This week has kicked off with a bang as the growth of the LEO Token Economy expands. In this post, we'll talk about the upcoming Collateralized Lending feature for LEO, HIVE Aggregation Technology (HAT) and the expansion of LeoDex.

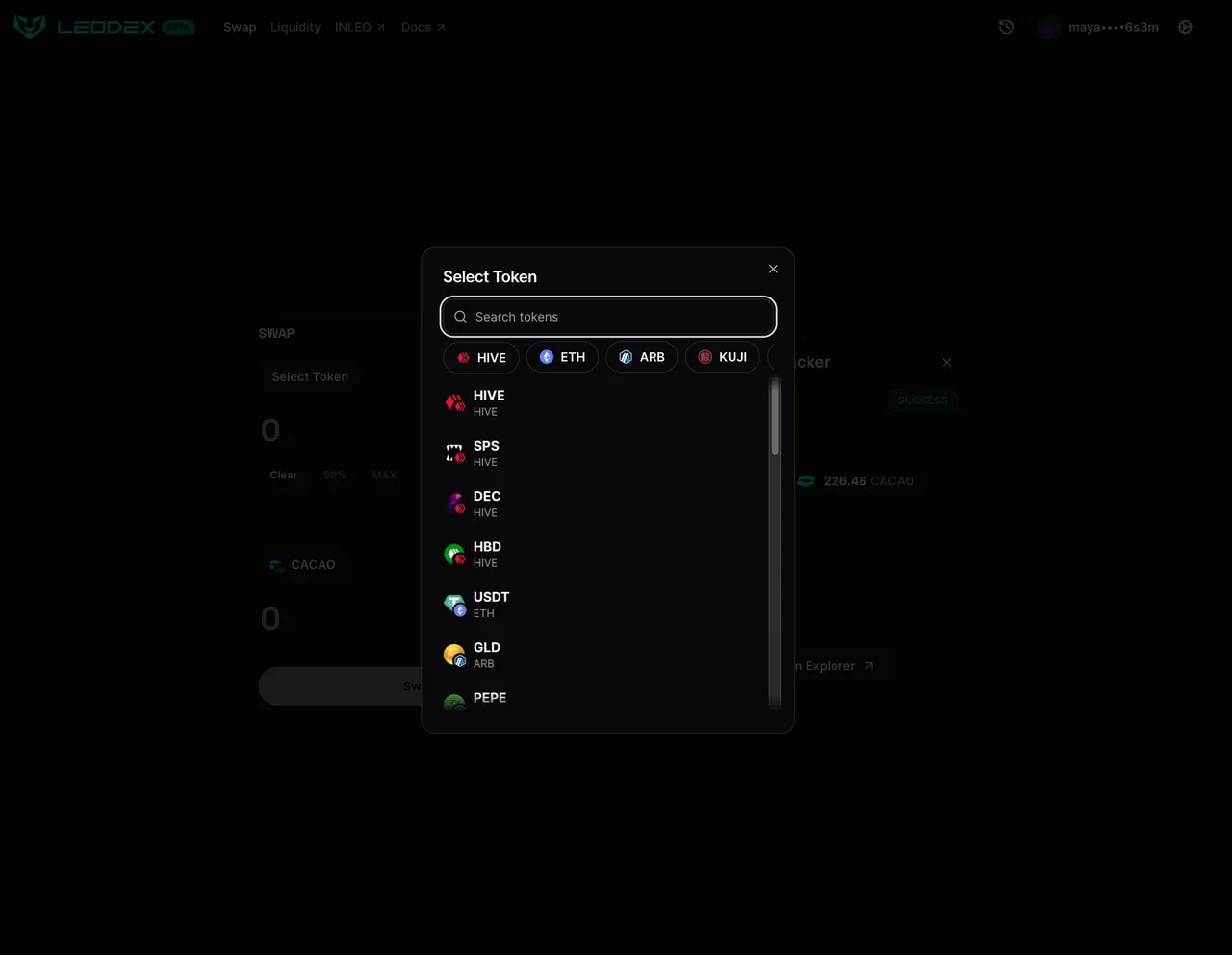

HIVE, HBD, SPS & DEC Now Available For L1 Trading on Maya Protocol - https://leodex.io

Collateralized Lending for LEO

We've been working hard on growing the presence of LEO & HIVE within the Maya Protocol ecosystem. This also extends to Thorchain and ChainFlip.

All 3 of these ecosystems are cross-chain platforms. They are focused on decentralizing liquidity, trading and ultimately: destroying the chokehold that CEXes have on the crypto space at large.

I am a firm believer in this mission and it is a door that I've been knocking on for years now. I believe it's extremely important for the decentralization and health of any crypto ecosystem to grow its presence on decentralized exchange rails.

Look no further than the Steem Hostile Takeover event or the FTX Implosion to find myriad reasons why you cannot rely on centralized exchanges. It's not a matter of if they will hurt you... but when.

This is why I've spent so much time, energy and resources to build the Hive Aggregation Technology that brings HIVE to the world of L1 DEXes. More on this later.

Collateralized Lending

If you are familiar with crypto collateralized lending, then this subject will be pretty easy to grasp. We've been talking about adding the ability to take collateralized loans on the LEO token for a long time. I always had it slated on the long-term roadmap.

That being said, it's a rather complex piece of financial technology and requires a ton of workload and ongoing maintenance. Not to mention protocol risks, etc.

ICYMI: I was on the Maya Protocol space speaking for a short period of time alongside the founder of Maya and their team. The subject of the X Space was talking about the new Collateralized Lending feature.

Toward the end of the space, I asked a few questions about collateralized loans and we also dug into the details of LEO specifically as an asset for collateralized lending.

When collateralized lending goes live on Maya, LEO will be one of the assets available to collateralize for a loan.

So now we've solved the problem of launching lending without actually having to launch lending. Perhaps this shows you why I value being at the cross-section of projects like Maya Protocol. We benefit from the adjacent development of other teams that are hard-charging in the space.

As Maya grows, LEO grows. As Hive grows, LEO grows. A rising tide raises all ships.

How Does It Work?

The feature isn't live on Maya (yet) but when it does go live, the gist of it is this:

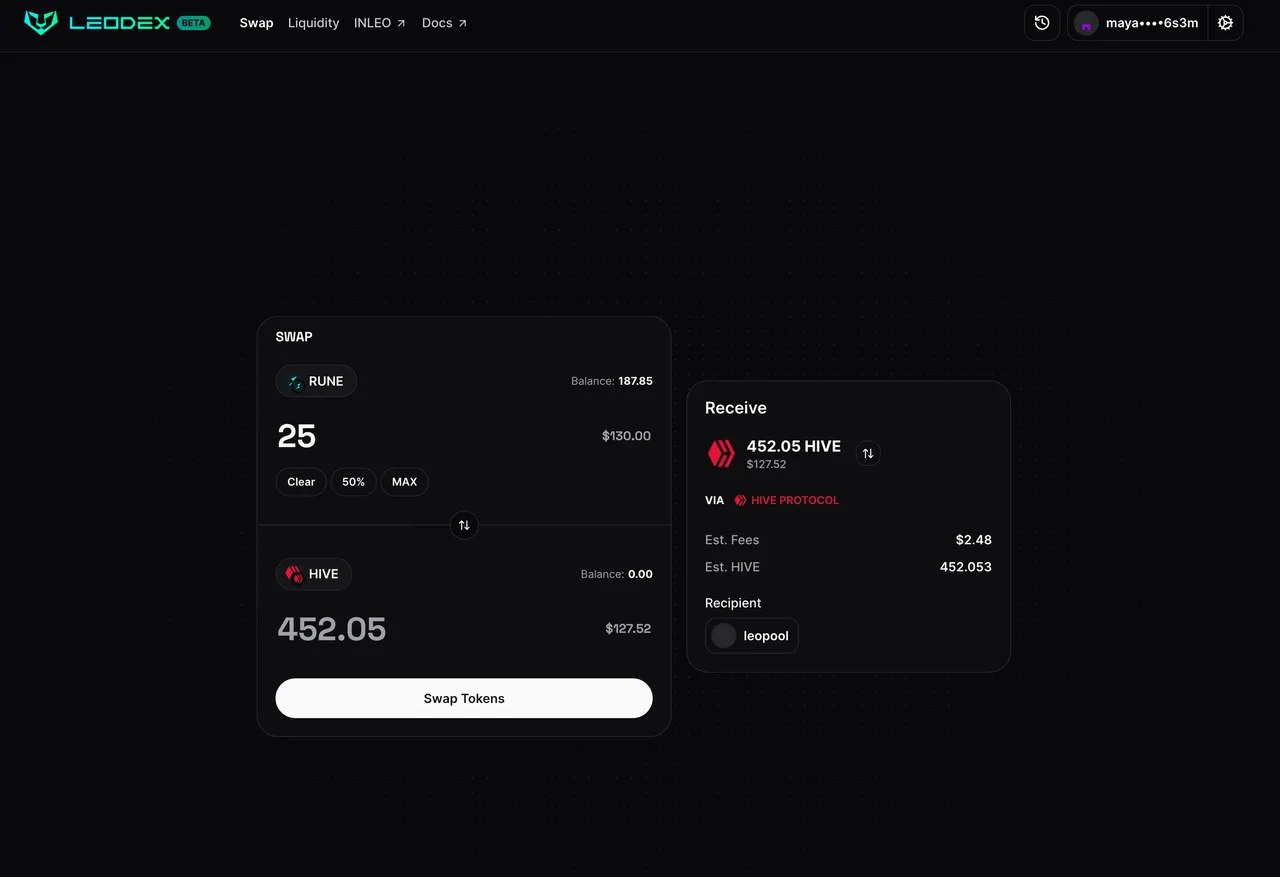

You'll be able to collateralize your LEO on the Maya Protocol, take out a stablecoin loan against it and then pay it back at any point in the future.

The loan will be backed by your LEO tokens that you put up as collateral. A variable interest rate will be charged on the loan. That interest will get paid to Liquidity Providers in the LEO:CACAO pool.

One of the fascinating parts of this design from the Maya team is that it actually builds more incentives for being a LEO:CACAO liquidity provider.

This is extremely important because it leads to more potential liquidity in the LP... which means that HIVE Aggregated Swaps also have more potential (in terms of lower slippage and larger trades).

Hive Aggregation Technology

When Collateralized Lending goes live, we'll continue to do deep dives into the economics of it and how it works. The fundamental premise for all of this is that our aim is to grow the HIVE trading volume that is happening on Decentralized Exchanges.

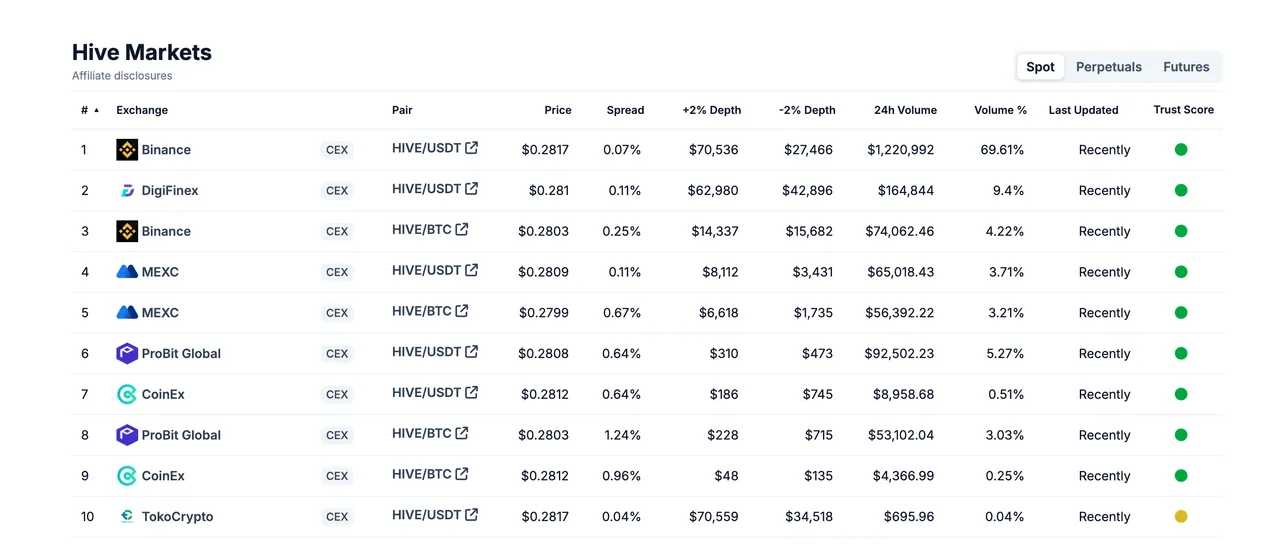

This has been my goal for a very long time. I am firmly against Centralized Exchanges and believe that while they have a place in the crypto space, they should not be the top dog who control all the inflows and outflows.

Right now, HIVE is like many other assets where 90% or more of the trading volume is happening on CEXes. Even BTC and other assets still have a large % of their trading volume happening on CEXes.

My goal is to slowly see more of this trading volume move to decentralized platforms like Maya, Thorchain and ChainFlip.

In order to do this, we built HAT - which allows HIVE, HBD and Hive L2 assets to be instantly tradable across Maya Protocol (and soon, Thorchain & ChainFlip as well).

The technology continues to improve and as the liquidity for LEO-CACAO grows, the ability to do larger HIVE, HBD and HIVE L2 asset swaps will be improved as well (from a slippage perspective).

More Features on LeoDex and Leveraging it to Grow Hive

Our goal with LeoDex is two-fold:

- Grow our (LEO & HIVE)'s presence on Multi-Chain DEXes in terms of trading volume and investors

- Grow our (LEO & HIVE)'s monthly active user base

LeoDex achieves #1 with the capabilities to trade LEO, HIVE, HBD and Hive L2 assets directly on Maya Protocol with our Hive Aggregation Technology.

Our goal is to continue to scale this up and attract more users and investors to the Hive ecosystem by being the connection point to the world of cross-chain DEXes.

The second goal is achieved by educating these users about what INLEO is and why having a Hive account is a valuable thing.

Something to keep in mind is that this group of users is highly motivated by APRs and investments. They are financially-focused.

This means that we have the ability to attract them to the long-term potential of HIVE by staking it as HIVE POWER and either curating actively or delegating that HIVE POWER out for a passive return (many of them like the buy, stake and passive return route).

This has been our goal for a long time: creating a use case for these new users to not only come and use the Hive ecosystem by creating an account, but actually Buy HIVE, stake it and earn yield.

That's what drew me to the legacy blockchain so many years ago. The idea that you could buy HIVE*, stake that as HIVE POWER and then earn an active (or passive) yield on it.

I believe this strategy is already bearing some fruits but we need to scale it up. We need to have larger potential HIVE & HBD swaps in order to onboard more capital from Maya & Thorchain into the Hive ecosystem.

This is my primary goal and why we've done things like the expand the offerings of @leo.voter via the https://inleo.io/dashboard (where users can delegate their HIVE POWER and earn yield).

We're also educating these Maya / TC users about HBD. The fact that we have a decentralized algo-stablecoin that has been actively used for 6+ years with no crash events that ALSO pays 20% passive yield... this is a huge marketing opportunity. We added HBD to https://leodex.io last week and we're starting to push the message of HBD very intensely across all of our channels.

You'll see that happening primarily on X where Khal is joining a lot of Maya/TC X Spaces and talking specifically about LEO, HIVE, HBD and Hive's investment potentials (buying & staking HIVE/HBD for passive yield).

You can see that the vision is slowly coming together. We've spent so many months putting all of this technology into place and building our relationships with key players in the cross-chain space.

Now is the time to reap the harvest and see massive user growth for HIVE (and hopefully, some investors in HIVE POWER & HBD as well).

Partnerships & KOLs

We've been working on a number of partnerships with communities, platforms and key opinion leaders in the Thorchain & Maya & ChainFlip ecosystems.

Get ready for some massive inflows in terms of monthly active users as well as investors to LEO, HIVE and HBD. This has been our goal since the beginning and after months of laying the groundwork, we're ready to bring them all on board.

Onwards 🦁