The LEO token has been the central token in the LEO Ecosystem for 6 years now. We had our 6 year anniversary this month on July 3rd - wild! Over these 6 years, the LEO Team has continue to build bleeding edge technologies for the crypto industry. Recently, we completely revamped our LEO tokenomics to make LEO:

- Deflationary

- Buybacks-driven

- 0 Inflation

- Max Supply cap set to 30M tokens

- Natively on Arbitrum Network

In this post, I'll explore some of the reasons LEO has been performing so well and why I believe (NFA) it will continue to do so.

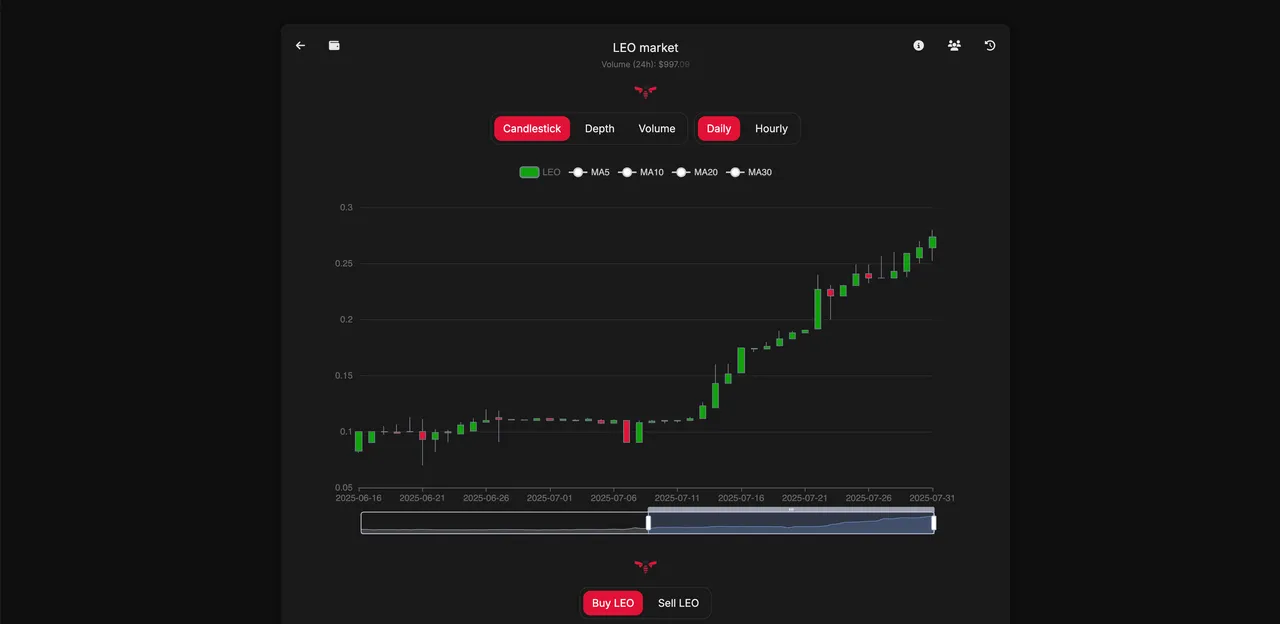

What is LeoDex's LEO Token and Why is It Performing Well?

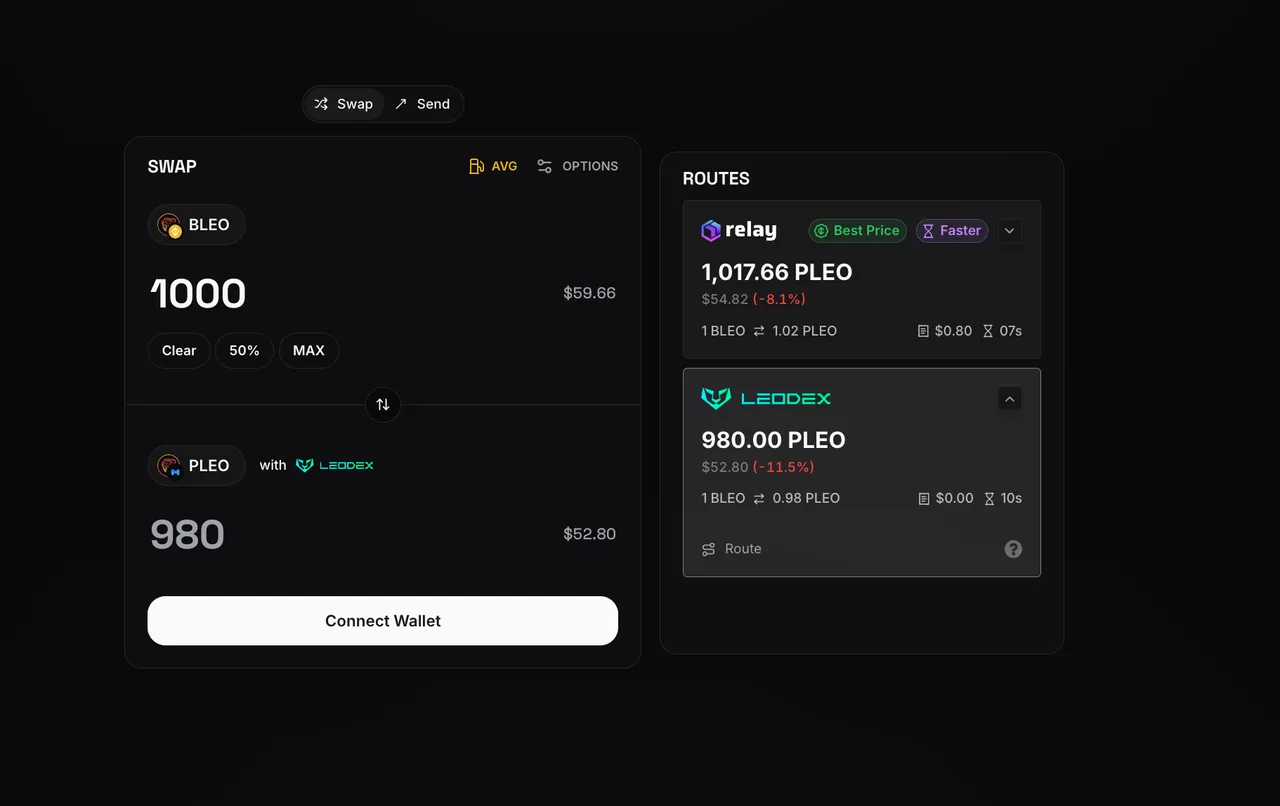

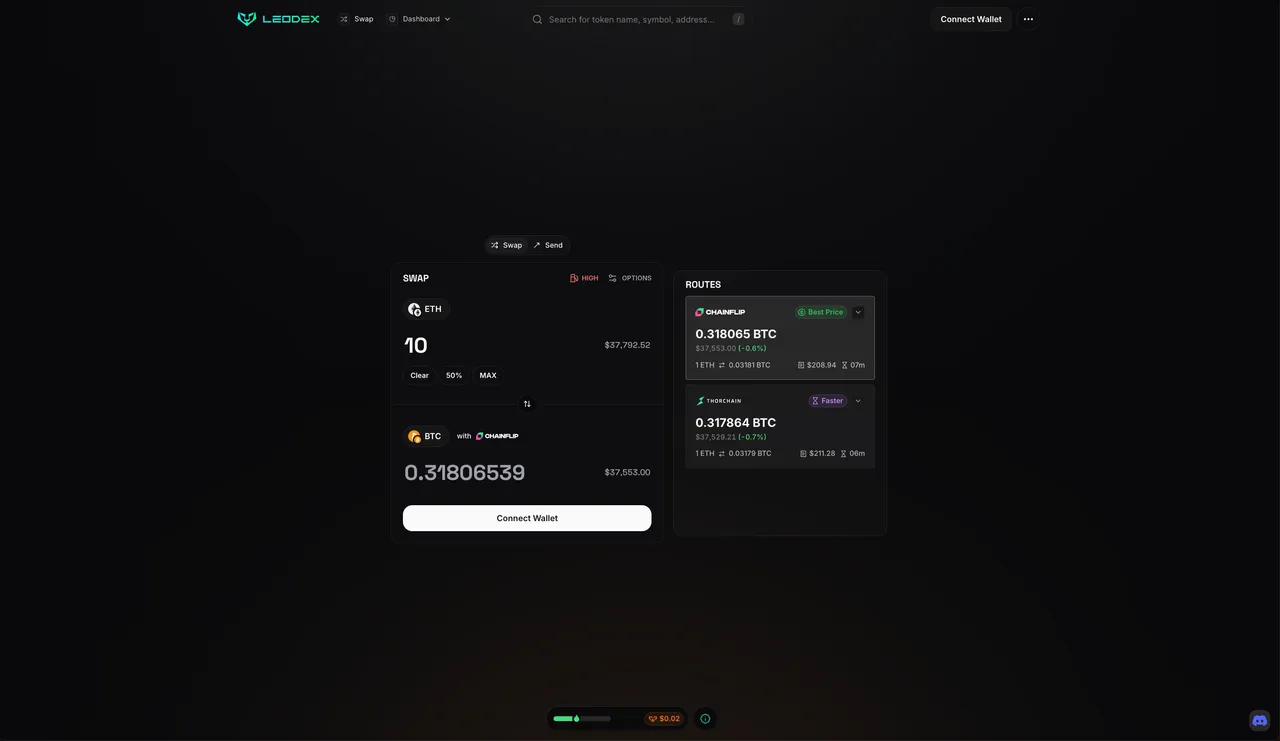

The LEO token is at the heart of the LEO economy. Our team and community dreams up big ideas and works hard to achieve them. In April of 2025 for example, we set out to build the #1 cross-chain DEX Web App called LeoDex. Just a few months in and we are already the #1 DEX Web App for Maya and we are climbing the ranks of THORChain - becoming a top #10 Web App for THORChain in recent weeks. We are growing our influence in these ecosystems and plan to continue to expand our support to other cross-chain communities and trading protocols.

As part of our LEO 2.0 changes, LEO has migrated to the Arbitrum blockchain. The native version of LEO lives on Arbitrum while we have wrapped versions that are operated by Protocol-Owned Oracles. These Oracles allow users to bridge between blockchains and pay a small fee. 100% of the fee revenue burns LEO, creating deflationary pressure.

- LEO is natively on Arbitrum blockchain

- bLEO is on BSC

- pLEO is on Polygon

- heLEO is on Hive Engine

All 4 versions of LEO are fungible and can be seamlessly converted between each other using the oracle bridges. This generates fee revenue each month, which creates deflationary pressure on the LEO supply.

LeoDex

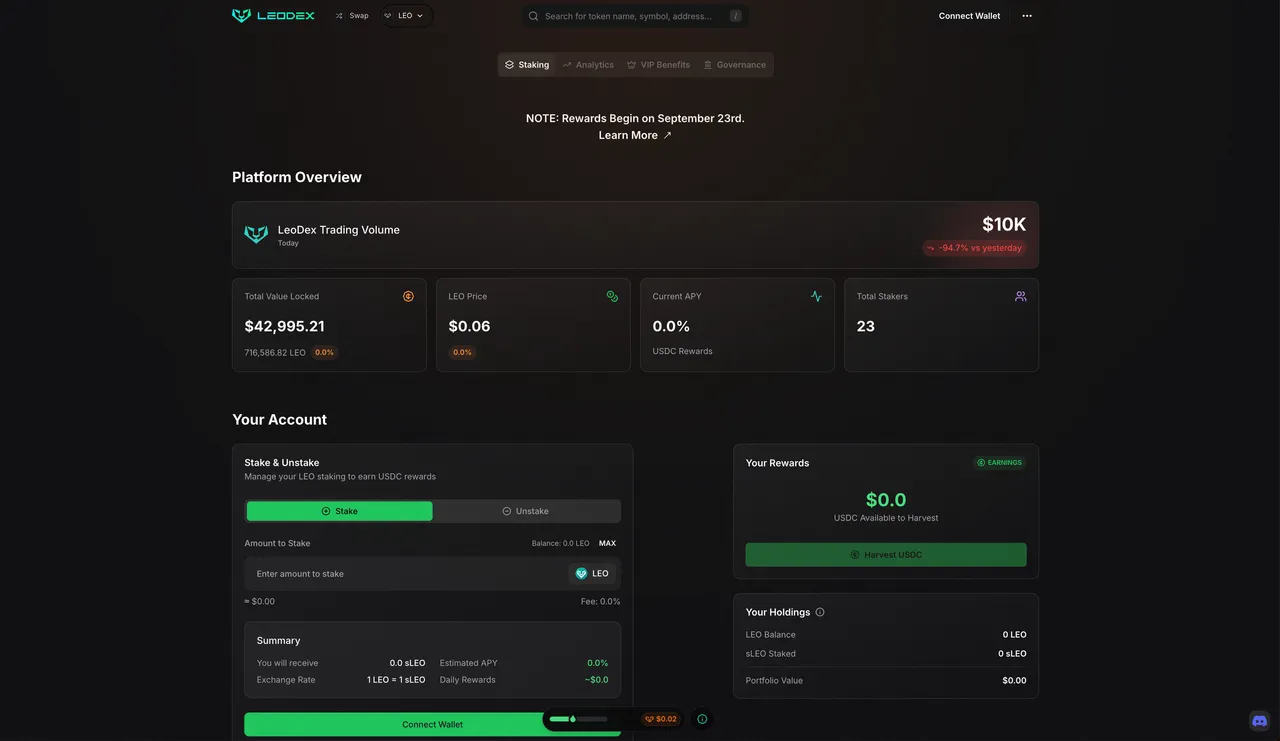

https://LeoDex.io is already driving massive revenue into the LEO Token Economy. Until September 23rd, 100% of LeoDex Affiliate Fee revenue is buying back the LEO token. After September 23rd, 100% of affiliate fee revenue will flow directly to users who stake LEO as sLEO. sLEO stakers received daily USDC payouts (on Arbitrum). This increases the utility of the LEO token and expands our potential holder base exponentially.

LeoDex's daily USDC payouts to sLEO stakers begins on September 23rd. Simply use https://leodex.io/leo to stake your LEO and start harvesting USDC each day. The USDC is entirely based on LeoDex Volume. Every day, swappers use LeoDex and pay affiliate fees. These fees flow directly to the sLEO contract to be split and claimed on a stake-weighted basis between all LEO stakers.

INLEO

INLEO is our Web3 social media app that allows users to Thread, Blog and Create Shorts directly on the blockchain. INLEO is a gathering place for our community and also stands out as the first Web3 platform to launch Microblogging at scale directly on a blockchain. We've started to introduce incredibly powerful AI tools and Agents and believe that INLEO will become a bleeding edge driver of AI in Web3. Our LLM model is being trained on all the data on INLEO and the underlying Hive Blockchain. This model will create radically new tools to enhance the Web3 experience while driving revenue directly to the LEO token.

As a key part of LEO 2.0, the INLEO Platform got rid of its inflationary rewards pool. Now, authors earn LEO from what we call "SIRP".

SIRP stands for System Income Rewards Pool. This Rewards Pool is entirely created by buybacks of the LEO token. Every day, the @leopool account buys LEO tokens off the market and then sends them to the SIRP account (@leo.tokens). Then, the SIRP account pays authors/curators on the INLEO platform with those LEO tokens. The buyback revenue comes from:

- INLEO Premium (a $10/mo premium subscription for advanced features on INLEO)

- Creator Subscriptions (a $5/mo substack-like feature for P2P subscriptions)

- Beneficiaries for authors to the INLEO Platform

- LeoAds (in the future)

- LeoAI (VerySoon)

- @leo.voter revenue

This model has been a core driver of the economically positive impacts we're seeing on the LEO token today.

AI

AI is undeniably going to reshape the entire landscape of... everything. The LEO team has been doing deep RnD on AI for the past 2-3 years. We've already launched various AI Projects and have more on the way. We believe AI will be a core driver of future revenue and value capture to the LEO Token.

One of the cornerstone developments has been the release of AI Agent Assistants. These Agents are live on INLEO today and can help you with various tasks.

- @leo.alerts reports on the real-time buybacks happening on both the INLEO SIRP and LeoDex POL

- @leo.alerts publishes weekly and monthly reports on buybacks and LEO tokenomics

- @askrafiki (currently offline awaiting V2 release) is a powerful chatbot that can answer any question directly onchain. The V2 release will include our new Vector Database solution. This means that Rafiki will be trained on all the data on the Hive blockchain (LeoAI LLM)

- ProjectW is our next AI Agent that will be accessible to INLEO Premium Subscribers only. This new agent will actually complete tasks for you - like setting a Hive Engine trade by simply writing a Thread on INLEO asking it to "buy 10 LEO at $0.06" (for example)

- Many more

We've got a lot of Agents and various AI Projects that are in the works. All are aimed at driving revenue back to the LEO token.

The Future of the LEO Token Economy

We are headed in a very interesting direction. Inflation from the Rewards Pool was eating away economic value from LEO. Now, LEO is setup to absorb economic value relentlessly. We are seeing the effects of this already. The float of LEO is very tiny (majority is staked/locked/held by diamond hands). Many people are unwilling to sell their LEO at these prices as they know everything our team and community are building.

As always, our team is on the bleeding edge of converging technologies:

- Cross-chain DEX trading

- Web3 Social Media

- AI

The LEO token was always demolished in price because of poor tokenomics. With LEO 2.0, we made LEO:

- Deflationary

- Buybacks-driven

- 0 Inflation

- Max Supply cap set to 30M tokens

- Natively on Arbitrum Network

These changes completely fixed and reshaped our economy. We are now setup to actually benefit from all the hard work we put in to driving revenue and economic value to LEO.

As a team, we feel completely aligned. Our mission is so simple: drive economic value to LEO. We wake up every day and we make the best products we can possibly make and all of the products we make drive value back to the core token.

You can trade LEO in various places:

- LEO on https://leodex.io

- pLEO on https://leodex.io

- bLEO on https://leodex.io

- heLEO on BeeSwap

You can track LEO (Arbitrum) staking and USDC harvests on https://leodex.io/leo and prepare to stake for the September 23rd release of USDC Harvests.