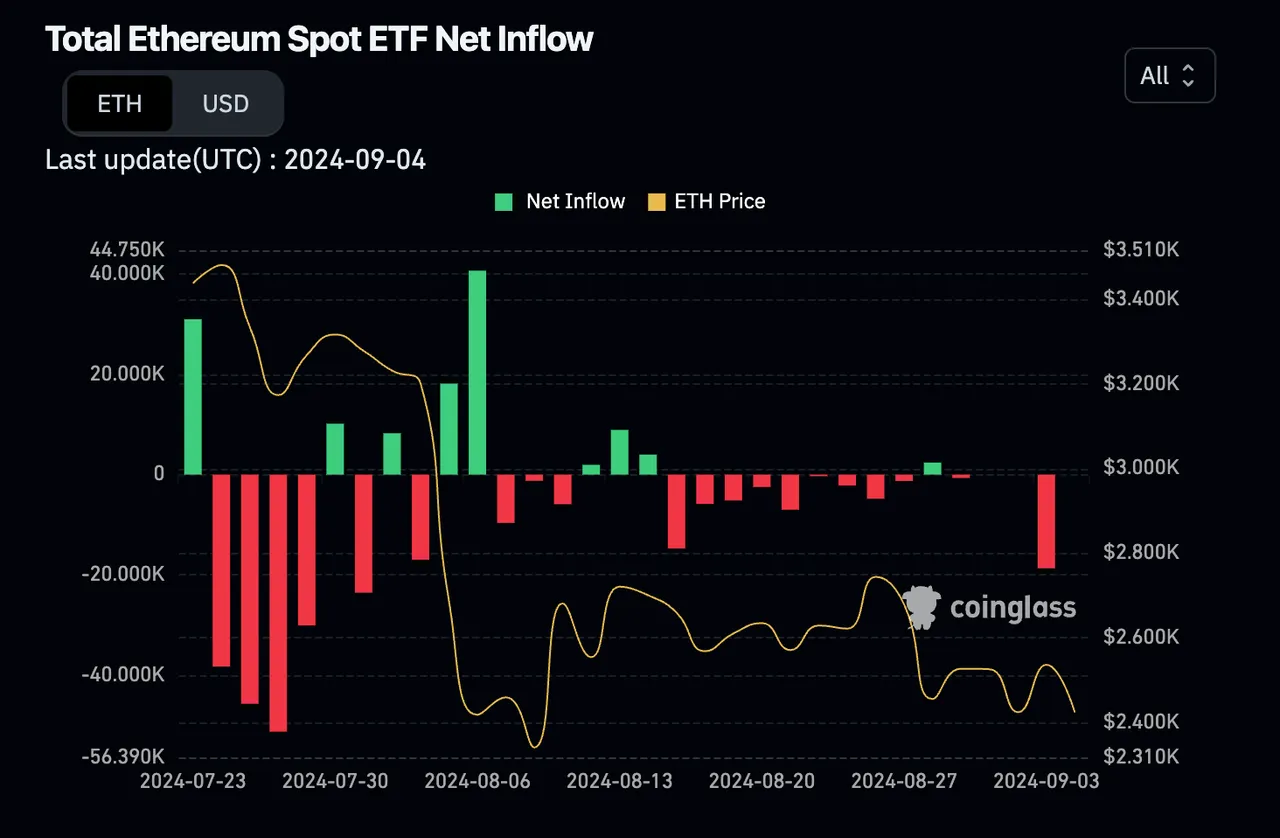

Ethereum ETF Outflows

Via Coinglass

This has been the year of ETFs. The BTC ETF brought a lot of attention to the industry and hopes that the ETH ETF could play out the same - bringing massive institution capital to Ethereum.

That hasn't quite played out. I think this could have been predicted with relative ease. Institutions look at Bitcoin as the "Gold of crypto".. Many still won't touch it but out of those who will, it's the only thing they will touch.

“On a net basis, the ETFs have seen outflows of almost half a billion dollars since inception, which is pretty disappointing and has definitely dampened sentiment,” Nolan said.

These numbers contrast to what happened with the launch of Bitcoin ETFs, which have seen surging interest from investors since they began trading on Jan. 11, 2024.

Ethereum has far less staying power than Bitcoin. Even as someone who holds a lot of ETH, I will freely admit that. That being said, we will always see risk rotation in any marketplace. Along with that, institutional grade investors understand economics and some understand technology as well. I don't think it's wild to predict that as a new Bitcoin bull cycle starts to take place, some institutional capital will rotate into ETH.

I could see large funds having some sort of split between BTC & ETH to have dual exposure. As BTC's market cap rises, ETH becomes a lower cap (relatively speaking) play and that can be attractive to many different investors in the TradFi markets.

Conclusion

To wrap this all up, ETH hasn't performed well this year and the L1 revenue is concerning a lot of people. The growth of L2's is not stopping any time soon and many believe that Ethereum could get unseated as the most popular destination for various forms of capital in the space.

All of that being said, Ethereum is still the "gold standard" of altcoins. I believe that the Ethereum blockchain is still one of the best places for development in the space. I also think that ETH's economic value is far different than just L1 fees.

Until the day that ETH Core stops developing and more importantly; the community stops developing, I believe ETH will be an incredibly valuable asset in the space and rise with the whole industry.

There is so much happening on Ethereum and at the end of the day, there is no second best Smart Contract layer to run complex financial (and other) applications. Ethereum has solidified it's place as the most valuable place to build with the most capital looking for homes. I don't see that changing any time soon.

In the meantime, we could see more negative sentiment and more pain. I am a buyer while this blood is in the streets.