Summary

- The pest market control industry is forecasted to grow 5.2% CAGR by 2025.

- Rollins price multiplied 20 times in the last two decades.

- Bullish flag points to trend’s continuation.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

Bugs are a great pest in Colorado. They come out of the Earth, infest the wooden walls, and cannot be got read off by any amount of cleanliness. Many careful housewives take their beds to pieces every week and put carbolic acid on them. - Isabella Bird

No need for such extreme measures as using carbolic acid to get read of pest - Rollins (NYSE:ROL) wrote history in the pest control market, in the last two decades, expanding globally at a fabulous pace. Investors rewarded the visionary management as shares multiplied 20 times since 2000. The 2008 financial crisis is barely visible on the Rollins chart. The rally so far is nothing short than amazing - but is there room for more?

According to a report by Allied Market Research, the global pest control market is about to grow at a 5.2% CAGR until 2025, expected to reach $27.6 billion. The demand is mainly driven by the agricultural sector in countries like Brazil, China, or Russia. Also, climate change leading to a rise in temperatures leads to an increasing pest population - good business for pest control companies like Rollins.

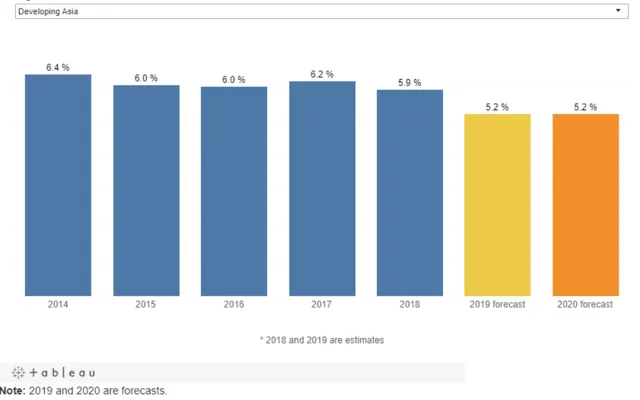

A recent Lead-Lag Report I wrote mentioned that the growth in developing economies in Asia continues to weaken. According to the Asian Development bank, the growth in these economies will dip to 5.2% in 2019 and 2020.

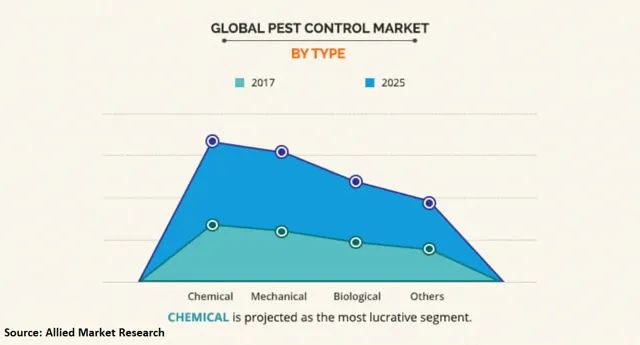

But that's unlikely to affect Rollins. In fact, Asia-Pacific is expected to be the fastest-growing region for Rollins, as the pest control market expands in China, India, and other emerging economies. All segments are expected to increase by 2025, with a plus in the chemical sector.

Obviously, competition is aware of the trend. Companies like BASF (OTCQX:BASFY), Syngenta (OTC:SYENF), Rentokil Initial (OTCPK:RKLIF) or Bayer (OTCPK:BAYZF) compete on the same markets, invest new products, (e.g., BASF Seclira WG - a colorless, multisector insecticide recently approved in Australia) in a sector where mergers and acquisitions are the norms (e.g., Rentokil Initial acquiring Vector Disease Acquisition).

But Rollins executed the management plan accordingly so far. This is a company posting almost 90% three-year-average growth operating income and pays a yearly annual dividend that grew 3.82% per year in the last three years.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.